Economic calendar (Universal time)

Today, the economic calendar contains a variety of statistics, but publication of important indicators on December 5 is not expected.

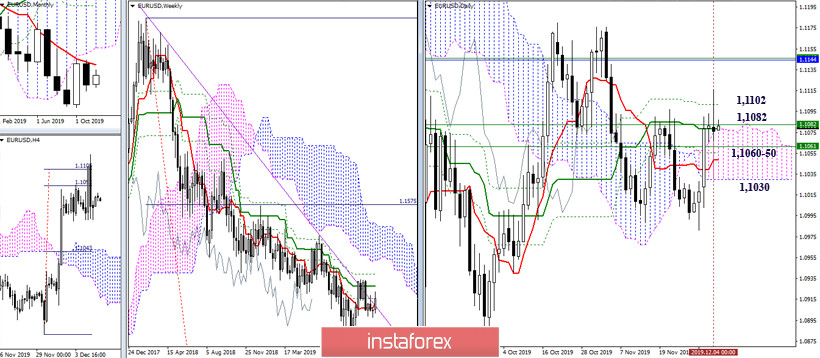

EUR / USD

Yesterday, none of the players managed to be as convincing as possible. As a result, the day has a long upper shadow, but the full-fledged rebound of the day candle is still not complete. Therefore, it is now highly likely that consolidation and uncertainty will develop. The current resistance is 1.1102 (the final boundary of the daily cross). The center of attraction is the area of 1.1082 (weekly Fibo Kijun + daily medium-term trend + upper boundary of the daily cloud). In this situation, support can be noted at 1.1060-50 (weekly Tenkan + daily levels) and 1.1030 (lower boundary of the daily cloud).

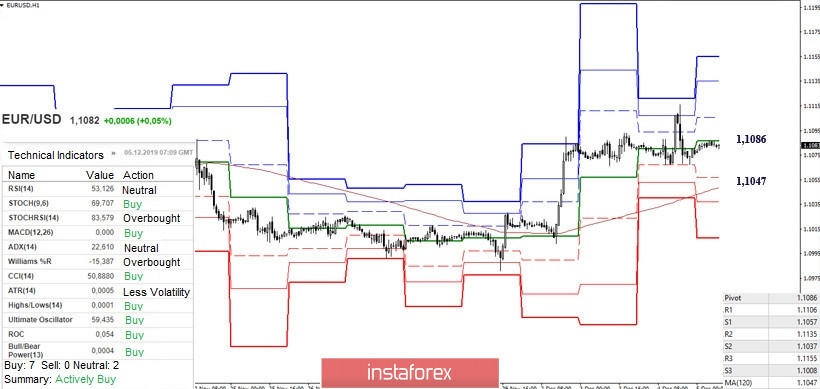

At the moment, the pair is deep enough in the downward correction zone. The players on the upside need to overcome 1.1086 (central Pivot level) and 1.1116 (maximum extreme), in order to regain their advantages and opportunities today. The positions of players to lower can be strengthened, having consolidated below the weekly long-term trend, which is now located at 1.1047. Due to the lack of clear priorities in yesterday's daily movement, today's movement will most likely develop within the boundaries indicated above 1.1116 - 1.1086 - 1.1047.

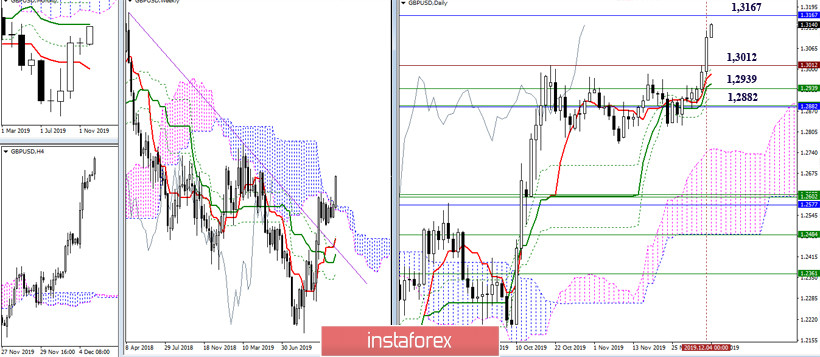

GBP / USD

Yesterday, players on the upside continued to rise and are now close to testing the monthly medium-term trend (1.3167). Future analysis and forecast will depend on the outcome of this interaction. Today, the support zone has retained its location, but it is located quite far from the current price chart - 1.302 - 1.2939 - 1.2882 (maximum extremum + weekly cloud + daily cross + monthly Fibo Kijun), so it is unlikely to be relevant in the near future time.

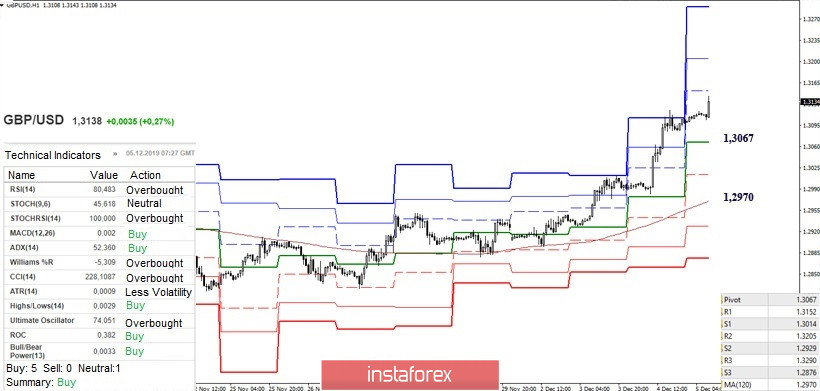

On the side of players to the upside, the support for all analyzed technical instruments. As a result, the current upward trend is now in its active phase. Today, resistance within the day is located at 1.3152 (R1) - 1.3205 (R2) - 1.3290 (R3). The key supports are 1.3067 (central pivot level) and 1.2970 (weekly long-term trend), with 1.3014 (S1) as intermediate support.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)