Hello!

At the beginning of the review on this currency pair, let's briefly talk about macroeconomic reports that may affect the price dynamics of GBP/USD.

Yesterday's data on the index of business activity in the construction sector of the UK exceeded the expectations of experts. The actual value of the index was 45.3 against the forecast of 44.5.

Today at 10:30 (London time), the publication of the PMI in the services sector is expected. No more important and meaningful statistics from the UK are scheduled this week. But on December 6, data on the US labor market will be released. As a rule, labor reports from the United States have a significant impact on the exchange rate of the US currency, so for the pound/dollar pair, Friday will be the most important and significant day of the entire current week.

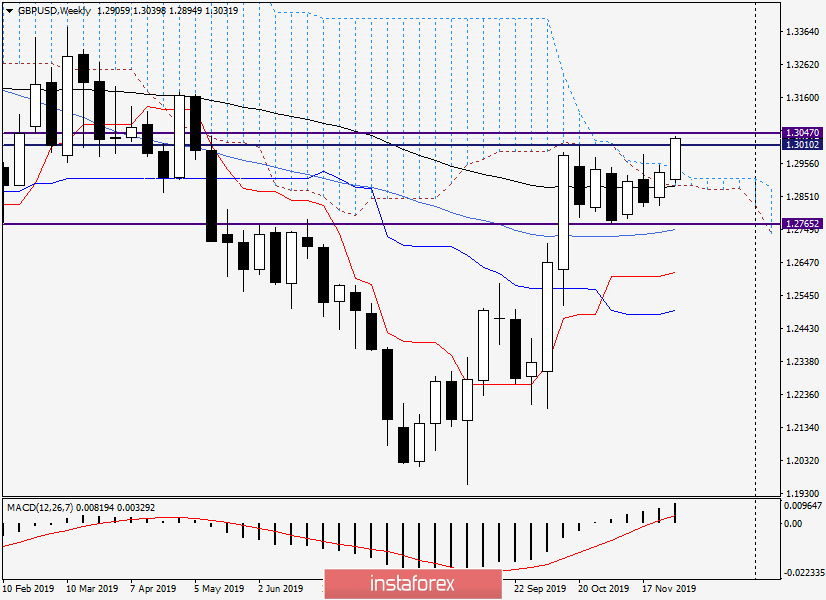

Weekly

At the moment, the pound/dollar continues to trade in the range of 1.3011-1.2765. As noted earlier, the further direction of trading on GBP/USD will be decided on which way the pair will leave the designated range.

A breakout of the support of 1.2765 will point to further downward prospects for the British currency. If the pair manages to break through the strong resistance of sellers in the area of 1.3010-1.3050 and close trading higher, we can assume a further upward scenario.

At the time of writing, the "Briton" is inclined to growth and shows intentions to break through the hated resistance in the zone of 1.3010-1.3050. But what will happen from this, we will know only on Friday after the publication of labor reports from the United States and the reaction of market participants to them. The day will be very important and will largely affect the trading results of the current five-day period.

