It seems that the American side simply did not have any "arguments" to force China to enter into the negotiation process on mutual trade with Washington's interests dominating.

D. Trump's sharp "tweets" regarding the prospects for concluding a new trade agreement with Beijing did have a negative effect on the sentiment of investors. If these attacks were previously softer and interspersed with positive sayings about the imminent conclusion of a trade deal after the bill was passed last week to help protesters in Hong Kong, then the president's subsequent words about the postponement of the possibility of concluding an agreement by the end of next year, hit the markets severely, which was only compounded by the mixed data of economic statistics on the country's economy that were published on Monday.

Despite all the drama, it is likely that a specific attitude of investors towards the personality of the American president and his fortunes regarding domestic, foreign policy and the economy saves the markets from a serious collapse. Moreover, the stock market in America is still only being adjusted, and, in our opinion, this is even good, because it cannot grow forever without corrections, and the events of recent days are an excellent occasion for this.

Now, the focus of the market will be December 15, when the previously announced new US duties on Beijing and, accordingly, the mirror measures of the Chinese side will come into effect. In our opinion, these events will become the real point or line that will be followed by a real collapse of global financial markets, or there will be a powerful reversal of investor sentiment in a positive direction, and after which, we will see a new wave of growth in the markets.

Today, the attention of the market will be turned to the publication of employment data in the United States from ADP. An increase in the number of new jobs in November is expected to reach 140,000 against 125,000 in October. In addition, the values of the index of business activity in the non-manufacturing sector will also be released, where it is expected to decrease to 56.1 points from 57.0 points as well as the numbers of the index of purchasing managers for non-manufacturing from ISM.

In the morning, Caixin's Service Sector Performance Index (PMI) was published. The indicator significantly increased to 53.5 points from 51.1 points, but this did not have a positive impact on the Chinese stock market. Futures for US stock indexes, in turn, are still trading in positive territory. Thus, the market continues to digest the prospects for a deterioration in relations between Washington and Beijing.

In our opinion, negativity will prevail, hanging over the markets until December 15 until Trump announces something positive on Twitter. If the data from the USA does not disappoint and turns out to be at least moderately positive today, this may become the basis for a slight correction in the markets towards their growth and increase in the dollar.

Forecast of the day:

USD/JPY is in a short-term upward trend. It is at a bifurcation point in the wake of the demand for protective assets and the possible local strengthening of the dollar, if the statistics from the US prove to be strong. Given this, on a positive data, we believe that the pair can turn around and move quickly to the level of 109.70. But on the negative, it is expected to move first to 108.30, and then to 108.00, but for this to happen, the pair should break out of the narrow range of 108.50-108.70.

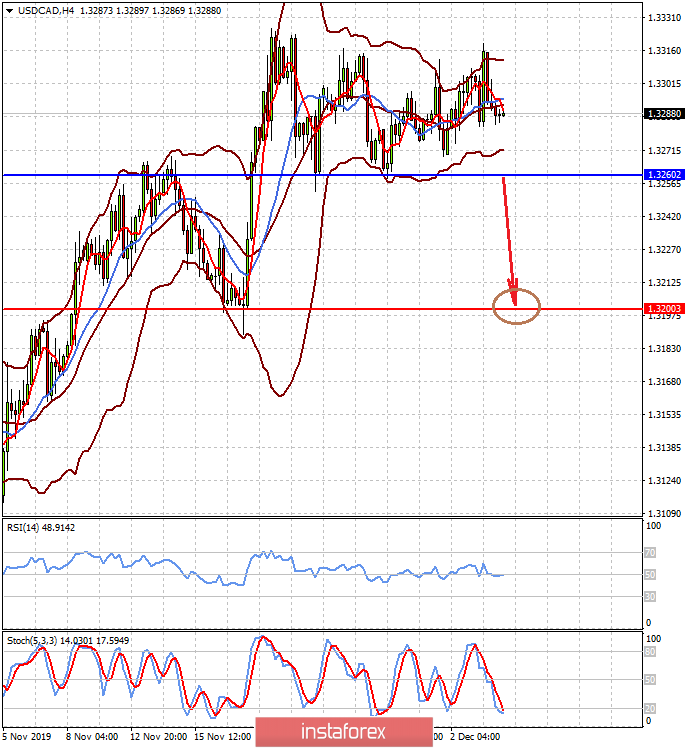

USD/CAD pair is consolidating above the level of 1.3260 amid the dynamics of oil prices and expectations of the final decision of the Central Bank of Canada on monetary policy. It is assumed that the key rate will remain unchanged at 1.75%. Now, the pair may fall to 1.3200 and break the level of 1.3260, if the bank does not make it clear that we should expect a decrease in rates in the future and oil prices locally turn up.