The market, as it has often been the case recently, has ignored macroeconomic statistics. However, further developments showed that investors still took it into account. This follows at least from the fact that the single European currency and the pound behaved in completely different ways. The sudden growth of the single European currency began almost immediately, as it became known that China imposed sanctions on the United States in response to the law on the protection of freedoms and democracy in Hong Kong. However, the sanctions are purely political in nature and do not affect trade relations. Although a number of media outlets and misinformation joyfully shouted that China had banned American ships from entering its ports, in fact it is about closing Hong Kong for American warships and aircraft. Therefore, China's response does not concern direct economic issues, which, in general, was quite predictable. In any case, it is clear that the continued increase in tension is clearly not conducive to a trade deal between the two largest economies in the world.

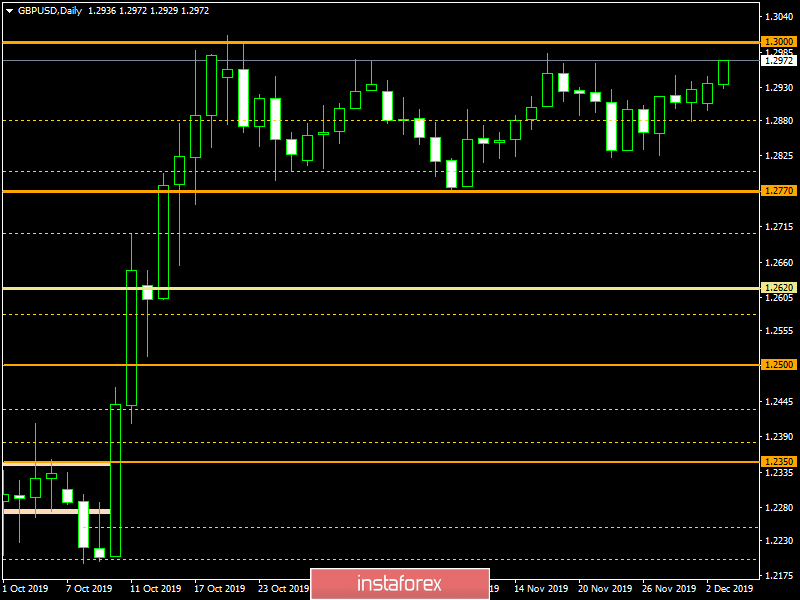

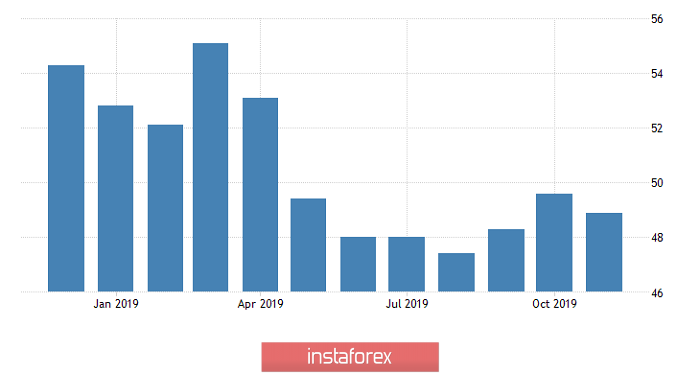

However, the final data on business activity indices were published before that, which explains why the pound and the single European currency behaved in completely different ways. In particular, the index of business activity in the manufacturing sector grew from 45.9 to 46.9 in Europe, while they expected growth to 46.6. But in the UK, this same index declined from 49.6 to 48.9, although it is worth noting that they expected a decline to 48.3. Thus, the fact that the index of business activity in the manufacturing sector of Europe increased, contributed to the growth of the single European currency, while its decline in the UK did not allow the pound to strengthen against the dollar despite the clearly negative background for the dollar.

