The Reserve Bank of Australia left all the parameters of monetary policy unchanged at today's meeting. In particular, the rate remained at 0.75%, after three rounds of decline this year. And although this fact was expected by the market, the Australian dollar strengthened against a basket of major currencies during the Asian session. The aussie approached the middle of the 68th figure when paired with the US currency, showing an upward impulse. Such price dynamics was determined not only by the results of the December meeting of the RBA, but also by other fundamental factors. This is a general weakening of the greenback against the background of the recent statements by Trump, and the restoration of the Chinese PMI in the manufacturing sector, and the increase in the cost of iron ore. All these circumstances gave impetus to the growth of AUD/USD - the wait-and-see attitude of the RBA only strengthened the position of the bulls of the pair.

Although the results of the last meeting of the RBA this year cannot be called hawkish. The regulator's members agreed to pause until the beginning of next year, but at the same time made it clear that the monetary policy easing cycle has not yet been completed - the central bank is only evaluating the effectiveness of the measures already taken. In general, the announced pause (which, in fact, served as an impetus to the growth of AUD/USD) is forced. The fact is that the triple rate reduction did not pass without a trace for the Australian housing market: real estate prices sharply increased - especially in the country's largest cities. The cost of housing in Sydney rose in November by 2.7% (in monthly terms) - this is the strongest growth rate in the last 30 years. Melbourne also showed similar dynamics, where prices rose by 2.2% - this is the highest since 2015. Across the country, apartment and house prices jumped 1.7% MOM, recording the fifth consecutive increase on a monthly basis.

RBA interest rate cut this year led to the fact that the banking sector lowered mortgage rates, which, in turn, affected the housing market in Australia. According to some experts, the Australian real estate market has become almost the only beneficiary of easing monetary policy: according to the latest data, prices for apartments and houses (primarily in large metropolitan areas of the country) will reach their new peaks by March next year. Since the RBA lowered its interest rate in June for the first time in many years, the monthly growth rate of the CoreLogic national housing price index has been the strongest since 2003.

Obviously, in such circumstances, the RBA did not dare to aggravate the situation. Especially amid ongoing trade negotiations between Washington and Beijing. Until January-February of next year it will become clear whether the parties will sign a preliminary agreement (the so-called "phase 1") or whether the global conflict will continue. But in general, judging by the rhetoric of the accompanying statement, the RBA members are ready to further mitigate monetary policy. Recent macroeconomic reports suggest that the rate will almost certainly be reduced in 2020 - at least to 0.50%.

I note that at the beginning of this year, the Australian government initiated the introduction of tax benefits for millions of households (for people with low and middle incomes), in the hope of stimulating the growth of consumer spending. Household debt makes up almost 200% of total annual income, while consumer activity leaves much to be desired due to a decrease in the labor market (in particular, due to a weak increase in the level of salaries).

The latest report on the labor market really turned out to be devastating. The unemployment rate unexpectedly rose to 5.3% (against the forecast of 5.2%), and the employment rate collapsed into the negative area. Moreover, this indicator has updated three-year lows - the number of employees immediately fell by 19 thousand. The negative dynamics in October was demonstrated by both the component of full employment and the component of part-time employment. Let me remind you that the number of employees increased by only 16 thousand in September - but mainly due to the full-time component. However, the October results disappointed on all fronts.

The RBA commented rather cautiously on the above figures - according to them, the effect of the measures already taken is not yet fully felt. Nevertheless, if the labor market continues to decline further, the probability of a rate cut to 0.5% at the beginning of next year will reach one hundred percent.

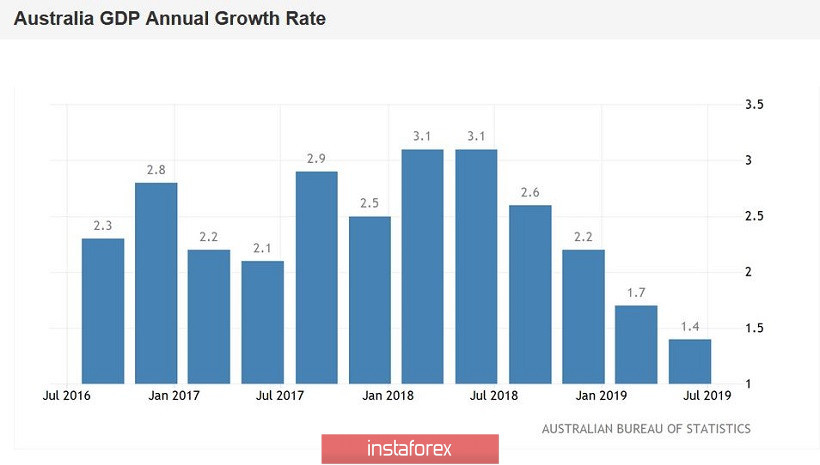

Summing up, it should be noted that the Australian regulator, so to speak, was afraid of the situation in the housing market. This fact supported the aussie. At the same time, the RBA acknowledged that the prerequisites for easing monetary policy remain. Australia's third-quarter GDP growth data will play a key role in this context. The release is expected tomorrow, December 4.

According to general forecasts, the Australian economy will grow by 1.6% on an annualized basis (0.5% on a quarterly basis). Over the past five quarters, the GDP indicator has been steadily declining, reaching a record low of 1.4% in the second quarter of 2019. If the release comes out at least at the forecast level, the Australian dollar will receive additional support, and paired with the US currency it will get an additional chance to approach the main resistance level of 0.70. If, contrary to forecasts, the indicator continues the negative trend, then the AUD/USD pair will return to the framework of the 67th figure.