The euro reacted lower to data that the number of jobs in the US private sector increased in November, but the overall picture was spoiled by a report on the non-manufacturing sector, where activity in November grew at a more subdued pace than in October. The British pound, meanwhile, is storming new heights on the news that the UK Conservative Party has every chance of a majority in parliament.

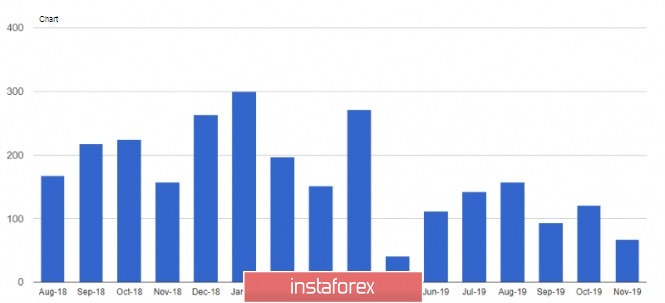

According to the data, the number of jobs in the US private sector grew by 67,000 at once. However, the data fell short of economists' expectations that the number of jobs would rise by 150,000 in November. The weakest growth was seen in small companies, where the number of jobs increased by only 11,000. The largest growth was recorded in medium-sized companies, where the increase was 29,000. Although the labor market is losing momentum, the unemployment rate remains near a historic low, which indicates the strength of the economy. The report also indicated that most of the job growth was provided by the services sector, which added 85,000 jobs at once. But the weakest growth was shown by the trade sector, which lost more than 15,000 jobs. Let me remind you that tomorrow the US Department of Labor employment report for November will be published.

Data on the slowdown in activity in the non-manufacturing sector did not harm the US dollar, which managed to hold its positions against the euro, returning the EURUSD pair under the resistance of 1.1090. According to a report by the Institute for Supply Management, the PMI for the US non-manufacturing sector in November was 53.9 points against 54.7 points in October this year. Economists had expected the index to decline only to 54.5 points. If we divide the report separately by spheres, the index of business activity fell immediately to 51.6 points, and the index of employment in the non-manufacturing sector rose to the level of 55.5 points.

Data on the slowdown in activity in the non-manufacturing sector did not harm the US dollar, which managed to hold its positions against the euro, returning the EURUSD pair under the resistance of 1.1090. According to a report by the Institute for Supply Management, the PMI for the US non-manufacturing sector in November was 53.9 points against 54.7 points in October this year. Economists had expected the index to decline only to 54.5 points. If we divide the report separately by spheres, the index of business activity fell immediately to 51.6 points, and the index of employment in the non-manufacturing sector rose to the level of 55.5 points.

As for the current technical picture of the EURUSD pair, after an unsuccessful attempt to continue rising above the resistance of 1.1095, the pair returned to a narrow side channel. Only a second break of this maximum will provide risk assets with a new impulse, which will lead to the renewal of highs in the area of 1.1131 and 1.1180. If the pressure on the euro returns, and for this, sellers of risky assets only need to push the trading instrument below the support of 1.1065, we can expect the EURUSD to fall to the lows of 1.1030 and 1.1000.

GBPUSD

The British pound continued to update monthly highs after the publication of new opinion polls that showed that British Prime Minister Boris Johnson with his Conservative Party can get a majority in the general election. Many are counting on Johnson's victory to end political uncertainty over Brexit. Let me remind you that the elections in the UK will be held on December 12, and any news concerning the two leading parties will affect the pound.

As for the technical picture of the GBPUSD pair, it seems that the bears will try not to let the pair above the resistance of 1.3120, from which a downward correction could be observed yesterday. The level of 1.3055 will be important for buyers, as bulls will try to build the lower border of the current upward channel from it, but we should not exclude the possibility of GBPUSD correction to the support area of 1.3010, from which the main growth began yesterday.

USDCAD

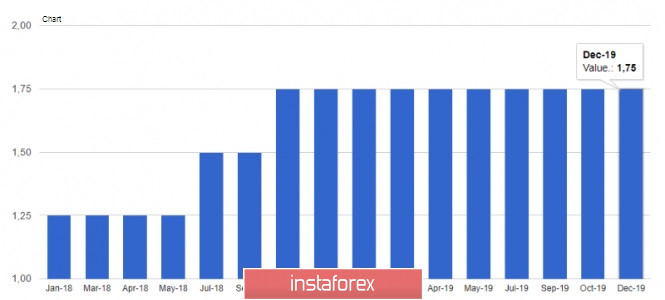

The Canadian dollar regained its positions against the US dollar, and the USDCAD pair fell from its weekly highs around 1.3320, to the level of 1.3190. This happened after the Bank of Canada left its key interest rate unchanged at 1.75%. But a more important point was the statement that there are now signs of stabilization of the world economy, which will have a positive impact on the country's economy. The regulator did not revise the latest forecast for economic growth, noting that trade conflicts are still the most important source of risk. The main support for the economy is provided by low-interest rates.

The Canadian dollar regained its positions against the US dollar, and the USDCAD pair fell from its weekly highs around 1.3320, to the level of 1.3190. This happened after the Bank of Canada left its key interest rate unchanged at 1.75%. But a more important point was the statement that there are now signs of stabilization of the world economy, which will have a positive impact on the country's economy. The regulator did not revise the latest forecast for economic growth, noting that trade conflicts are still the most important source of risk. The main support for the economy is provided by low-interest rates.

Many expected that the Canadian regulator will lower interest rates at this meeting, but it is still very early to talk about the end of the monetary policy easing cycle, as further decisions regarding rates will depend on the bank's assessment of the negative impact of trade conflicts.

As for the current technical picture of the USDCAD pair, the breakout of the support of 1.3195 may lead to the formation of a new bearish impulse, which will allow reaching the lows of 1.3160 and 1.3130. If the bulls manage to keep the pair above 1.3195, the option of an upward correction to the resistance of 1.3230 and 1.3260 is not excluded, from where the sellers will again actively act.