4-hour timeframe

Amplitude of the last 5 days (high-low): 33p - 20p - 47p - 87p - 27p.

Average volatility over the past 5 days: 43p (low).

On December 4, the EUR/USD currency pair made another jump, however, if we look more closely at the European currency's growth on Wednesday, it becomes clear that the entire leap is 30 points, and the volatility of the entire trading day is currently at 49 pips. Thus, from our point of view, nothing extraordinary happened except that the pair nevertheless updated the previous local high and, thus, showed its intention to form a more or less tangible upward trend. However, at the same time, we still believe that there are no good reasons for strengthening the European currency. Macroeconomic reports provide local support for the euro, but this joyful period for the EU currency can end very quickly, since in general the state of the EU economy remains much weaker than in the United States. Yes, inflation in the EU has shown positive dynamics in recent weeks, business activity indices in the services sector, but US data cannot be called a failure. Thus, the euro can still resume falling at any time.

Data was published during the European trading session today, it includes indices of business activity in the services sector of Germany and the European Union. Both exceeded their values and reached 51.7 and 51.9, respectively. However, the previous values and forecasts did not differ much from the total values for November. The situation is similar with the composite business activity indexes in Germany and the EU, both showed a slight improvement. But in France and Italy, business activity in the service sector decreased. Thus, it can hardly be stated that the euro showed growth today due to these reports. It would be more correct to say that the euro was strengthening due to the failed US ADP report reflecting the change in the number of workers in the private sector. Traders saw only 67,000 jobs instead of the expected 140,000. Thus, one of the relatively important macroeconomic reports of the United States completely failed, which triggered a sell-off of the US currency in the afternoon. But even with such a weakness in the US labor market report, the US dollar lost a few positions against the euro, which once again convinces us that bulls are very cautious about buying the euro. The Markit US business activity index in November was 51.6, which is fully consistent with experts' forecasts, and the composite index is 52.0, which is 0.1 points higher than forecasts.

Meanwhile, the United States clearly lacked one "Hong Kong Law" and was followed by another Law on Human Rights and Democracy, this time a bill that condemns the treatment of Muslims and ethnic minorities in China, in Xinjiang . The bill has already been passed by Congress and must now go through the Senate and the US President. It is anticipated that sanctions will be imposed against China, as well as against the country's first officials. According to correspondent John Sudworth, if the bill is approved, it will be the most significant attempt to force Beijing to stop the camp system in Xinjiang. The Chinese Foreign Ministry has already issued a statement, stressing in it that the bill intentionally distorted the goals of the Chinese authorities in Xinjiang County. In fact, the province is fighting against radical elements, terrorists and separatists. The Chinese Foreign Ministry also once again warns the US government that they will grossly intervene in the internal affairs of China and that retaliatory measures will immediately follow again if this law is signed by the president.

Despite the fact that there are all visible reasons for another escalation of the trade conflict between the United States and China, some sources close to the negotiation process argue that the parties are approaching consensus on the issue of canceling tariffs, which will be canceled as part of the first phase of the agreement. Even despite the situation around Hong Kong and Xinjiang, experts believe that they will not affect trade negotiations. Moreover, experts and political scientists believe that the deal will nevertheless be concluded before December 15, although we personally do not see any reasons or grounds for this. It is much more likely that on December 15, Trump will introduce new duties on Chinese imports for another 160 billion dollars. However, the wait was short.

From a technical point of view, the currency pair made a new attempt today to resume the upward trend, but after half an hour, it could be said that it failed, like the report from ADP. The euro grew by 30 points and could not hold on to new positions for itself and immediately began to fall, which again could be the beginning of a downward correction, which will eventually turn into a downward trend.

Trading recommendations:

The EUR/USD pair retains the prospects for an upward movement, and the volatility at today's trading is again low. Thus, it is still recommended to buy the euro very carefully, since it is growing very reluctantly and only thanks to weak macroeconomic statistics from across the ocean. Tomorrow, for example, there will definitely not be such gifts in the form of weak reports from the United States. Selling the euro, which has more fundamental grounds, will be better after overcoming the critical Kijun-sen line.

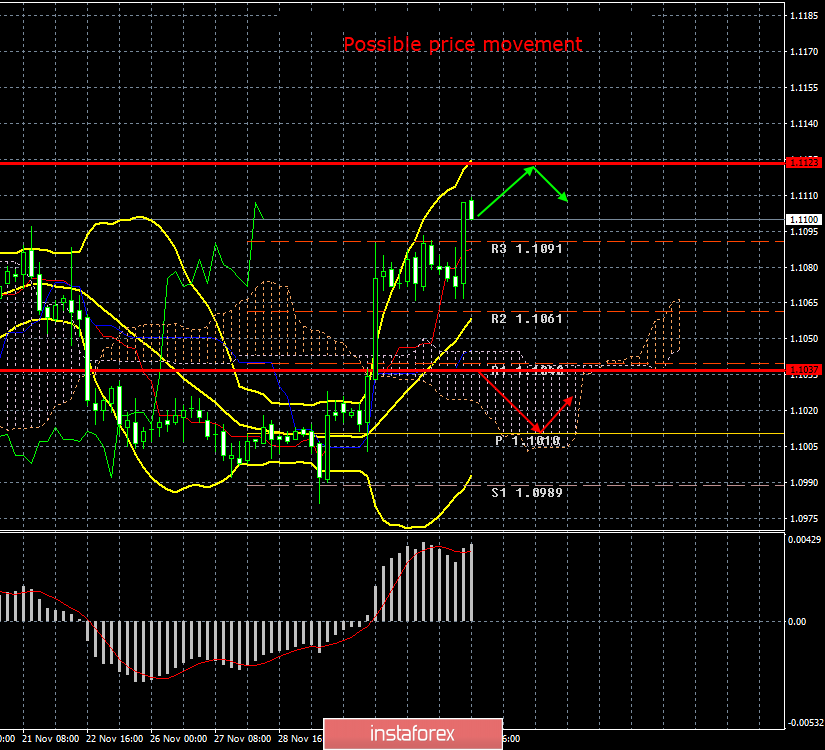

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.