Hello!

Here came the last month in this calendar year. On Friday, the November trading closed, so we will start to consider the main currency pair from the highest timeframe.

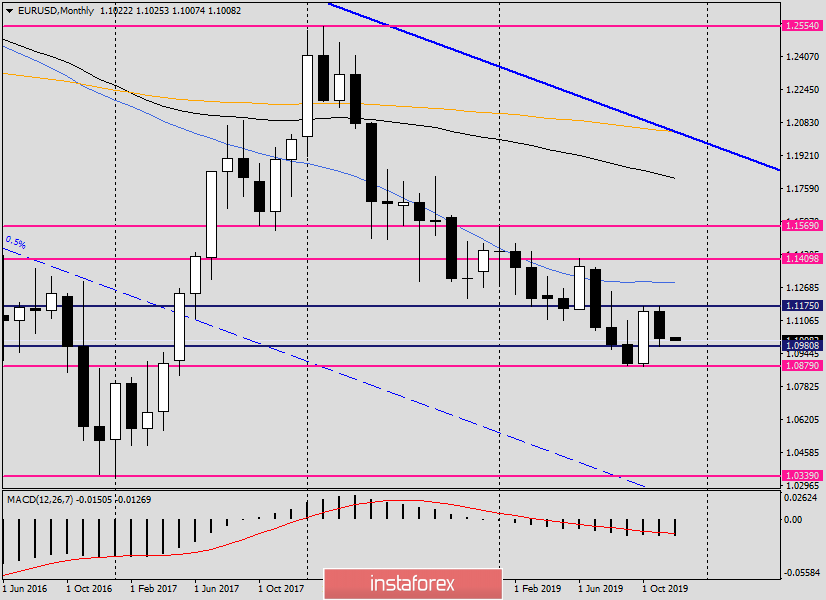

Monthly

After the November and quite good growth, the next month turned out to be completely different for the main EUR/USD currency pair. At the end of November trading, the quote fell to the area of 1.0980, where it closed the trading session of last month.

Judging by the monthly chart, it is not easy to understand how the trading will take place in December. There are two benchmarks here: last month's lows at 10980 and highs at 1.1175. I believe that the breakdown of one of these marks will indicate the future prospects of the currency. The update of November lows will open the way to the support of 1.0880, and the breakdown of the resistance of 1.1175 will send the pair to a strong and important price area of 1.1250-1.1300. Perhaps this is all that can be said by looking at the monthly timeframe.

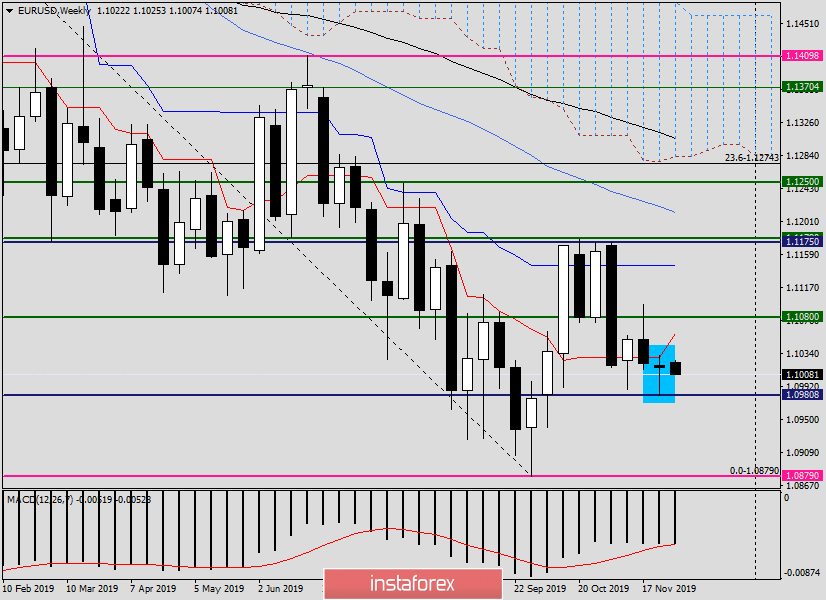

Weekly

Last week, the pair completed the formation of the Doji candle with a much longer lower shadow. Most often, after such candles, the market grows because a long lower shadow (or tail) indicates that there is no desire to further decline.

