The market needs a thrill, and it needs to be in the form of intrigues and scandals. Typically, with a political color, because there is no other way to explain yesterday's market behavior, which has tritely ignored European macroeconomic statistics. Indeed, the pace of decline in producer prices in Europe accelerated from 1.2% to 1.9%, this is contrary to what the forecasts have predicted with 2.2%, respectively. And this clearly indicates that the recent increase in inflation in Europe is likely to be temporary and we will soon see a resumption of its decline. So these data did not show anything good, but the single European currency stood still. And if you recall how events unfolded on Monday, it becomes clear that market participants lacked political factors for confidence yesterday.

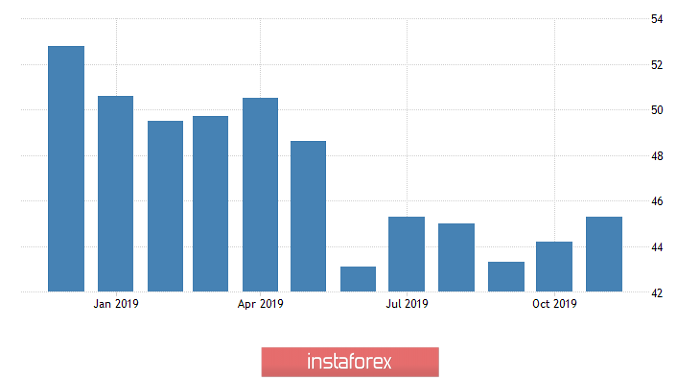

But the pound unexpectedly reacted quite cheerfully to the index of business activity in the construction sector, which grew from 44.2 to 45.3. It should be noted that the forecast predicted a growth of 44.5. We must not forget that the real estate market and the construction industry are directly related because it is extremely important for determining the investment attractiveness of the UK. However, it must be remembered that the United Kingdom is preparing for early parliamentary elections to be held next week, and the information space is full of all kinds of messages on this subject. In particular, the results of regular polls and all kinds of forecasts regarding the voting results. So traders are on knives and their nerves are strained to the limit. So yesterday's growth is partially associated with increased nervousness.

Construction sector business activity index (UK):

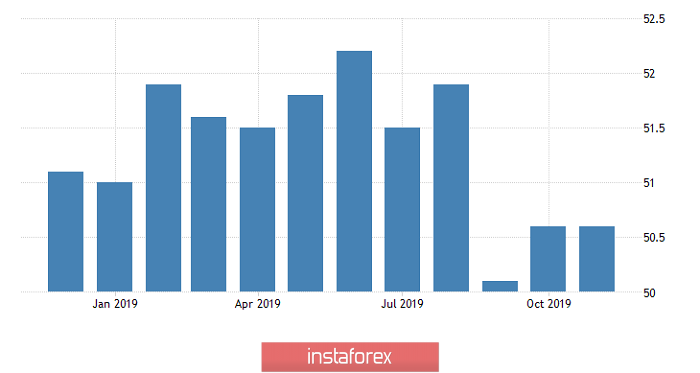

The pound continued to grow today, but not alone, it is in tandem with the only European currency. This is partly due to the publication of a number of macroeconomic data on the Old World. But beyond that, the market is preparing for today's publication of ADP employment data in the United States, although first things first. The final data on the index of business activity in the service sector was published in Europe, as well as the composite index of business activity. However, the data came out not quite as expected, for the index of business activity in the services sector in Europe fell from 52.2 to 51.9 although they were waiting for its decline to 51.5. Nevertheless, given the growth of the index of business activity in the manufacturing sector, the composite index remained unchanged at 50.6. Furthermore, if you look at the largest economies of the euro area, it's not so bad in terms of Germany, where the index of business activity in the service sector grew from 51.6 to 51.7, although they expected it to decline to 51.3. Due to this, the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped. the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped. the composite business activity index grew from 48.9 to 49.4. France, on the other hand, the index of business activity in the services sector remains unchanged, although it fell a few points from 52.9 going to 52.2. So the composite business activity index, which was supposed to grow from 52.6 to 52.7, fell to 52.1. It is for this reason that the growth of the single European currency stopped.

Composite Business Activity Index (Europe):

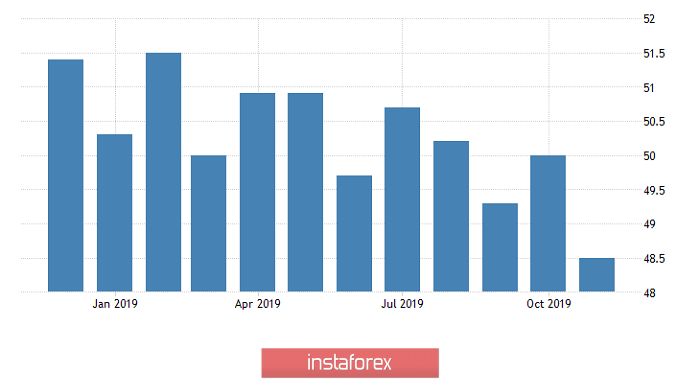

The pound is holding on. However, the final data on business activity indices, as in the case of the single European currency, will lead to the fact that it might need to retreat. The fact is that, unlike the eurozone, forecasts for the UK do not spark any optimism. In particular, the index of business activity in the service sector may decrease from 50.0 to 48.6, and the composite index from 50.0 to 48.5. Not only is this decline, but also the indices should fall below 50.0 points, which indicates increasing risks of the onset of an economic downturn.

Composite Business Activity Index (UK):

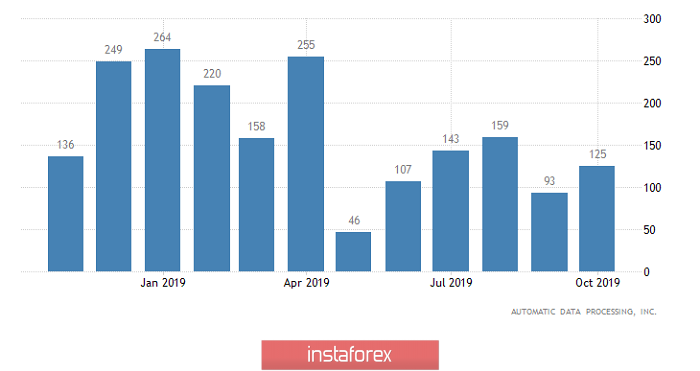

However, the main news of the day is the ADP data on employment, which can show its growth by 140 thousand against 125 thousand in the previous month. The increase in employment growth rates clearly indicates an improvement in the market situation, and in anticipation of the Friday publication of the report of the United States Department of Labor without any political factors, this will be a serious help in strengthening the dollar. In addition, the United States also publishes a summary of data on business activity indices, forecasts for which are rather optimistic. Thus, the index of business activity in the service sector should increase from 50.6 to 51.6. A composite index of business activity is likely to grow from 50.9 to 51.9.

Employment Change from ADP (United States):

Thus, the single European currency has every chance to end the day at 1.1050.

The pound will also have to decline, and the reference point is the 1.2950 mark.