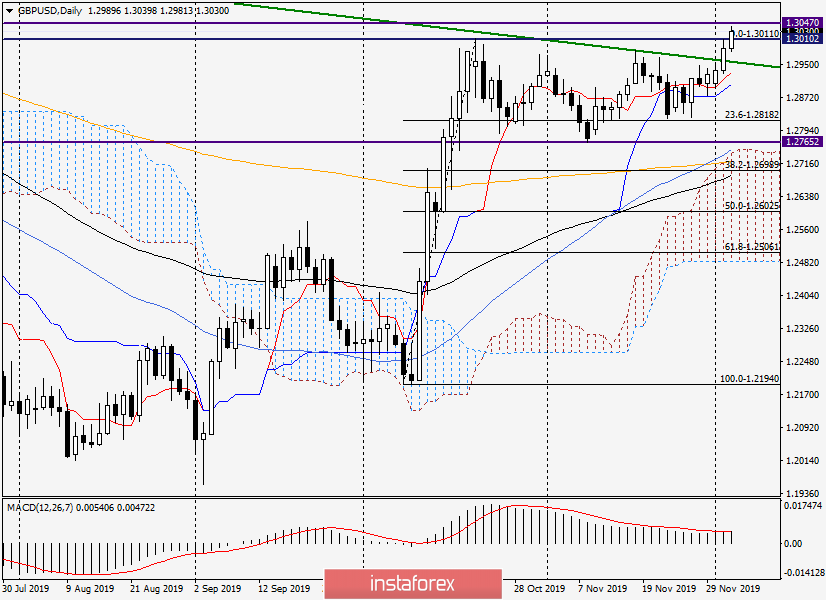

Daily

As seen on the daily chart, after a corrective pullback to the area of 23.6 Fibo from the growth of 1.2194-1.3011, the pair slowly but surely turned to resume the upward dynamics.

As a result of yesterday's growth, trading closed above the green resistance line of 1.3379-1.2983. However, as I have repeatedly noted, one closed candle may not be enough to consider the breakdown true. It is better to see three candles closed above this line in a row. And in this regard, again it is necessary to note the importance of subsequent trading days, especially Friday.

In the case of consolidation above the green resistance line, we should expect further growth to the levels of 1.3100 and 1.3155. If the resistance breakdown of 1.3379-1.2983 turns out to be false and the rate returns under this line, the probability is high to 1.2916 and 1.2888, where the Tenkan and Kijun lines of the Ichimoku indicator are located, respectively. The further targets for the pound/dollar pair will be the price zone of 1.2765-1.2740, where the 50 simple moving average and the upper limit of the Ichimoku indicator cloud pass.

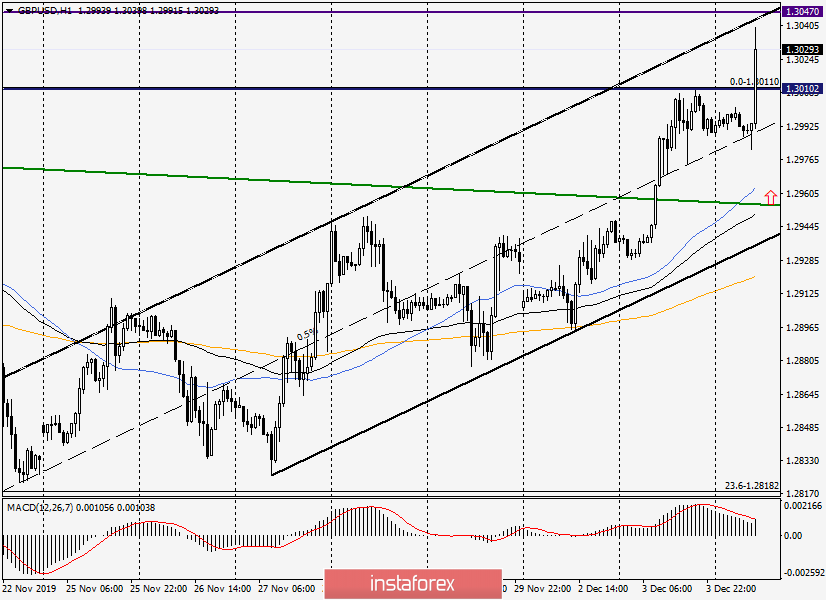

H1

As a rule, the most accurate prices for opening positions are considered on the hourly chart. Built a channel with two meters: 1.2826-1.2895 (support line) and 1.2947 (resistance line).

At the time of completion of this article, the pound/dollar is trading near the middle line of the constructed channel. Often such a line performs the functions of support or resistance. In our case, we see that the pair has received strong support and is aimed at retesting yesterday's highs around 1.3010.

Now on trading ideas. Of course, buying under resistance near the maximum values is not the best trading idea. However, the nature of trading on GBP/USD indicates a high probability of growth, so those who trade at the breakdown of levels and lines, it is risky to try to buy at the breakout of 1.3011. Those who use the tactics of buying after rollbacks and at more attractive prices, I recommend looking at the area of 1.2970-1.2950.

As for sales, they are, in my opinion, less relevant, and therefore riskier. However, if one or more bearish candlesticks appear under the resistance of 1.3011 on H4 and (or)H1, you can try to sell with a small stop and targets near 1.2960.

Good luck!