I believe that this is quite an important point that will determine the direction of the euro/dollar in the current week's trading. Judging by the last candle, with a high degree of probability at the trading on December 2-6, we can assume an upward scenario. However, do not forget that on Friday, important data on the US labor market will be published, which will determine the results of the week that started today.

In case of growth, the targets will be the levels of 1.1060, where the Tenkan line of the Ichimoku indicator passes, the landmark mark of 1.1080, as well as the highs of the previous week at 1.096.

If the market chooses the southern direction, we expect a decline to the last lows at 1.0980, and in the case of a breakdown of this mark, the road will open in the direction of 1.0940 and 1.0880.

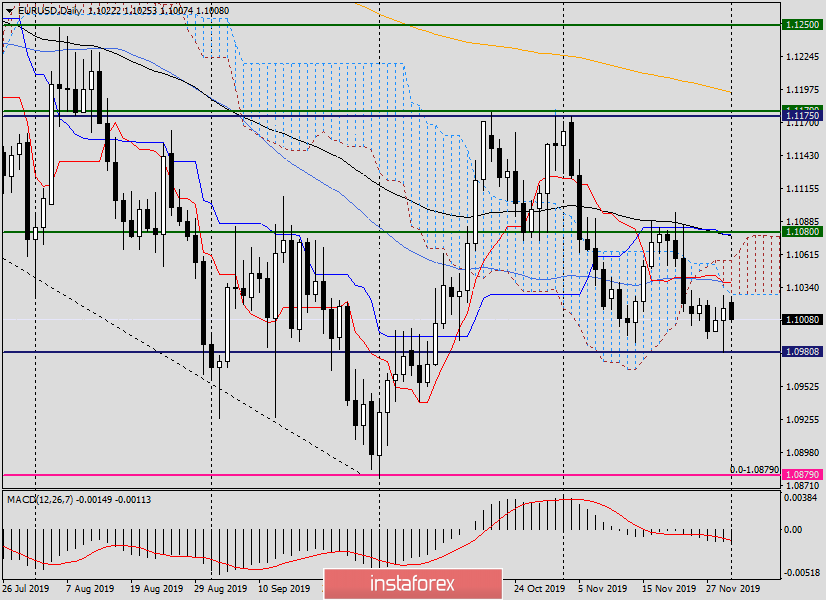

Daily

On the daily chart of EUR/USD, the situation is also more inclined to count on the strengthening of the quotation. In particular, this is indicated by a Friday candle with a long lower shadow and a fairly impressive bullish body.

As a rule, after the appearance of such candles, there is an increase in the rate, but this does not happen yet. At the time of writing, the euro/dollar is showing a downward trend.

Perhaps the market went "on acceleration" since the lower border of the Ichimoku indicator cloud can provide very strong resistance at the top, as well as the Tenkan line and 55 simple moving average, which converged at 1.1040.

Thus, the resistance zone can be designated as 1.1030-1.1040. If there are bearish candles on the daily, 4-hour or even on the hourly timeframes, it is risky and with small goals, you can try selling the pair. The risk is that an upward scenario is likely on higher timeframes, so the decline (if it continues) will be of a corrective nature.

The next purchases look good with a decline to the key technical and psychological level of 1.1000. Below, you can look at the opening of long positions in the price zone of 1.0990-1.0980.

Perhaps these are all trading ideas for the main currency pair at the moment. The main scenario looks like buying after corrective rollbacks to the designated goals. Tomorrow, we will look at smaller time intervals and try to find more specific points to enter the market.

Have a nice day!