Investors are guided solely by emotions, and not common sense, because market participants completely ignored macroeconomic statistics. Instead, the market reacted to the terrible tragedy that happened late in the evening in central London. Moreover, no matter how blasphemous this may sound, it still had a positive impact on the pound and the single European currency. The thing is that before the parliamentary elections there was nothing at all, and Boris Johnson had already managed to appoint the Laborites responsible for what had happened. The Conservatives, sparing no effort, are now only busy with the fact that they blame those replace to the legislation that the Laborites led by Jeremy Corbyn pushed through.

Allegedly, if not for the mitigation of punitive measures for criminals, none of this would have happened. And although the accusations of conservatives are clearly strained, in the context of that, before the election, a little less than two weeks, this is enough to strengthen the position of Boris Johnson. Indeed, voters now need simple and understandable explanations of how this this could happen. They will reflect on this later.

Now everyone is in shock, and conservatives are taking advantage of this. However, this is exactly what suits investors, as it reduces the risks of a new uncertainty that the victory of Labor will inevitably cause. After all, Jeremy Corbyn threatens to hold a second referendum. Well, investors need clarity and certainty, even if they do not bode well. Better so than not to understand at all what awaits you in the future. So investors and businessmen enthusiastically embraced the growing prospects for conservative victory.

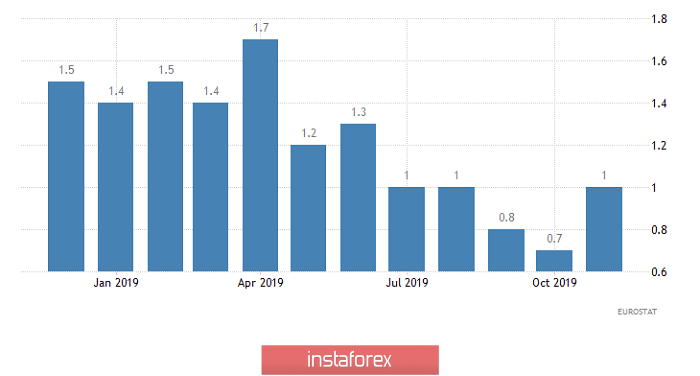

At the same time, although due to business and with enthusiasm perceives the prospect of a conservative victory, investors simply surprisingly do not notice what is happening right now in the economy. But inflation in Europe accelerated from 0.7% to 1.0%, although a preliminary estimate was to show its growth to 0.9%. Moreover, in Germany, the number of unemployed fell by 16 thousand, but it was supposed to grow by 5 thousand. In France, preliminary data on inflation showed its growth from 0.8% to 1.0%. In Italy, all the same, preliminary data showed an increase in inflation from 0.2% to 0.4%, with a forecast of 0.3%. Well, the final data on Italy's GDP for the third quarter confirmed the fact of accelerating economic growth from 0.1% to 0.3%. So it is clear that the data were clearly positive. But they were completely ignored.

Inflation (Europe):

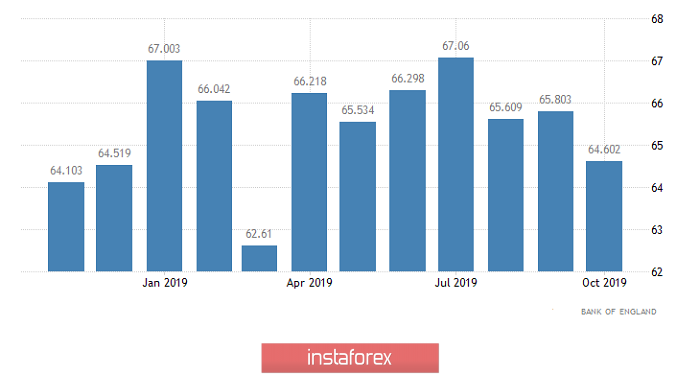

However, British statistics were mixed. On the one hand, consumer lending gained to 1.326 billion pounds, against 0.785 billion pounds in the previous month. It was expected to reach 0.900 billion pounds. Moreover, net consumer lending rose from 4.6 billion pounds to 5.6 billion pounds. However, the number of approved mortgage applications fell from 65,803 to 64,602. So it's not surprising that the pound just stood still while this data came out. There was simply no reason for any gestures.

