To open long positions on GBPUSD, you need:

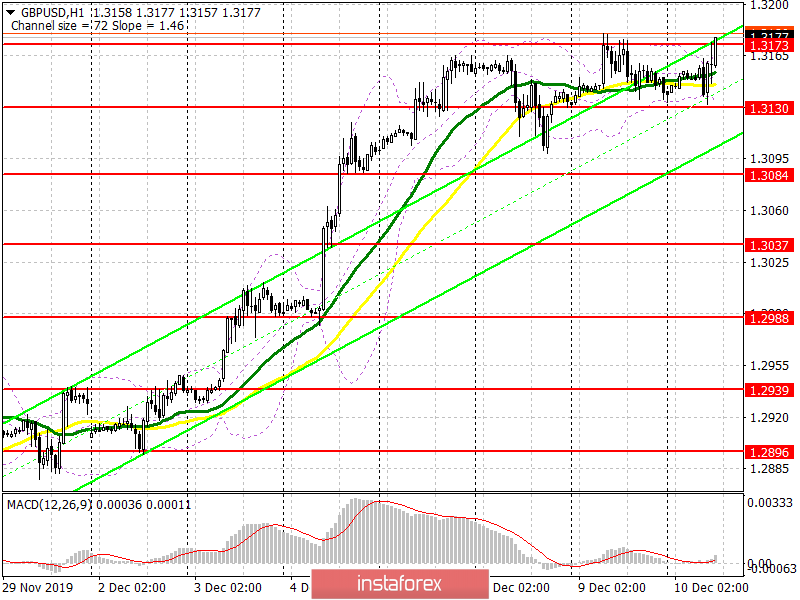

In the first half of the day, there were reports on the state of the UK economy, which showed no changes in October this year compared to September, where there was a growth of only 0.1%. The lack of growth points to problems primarily related to Brexit. However, the buyers of the pound were almost embarrassed. As noted in the morning forecast, the formation of a false breakout at 1.3130 led to new purchases, and now the bulls are trying to break above the resistance of 1.3173, which may trigger a new wave of purchases before the important elections in the UK, which will be held later this week. Consolidation above 1.3173 will open a direct road to the area of highs of 1.3227 and 1.3265, where I recommend taking the profits. Important opinion polls may also be published today. If they point to a decline in the leadership of the UK Conservative Party, the pressure on the pound could intensify. In this case, it is best to open new long positions only after the decline to the lows of 1.3084 and 1.3037.

To open short positions on GBPUSD, you need:

In the first half of the day, the bears coped with the morning task and reached the support of 1.3130, but they did not have enough strength to continue the downward correction. At the moment, it is necessary to keep the resistance at 1.3173, as its breakdown will lead to the demolition of stop orders and the continuation of the bullish trend. In this scenario, it is best to open short positions only after the highs of 1.3227 and 1.3265 have been updated. If the bears manage to regain the market's location after weak opinion polls, or after good data on the American economy, only a breakthrough in support of 1.3130 will increase the pressure on GBP/USD, which will lead to a downward correction in the area of lows of 1.3084 and 1.3037, where I recommend taking the profits.

Indicator signals:

Moving Averages

Trading is above the 30 and 50 daily averages, indicating an upward trend.

Bollinger Bands

If the pound falls, the lower border of the indicator around 1.3130 will provide support. Breaking the upper limit of the indicator in the area of 1.3175 will strengthen the demand for the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.