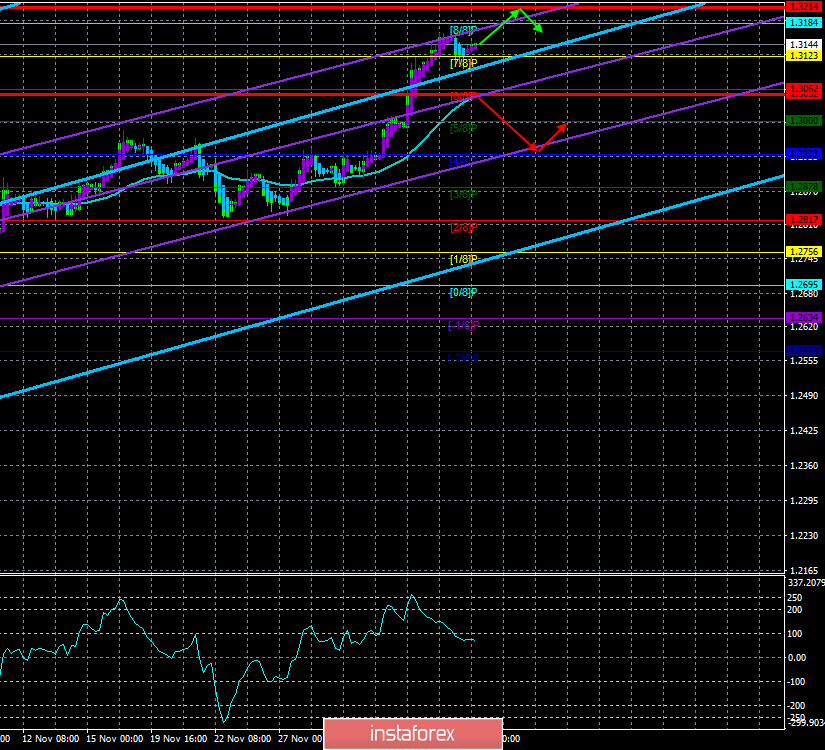

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 73.5504

The British pound continues to grow as if nothing had happened. All Friday's macroeconomic reports and events were ignored by traders, although this is again the case when the British pound could have fallen significantly, if not for traders who continue to actively believe in the victory of Boris Johnson's party in the elections on December 12 and only based on this factor alone, they continue to buy the pound. On Friday, the pound/dollar pair did not even have a correction. Just a few dozen points down, after which the upward movement immediately resumed. Well, the election is not long to wait. Voting will begin already on Thursday, and the next day on Friday, the results will be known, and at the same time, the answers to several fundamental questions that will determine the future of the UK.

On the first trading day of the new week, no macroeconomic publications are scheduled in the UK, as in the United States. However, traders of this currency pair do not need them now. This week, there will be a movement called "believe in the victory of the conservatives - buy the pound." Thus, we do not expect any changes in the trend of the currency pair movement until next week. Around the same time, it will finally become clear whether Brexit will take place at the end of January with a probability of 90-100% or the whole process will again "walk along the edge of a knife", and Boris Johnson will collect the votes of parliamentarians necessary for the implementation of his plan. The Prime Minister of Great Britain, by the way, continues to crumble in promises. We have already witnessed his promises to take Britain out of the EU by October 31, and now we have seen promises to implement Brexit by January 31 and complete all negotiations on a post-divorce trade agreement with the EU by December 31, 2020. However, as we have said before, many political experts believe that within one year of the "transition period", it is physically very difficult to conclude an agreement that will determine the trade relations between the Alliance and the Kingdom for many years. According to many experts, it is possible to conclude only an agreement "in a hurry". Thus, Boris Johnson cannot understand this and, most likely, continues to be guided by the strategy of "promise everything - do what you can." The main thing now is to get as many votes as possible in the elections, to win them, and then we will have to work with the balance of forces in the parliament, which will be obtained after the elections.

In general, the uncertainty that we have been writing about for several years, the uncertainty that the pound is so afraid of, it persists. Who can now say how the whole Brexit epic will end? We believe that the pound will continue to strengthen in the week, but it cannot grow permanently, ignoring all the macroeconomic statistics from the States and the UK. And from both countries come such economic data that should cause a sell-off of the British currency. At a time when the pound was falling on expectations of a "hard" Brexit, it was also falling because of economic data that continued to deteriorate in the United Kingdom. Fell on very reasonable expectations of a serious deterioration in the economic situation in the Foggy Albion with any Brexit option. Now what? The pound is rising because markets believe in the implementation of Boris Johnson's plan, which, although better than the "hard" scenario, will also harm the British economy. Thus, we believe that the pound will resume its decline sooner or later. Even if Brexit ends before January 31. The only thing is we need to wait for a turn down technical indicators and try not to "catch" the downward reversal of the pound. At the beginning of the new week, the British currency already shows a desire to continue growing, and all indicators are still directed upwards.

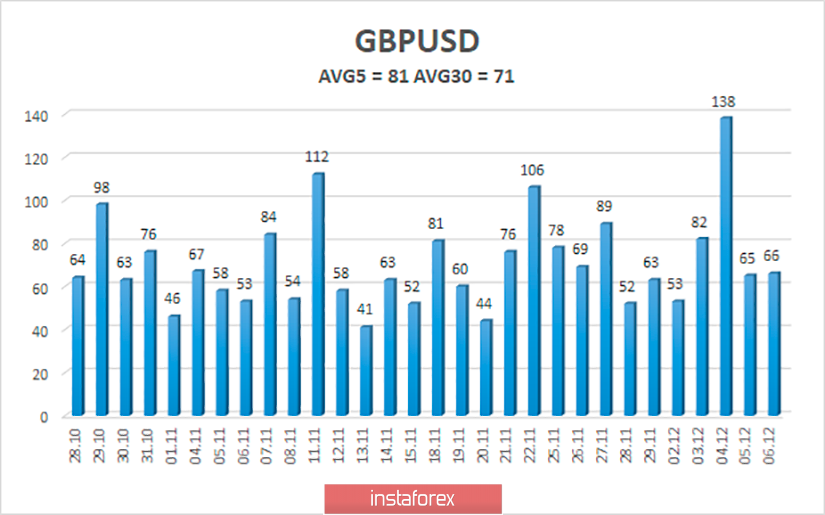

The average volatility of the pound/dollar pair for the last 5 days has not changed and is 81 points, for the last 30 days -71 points. Based on the average volatility of the pair, the maximum possible level for today is 1.3214, if the pair continuously moves up all day. Based on the same indicators of volatility, we can conclude that the sale of the British currency today will not become relevant since the price is unlikely to be able to consolidate below the moving average line today.

Nearest support levels:

S1 - 1.3123

S2 - 1.3062

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3184

R2 - 1.3245

R3 - 1.3306

Trading recommendations:

The GBP/USD currency pair continues its upward trend. Thus, in these conditions, it is recommended to continue to buy the pound until the reversal of the Heiken Ashi indicator down from the targets of 1.3214 and 1.3245. It is not recommended to return to sales today, as the price is too far from the moving average line. All macroeconomic statistics are still ignored by traders, political and technical factors are in the foreground.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.