Manufacturing PMI (UK):

It is worth paying attention to what is happening with the index of business activity in the manufacturing sector in the largest economies of the euro area. In particular, in Germany, it unexpectedly rose to 44.1, where the index was expected to grow from 42.1 to 43.8. In France, the index grew from 50.7 to 51.7, rather than 51.6, as preliminary data showed. In Spain, where they were waiting for the index to decline from 46.8 to 46.7, they were happy to report its growth to 47.5. Unfortunately, it is only in the third economy of the euro area, that is, in Italy, the index fell from 47.7 to 47.6. Despite that, they were expecting a decline already, up to 47.5, so in this case, the data came out better than forecasts.

Manufacturing PMI (Europe):

At the same time, Christine Lagarde, who delivered a speech in the European Parliament, also contributed. Her speech was extremely cautious and balanced, devoiding any direct instructions and even hints. However, despite the extremely veiled language, it can be understood that the board of the European Central Bank does not intend to further soften the parameters of its monetary policy. This is indicated by the words of Christine Lagarde that the board of governors is extremely wary of the side effects of monetary policy in September, when the decision was made to reduce the rate on deposits from -0.4% to -0.5%. Although she did not use the phrase "super soft monetary policy," but given that this is what the European Central Bank is doing, it's clear what she was talking about. Consequently, the Board of the European Central Bank is aware of the consequences that can lead to an endless decrease in interest rates, which means that you should not expect a decrease in the refinancing rate to a negative level in the near future. This was another reason to strengthen the single European currency.

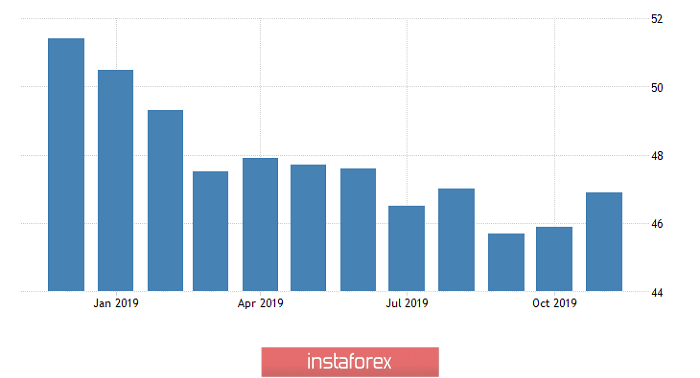

Moreover, the misadventures of the dollar did not end there, as it was finally finished off by American statistics, which seemed pretty good at first. After all, the final data on the index of business activity in the manufacturing sector showed its growth from 51.3 to 52.6, while a preliminary estimate showed growth only to 52.2. However, the joy lasted only fifteen minutes, since that similar data were published after so much time, but already from ISM. They showed that the index of business activity in the manufacturing sector decreased from 48.3 to 48.1, and what's worst of all is that they predicted growth to 49.2. Moreover, along with ISM data, data on construction costs were published, which not only fell by 0.8%, although they should have grown by 0.4%. The data for the previous month were also reviewed, and instead of an increase of 0. 5%, construction costs then declined by 0.3%. Therefore, the dollar really had nothing to grow from.

ISM Manufacturing PMI (United States):

