Several factors at once caused the sudden growth of the single European currency. Moreover, all these factors worked together, and each of them individually was clearly not enough to somehow revive the market. After all, market participants simply ignored European statistics, which turned out to be very good. However, in combination with the information that China imposed retaliatory sanctions against the United States, it launched the process of strengthening the single European currency although it is more political rather than economic.After that, growth continued thanks to the efforts of Christine Lagarde, who spoke in the European Parliament. Despite the fact that she did not say anything directly about the further plans of the European Central Bank regarding the refinancing rate, she still hinted in a veiled way that the regulator will not rush to further ease the parameters of monetary policy. Well, from this, it follows that you should perhaps not expect a decrease in the refinancing rate to negative values.

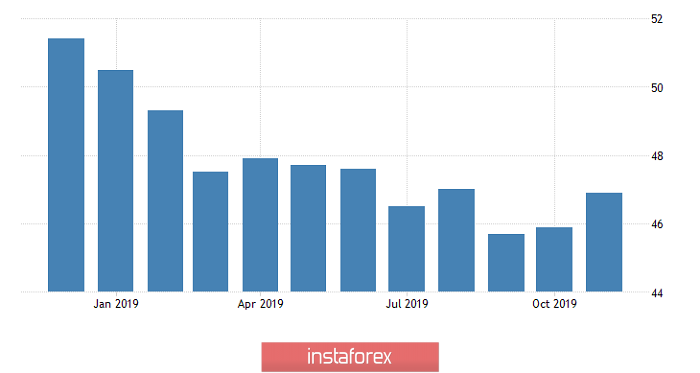

At the same time, it's worth paying attention to European statistics although everyone is only busy discussing yet another tensions between China and the United States. Moreover, the index of business activity in the manufacturing sector increased from 45.9 to 46.9, while a preliminary estimate showed an increase to 46.6. If you look at the largest economies of the euro area, you get the following picture. In Germany, the index of business activity in the manufacturing sector rose from 42.1 to 44.1 instead of the expected 43.8. In France, the index grew from 50.7 to 51.7, while growth was expected to reach 51.6. In Spain, where they expected a decrease in the index of business activity in the manufacturing sector from 46.8 to 46.7, they received an increase to 47.5. It was only in Italy that there was a decrease in the index of business activity in the manufacturing sector, however, it's still not so, as was expected. They predicted a decrease from 47.7 to 47.5, but in fact received 47.6. All this happens against the background of extremely cautious statements by Christine Lagarde regarding the state of the European economy. Thus, it turns out that European industry shows hints of improving its dynamics, but the European Central Bank is not in a hurry with conclusions, which can only please. This clearly indicates that the regulator does not intend to take drastic steps.

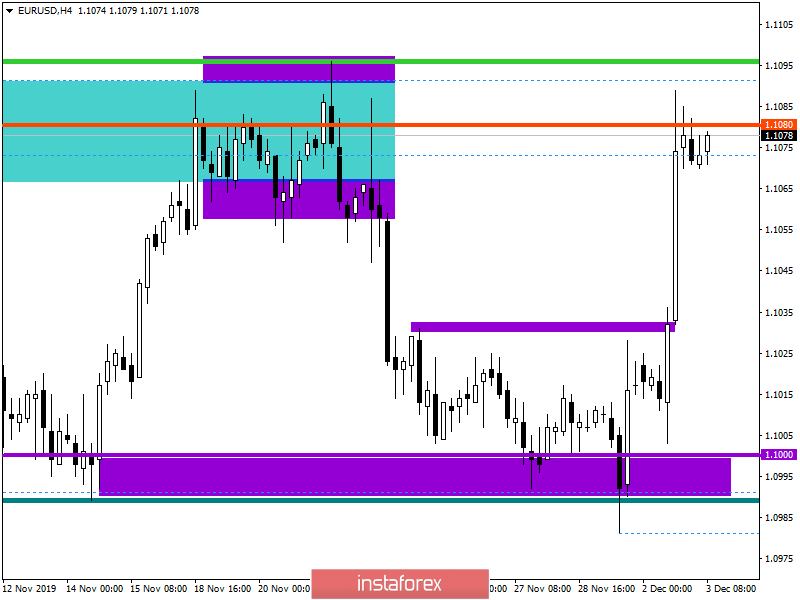

Manufacturing PMI (Europe):