Mortgages Approved (UK):

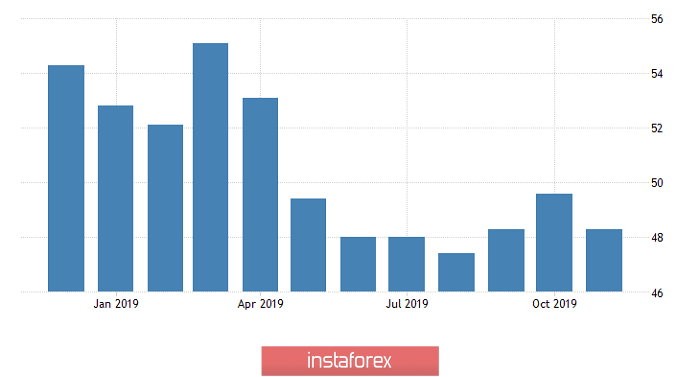

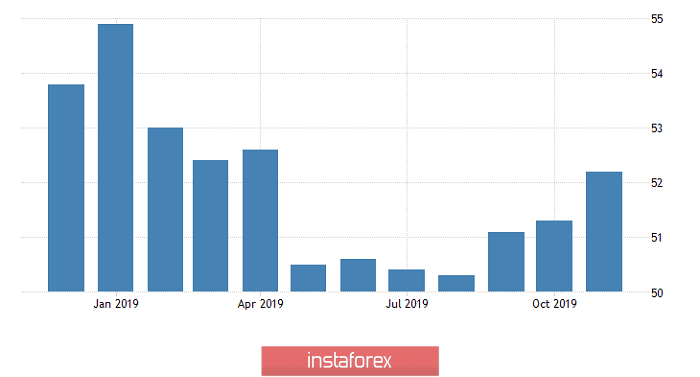

Today, on both sides of the Atlantic, the final data on the index of business activity in the manufacturing sector are published, and continental Europe has already reported on them. At the same time, the index of business activity in the manufacturing sector of the euro area rose from 45.9 to 46.9, although preliminary data showed an increase to 46.6. If you look at the largest countries in the euro area, the following picture develops, in Germany, the index rose from 42.1 to 44.1 with a forecast of 43.8, in France, the index of business activity in the manufacturing sector increased from 50.7 not to 51.6, but to 51.7. In Spain, it rose from 46.8 to 47.5, although it was supposed to decline to 46.7, and it is only in Italy where it fell from 47.7 to 47.6, however, they were waiting for a decrease to 47.5. So in general,

Manufacturing PMI (Europe):

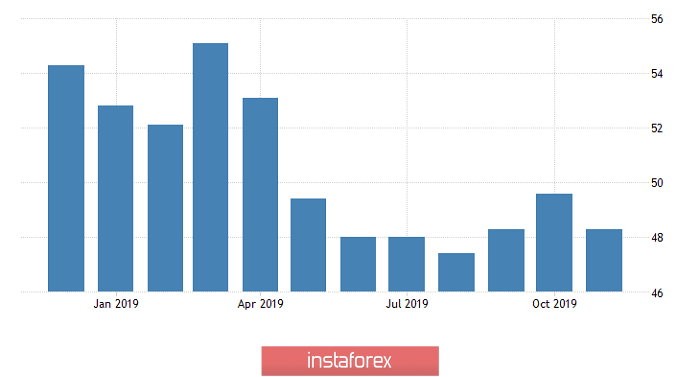

Similar data for the UK will soon be published, and the index is expected to decline from 49.6 to 48.3. However, investors will most likely, once again, ignore macroeconomic statistics. But in this case, they can be understood, since early parliamentary elections are on the verge.

Manufacturing PMI (UK):

Apparently, the market is still waiting for the publication of US statistics, which should show an increase in the index of business activity in the manufacturing sector from 51.3 to 52.2. In addition, construction costs may increase by 0.5%, which will only enhance the positive effect of the growth of the index of business activity in the manufacturing sector.

Manufacturing PMI (United States):

Given the positive nature of data for Europe, as well as optimistic forecasts for the United States, it is highly likely that the single European currency will stand still, since it is not clear what exactly to give preference to. Thus, the single European currency will hang around 1.1000.

The pound will initially decline slightly, to about 1.2875, after which it will remain in the region of this value.