The market sometimes behaves in such a way that you just want to bang your head against the wall, after first tearing cotton off from it. In addition, the market sometimes ignores absolutely any data, regardless of its importance, and then it suddenly starts to get excited because of some little things there. That is exactly what happened yesterday. At least with a single European currency. The pound, in turn, has its own solo performance.

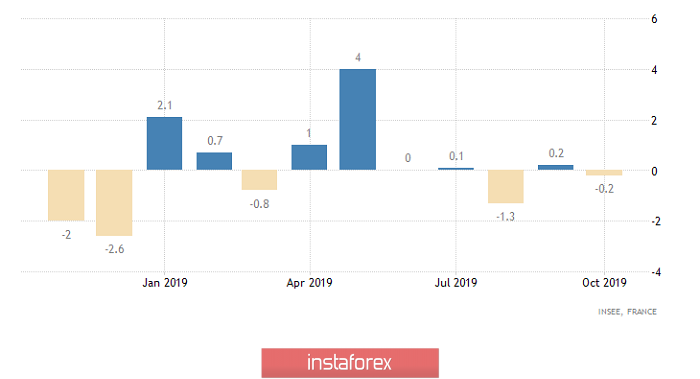

In the morning, the pound as well as the single European currency grew slowly almost imperceptibly. At the same time, they did not habitually not paying attention to macroeconomic data. However, in France, the growth rate of industrial production by 0.2% was replaced by a decline all the same 0.2%. It is just the sign has changed from plus to minus. Meanwhile, in Italy, the rate of decline in industrial production increased from -2.2% to -2.4%, but we are talking about the second and third economies of the euro area. Now, considering that we add a steady decline in industrial production in Germany to this, then the picture is just fine. But unfortunately, the single European currency just went up step by step without batting an eye.

Industrial Production (France):

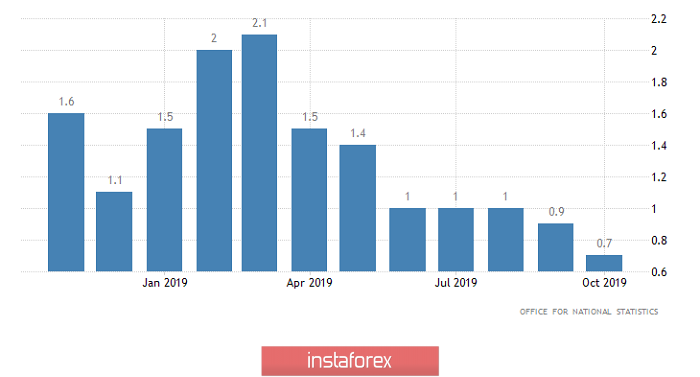

There is a similar picture with the pound. However, the industry showed at least some hint of improvement in the UK. The fact is that the decline in industrial production slowed down from -1.4% to -1.3%, although this is the only thing that the pound can bring to its assets. All other data makes you scratch your head only. Thus, the volume of construction has decreased by 2.1%, and this applies to the real estate market, which is one of the main criteria for determining the investment attractiveness of the United Kingdom. In addition, the final GDP data confirmed the fact of a slowdown in economic growth from 0.9% to 0.7%. Nevertheless, the pound, as well as the single European currency, grew slightly.

GDP growth rate (UK):

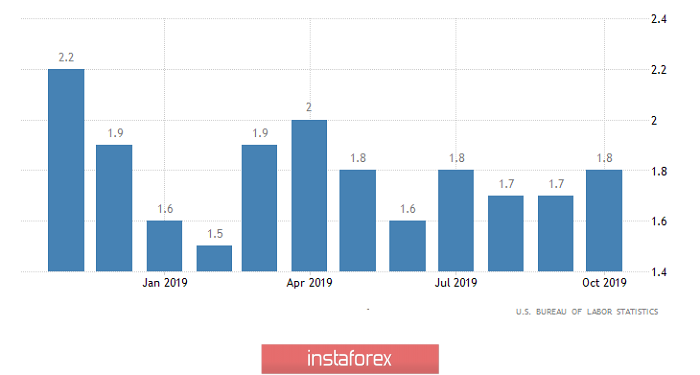

On the other hand, the growth of the pound and the single European currency intensified sharply as soon as American statistics were published. However, the whole point is that usually nobody looks at this data at all. We are talking about labor productivity and labor costs. So, the growth rate of labor productivity outside agriculture has changed its growth by 2.5% to a decline of 0.2%. At the same time, the growth rate of labor costs accelerated from 2.4% to 2.5%. To simply put it, labor productivity is declining, and staff costs are rising. Well, from the point of view of investors, such a situation is clearly another reason to visit your psychotherapist. Therefore, the negative market attitude towards this data is understandable. The only incomprehensible thing is that usually the market does not notice them at all.

Labor Productivity (United States):

However, the pound could not develop its success, as it was prevented by regular sociological polls. Students at sociologists, as a preparation for their thesis, run through the streets of British cities and pester passers-by with all sorts of silly questions about who they intend to vote for. And apparently, they already got so much the innocent subjects of Her Majesty that the level of support for the conservatives began to decline, and now, they are no longer expecting such an unconditional victory. All of this happened a day before the early parliamentary elections. In turn, the business was very tense, thought and decided, away from harm's way, to withdraw at least some money from the UK. Now, let them lie on the continent for several days. But you'll never know, the results of the vote will be such that no decision can be made at all without Jeremy Corbyn.

Today, everything that we can see at first glance will revolve around the last meeting of the Federal Committee on Open Market Operations this year, but only in part. The fact is that Jerome Powell has previously officially announced that the Federal Reserve is taking a break in terms of making any changes to the monetary policy pursued by the regulator. Therefore, there is no need to wait for anything from this meeting. However, a few hours before that, inflation data will be published, which can show its growth from 1.8% to 2.0%. Not only that it should grow, but should also be exactly to the target level previously designated by the Federal Reserve. This in itself may be an occasion for Jerome Powell and his gang to think about the possibility of raising the refinancing rate. Thus, the intrigue lies in the fact that this fact may be reflected in the final press release of the Federal Committee for Operations on the Open Market. But even if this does not happen, the very fact of increasing inflation will have a beneficial effect on the dollar.

Inflation (United States):

The single European currency is already somewhat overbought, so inflation data is an excellent reason to balance imbalances. Thus, we should expect a decrease in the single European currency to 1.1050.

Everything is uncertain in the UK because of the upcoming early parliamentary elections tomorrow, so any occasion will have a significant impact on the pound. Given the growing fears that was demonstrated yesterday, it can be argued that the pound is likely to be prone to decline and the fact is that inflation in the United States should send it to around 1.3025.