Good day!

Last week, as a result of strong growth in the technical picture of the pound/dollar pair, there were serious and significant changes. The US currency was not helped by good reports on unemployment and job creation in non-agricultural sectors of the US economy for November.

No less significant events are expected this week. I believe that the main events for the entire market will be the Fed's decision on rates and updated economic forecasts, as well as the US consumer price index (CPI).

Regarding the pound, GDP data will be important.

Briefly about the external background. In general, there are no global changes. Everything goes on as usual. The US and China are still in negotiations on trade relations and continue to seek a compromise. President Trump still makes rather controversial statements from time to time.

The UK is still in the "divorce" process with the European Union, and it seems that this will never end. The Labor and conservatives continue the election race. At the same time, the gap between Labor and conservatives has decreased.

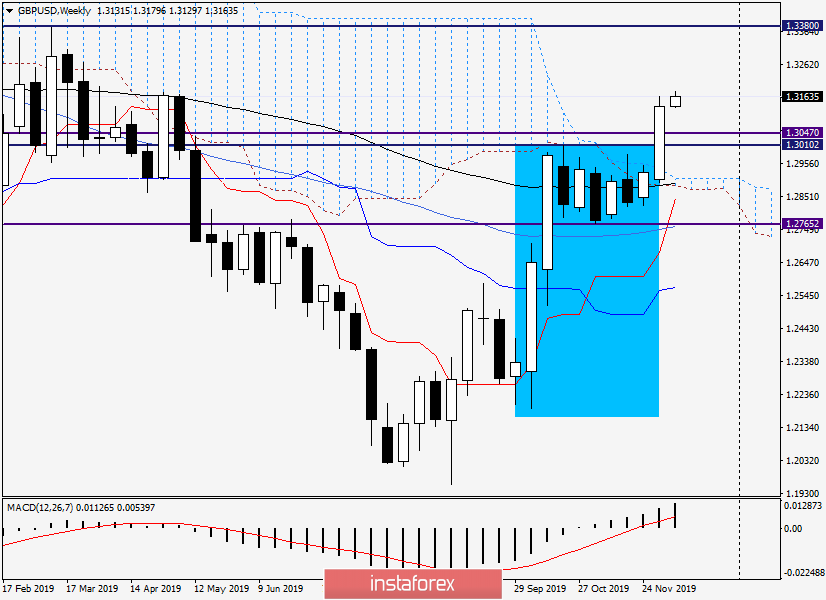

Analysis of the technical picture of GBP/USD, as a rule, on Mondays, we will start with the weekly chart.

Weekly

It is in this timeframe that the most significant changes have occurred. As a result of the 6-week consolidation in a relatively narrow range, there was a model of continuation of the technical analysis "Flag". In this case, it is a signal for continued growth, which means purchases of the British currency.

At the same time, I believe that it is most expedient and profitable to open long positions on the pound at prices after corrective rollbacks, which have not been canceled.

After a confident and powerful breakthrough of the strong resistance zone of 1.3000-1.3050, it is quite possible to expect a rise to the resistance level of 1.3380 and to the psychological mark of 1.3500, where the 200-exponential moving average is located. Naturally, this will not happen immediately, and the pair is still "pawed". Now let's try to find the best points to enter the market.

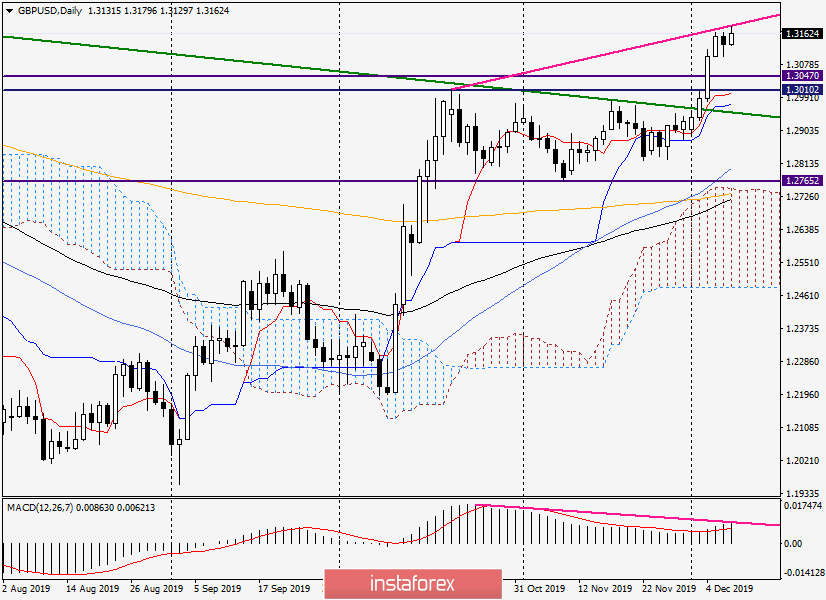

Daily

As you can see, the pair has a strong bullish mood. This can be judged by the fact that the reversal in its form and essence of the bearish candle for December 6 at the time of writing is absorbed by growth. This problem will be solved if the closing price of today's trading is above 1.3164, which is quite realistic, taking into account the current highs at 1.3180.

Judging by the daily chart, the most attractive price and correct technique of buying would be after the rollback to the area of 1.3050-1.3000. But will the market give such a pullback? Unknown. Basically, after such a strong movement, the correction is insignificant or even completely takes place in the sidewall.

It is also necessary to pay attention to the bearish divergence that formed on the daily chart. This may be an additional signal for a corrective pullback of GBP/USD.

At the moment, the main trading idea for the pound/dollar pair is buying, which is better to open after corrective rollbacks in the price zones of 1.3135-1.3100 and 1.3050-1.3000. At the same time, it is necessary to remember that the first (earlier) variant of positioning is also riskier.

On sales, I can say the following. This positioning is against the main upward movement, which the market has chosen. If today's candle does not absorb the previous one and will be a bearish model, you can try selling with a small stop and the nearest targets in the area of 1.3135-1.3100. So far, this is all thoughts on the pound/dollar pair.

Good luck and big profits!