Economic calendar (Universal time)

Today's economic calendar is full of statistics from the United States. The most important events of the current day include:

13:30 basic consumer price index (USA);

15:30 crude oil reserves (USA);

19:00 Fed decision on interest rate;

19:30 press conference and economic forecasts from FOMC.

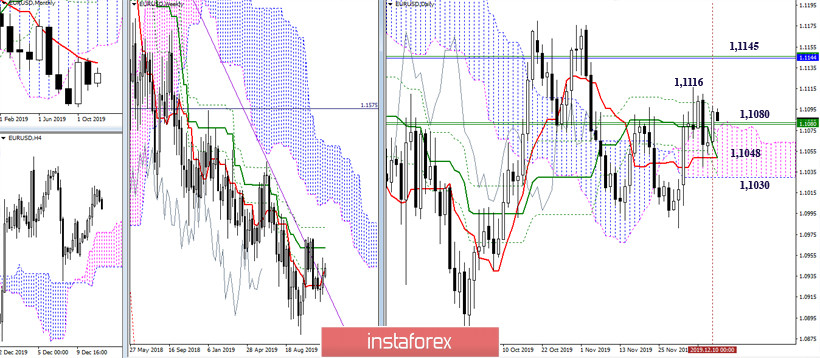

EUR / USD

Yesterday, players on the upside went into the bullish zone relative to the daily cloud, but so far, they have not been able to leave the uncertainty and the limits of movement for the past week. In the case of strengthening bull positions and sentiments, the nearest upward orientations are now 1.1116 (maximum extreme) and 1.1145 (weekly Kijun + monthly Tenkan). As for the bears, the daily cloud continues to be a zone of attraction and an obstacle in the development of decline. Its upper boundary is now strengthened by weekly support levels in the region of 1.1080 (Tenkan + Fibo Kijun), 1.1048 (daily cross) which can serve as an intermediate support level, while the lower boundary is located at 1.1030.

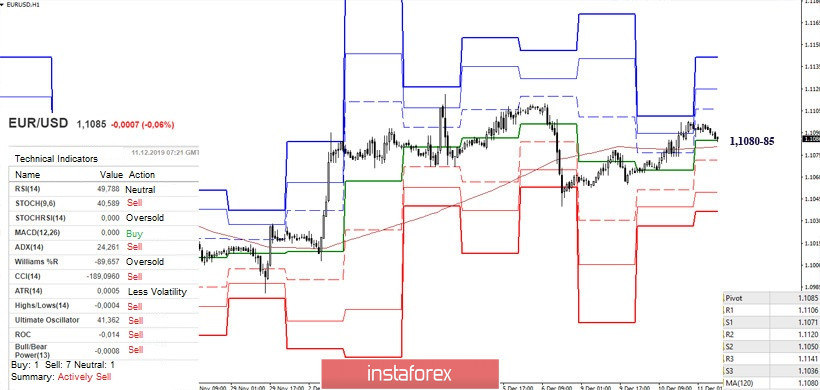

At the moment, upward players are performing a retest of the key levels of the lower halves passed on the eve. Today, they are in the important zone for all time intervals of 1.1080-85 (central Pivot level + weekly long-term trend). Now, maintaining key supports and updating highs will continue to strengthen the bullish sentiment. At the same time, resistance within the day will be the classic Pivot levels 1.1106 (R1) - 1.1120 (R2) - 1.1141 (R3).

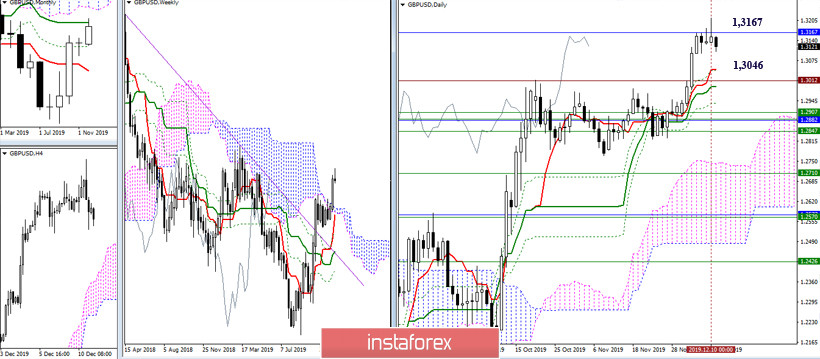

GBP / USD

Yesterday's expectation of correction remained the expectation. The pair did not update the low of the previous day. Nevertheless, the result of the next testing of the resistance met at 1.3167 (monthly Kijun) formed the preconditions for correction again according to the results of the day, so thanks to which we are seeing a decrease in the pair today. At the same time, the closest reference point for the development of correction in the upper halves is the daily short-term trend, which in the current situation is located at 1.3046.

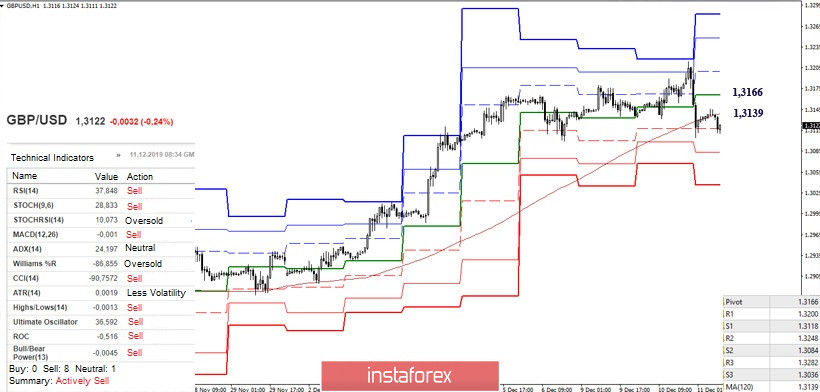

At the moment, there is a struggle for key levels of the lower halves. Reliably breaking through the support of the weekly long-term trend (1.3139) and the reversal of the moving are the main tasks for players on the downside. Thus, if the players on the upside manage to regain 1.3139 - 1.3166 (weekly long-term trend + central Pivot level), then the implementation of a full-fledged (up to the daily short-term trend) downward correction will be problematic again or its execution will be delayed in time. Now, support for the classic Pivot levels on H1 are located at 1.3118 - 1.3084 - 1.3036 today, while resistance is located at 1.3200 - 1.3248 - 1.3282.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)