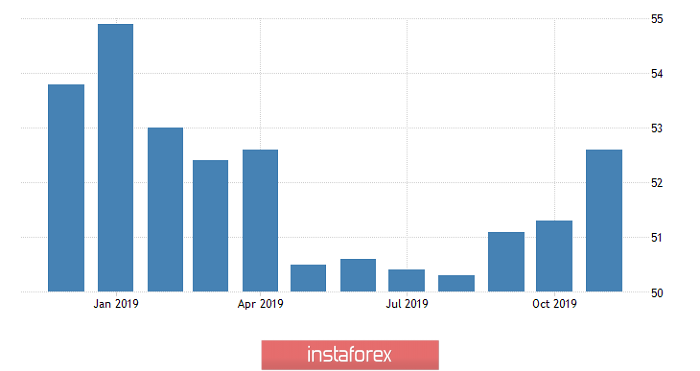

On the other hand, there was another factor that contributed to the strengthening of the single European currency — American statistics. Although it looked very good initially, as the index of business activity in the manufacturing sector increased from 51.3 to 52.6, and not to 52.2, as forecasts showed. But unfortunately, the good news ended there. Similar data, but from ISM, showed a decrease in the index from 48.3 to 48.1, although they should have shown growth to 49.2. Even worse, construction costs not only fell by 0.8%, but previous results were also reviewed, and instead of a 0.5% growth, there was a decrease of 0.3%.

Manufacturing PMI (United States):

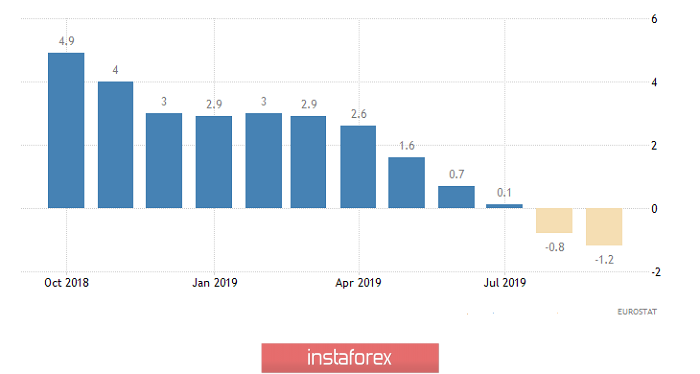

After such rapid growth, a small rebound looks logical. However, we need a reason. Its role can be played by data on producer prices in Europe, which are still decreasing by 1.2%, and there is every reason to believe that the decline will increase to 1.9%. Although the index of business activity in the manufacturing sector has grown, a further decline in prices will have a very negative impact on the entire industry.

Producer Price Index (Europe):

In terms of technical analysis, we see a multi-day slowdown within the psychological 1,1000, which has gotten results The control level was worked out by the quotation and the cluster gave acceleration. As a result of which, we saw an inertial upward movement up to the next level of 1.1080. After that, the upward movement began to decline and a pullback / stagnation formed along the level of 1.1080.

In terms of a general review of the trading chart, we see that the recovery process with respect to the elongated correction was hit, which 66% returned to the region of 30%, during the development stage.

It is likely to assume that the oscillation along the level of 1.1080 will remain for some time, where the boundaries of the oscillation are 1.1070 / 1.1090. A characteristic overbought is felt in the market, but it is better to work on the breakdown of conditional boundaries.

We concretize all of the above into trading signals:

- We consider long positions in case of price fixing higher than 1.1090 / 1.1100.

- We consider short positions in case of price fixing lower than 1.1070, not a puncture shadow.

From the point of view of a comprehensive indicator analysis, we see that due to the price spike, the indicators' indicators turned around and unanimously took the upside. In the case of movement along the level of 1.1080, the indicators on the minute and hour intervals can be multidirectional.