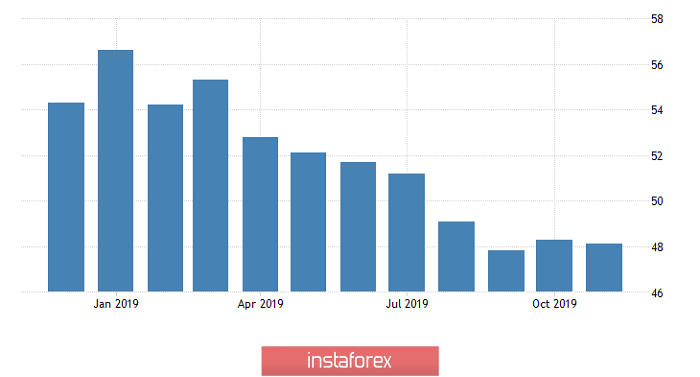

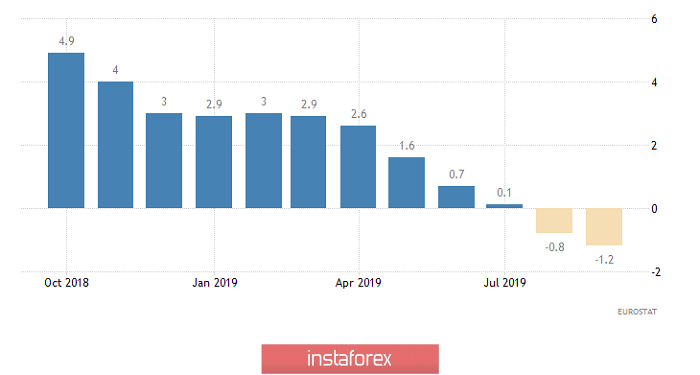

Today, American statistics takes the day off, so all attention is only focus on the Old World. The first thing you should pay attention to is the index of business activity in the UK construction sector, which should grow from 44.2 to 44.5. However, the pound is too busy with the upcoming parliamentary elections, and it will deal with the economy later. Thus, investors will ignore this data. In contrast to data on producer prices in Europe, which are already decreasing by 1.2%, there is practically no doubt that the pace of decline will increase. The only question is how much. The most optimistic forecasts indicate an increase in the rate of decline to 1.9%. However, there are those who indicate the possibility of increasing the decline to 2.2%. This contrasts sharply with yesterday's data on the index of business activity in the manufacturing sector in Europe, which may be the reason for a rebound in the single European currency.

Producer Price Index (Europe):

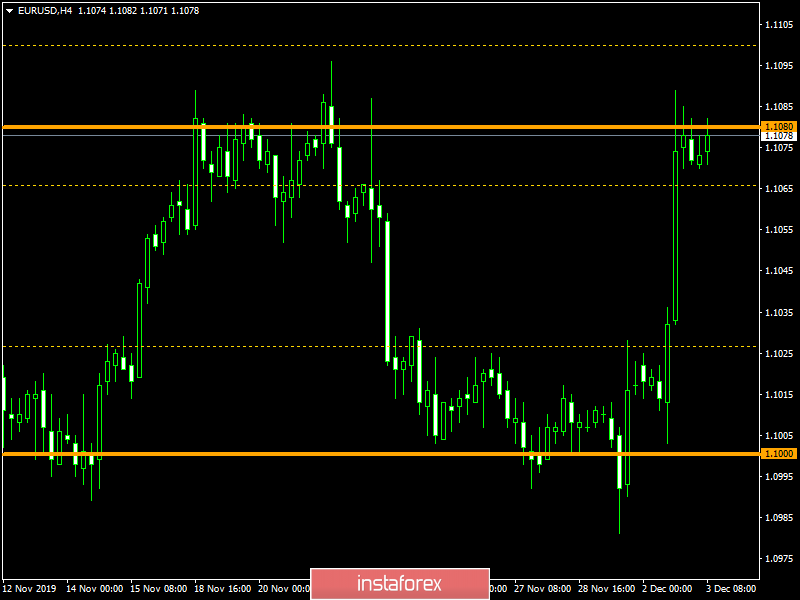

During the inertial movement, the euro/dollar currency pair returned to the level of 1.1080, leaving behind a multi-day accumulation and a psychological level of 1.1000. It is likely to assume that a characteristic overbought may exert local pressure on the single currency, which as a fact, will lead to stagnation along the check mark and a pullback.

The pound/dollar currency pair rushed towards the upper boundary of the flat 1.2770 / 1.3000, having initially stagnated, but then accelerated. It is likely to assume that the upper border of the flat formation will try to restrain the pressure of buyers once again and as a fact, we will see a slowdown followed by a rebound.