The decision of the Federal reserve on interest rates yesterday was quite expected, however, the statements that were made subsequently put pressure on the US dollar. It lost a number of its positions against the euro and the British pound, thereby maintaining the upward dynamics of these trading instruments.

According to the report, the Fed left the range of the interest rates on Federal funds unchanged between 1.50% and 1.75%. The committee on Open Market Operations of the Fed had voted 10 to 0 for this decision. The discount rate remained at 2.25%, thus, the Fed left the rates unchanged and signaled a long pause, saying that the current interest levels are appropriate. This then led to a decrease in the US dollar, since it is unlikely to expect a change in policy without having a good economic growth. And as we can remember from my past forecasts, many experts predicted a contraction of the US economy in 2020. The Fed said that it will also monitor the situation in the world and weak inflation, which once again emphasizes the uncertainty of the economic prospects.

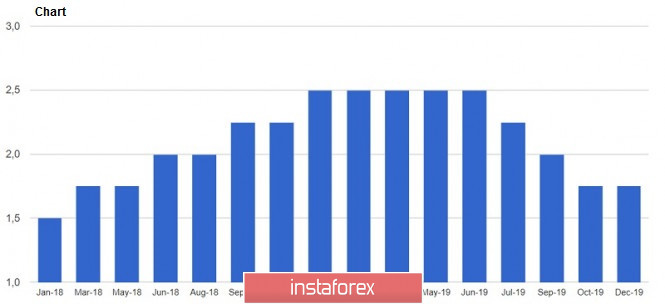

Central Bank experts forecast a median key interest rate of 1.6% at the end of 2019, and a similar level throughout 2020. Only at the end of 2021 can the rate rise to the level of 1.9%.The median interest rate in the longer term is 2.5%.

In his speech, Fed Chairman Jerome Powell said that monetary policy is in a good position to support Americans, and household spending is at a fairly high level. Problems, however, are caused by company investment and exports, which remain weak. Sluggish overseas growth and trade uncertainty are putting additional pressure on manufacturing and production, which slows the economy.

Powell is also concerned that inflation remains below the 2% target, but the open market committee expects it to return to 2% next year.

The fed Chairman also spoke on the topic of REPO market operations, explaining that this is being done in order to keep interest rates in the target range. In his opinion, REPO operations are currently very important and are unlikely to have macroeconomic consequences. Powell also noted that the economy has faced unexpected difficulties this year, and even though the U.S. labor market is in good shape, he is not sure that it is possible to talk about a limited supply of labor, since there is not enough acceleration in wage growth. Overheating in the labor market will be recorded only at higher rates of wage growth.

At the end of his speech, the head of the Federal reserve drew attention to the fact that the governors seek to significantly improve the monetary policy mechanisms in the future.

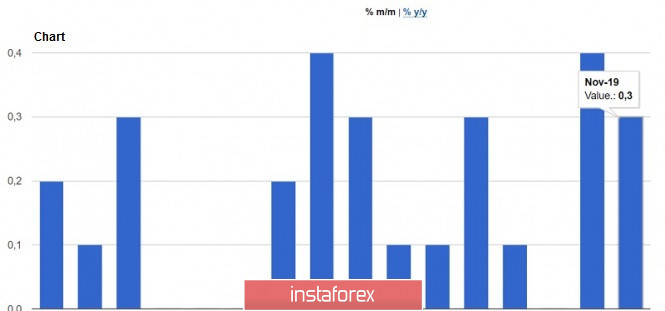

The US inflation data, although turning out to be better than economists' forecasts, signalled a slowdown in growth this November, and is not the best gift for the Fed by the end of the year.

According to a report by the U.S. Department of Commerce, U.S. consumer prices rose at a moderate pace in November, despite the historically low unemployment rate and duties on Chinese imports.

Thus, the US consumer price index in November 2019 increased by 0.3% compared to the previous month, mainly due to a jump in energy prices and rental real estates. Core inflation, which excludes volatile categories including energy, rose by only 0.2% in November. Compared to the same period the previous year, the index rose by 2.1%, while the base index rose by 2.3%.

This morning, all attention will be focused on the decision of the European Central Bank on interest rates, which will most likely remain unchanged at zero level. It is also unlikely that by the end of the year, the European regulator will make any significant changes in the course. However, it is expected that in the 1st quarter of 2020, the ECB will be forced to continue lowering rates if the measures that were taken in early autumn of this year do not bring a gentle result. So far, there is no special economic recovery observed.

As for the technical picture of the EUR/USD pair, increase can only continue on positive statements from the new President Christine Lagarde. A breakthrough on the resistance of 1.1160 will provide risky assets with an upward movement to the highs of 1.1200 and 1260. If the pressure on the euro returns, the intermediate support will be at the area of 1.1120, but the larger levels are concentrated at the lower border of the channel in the areas of 1.1070 and 1.1030.