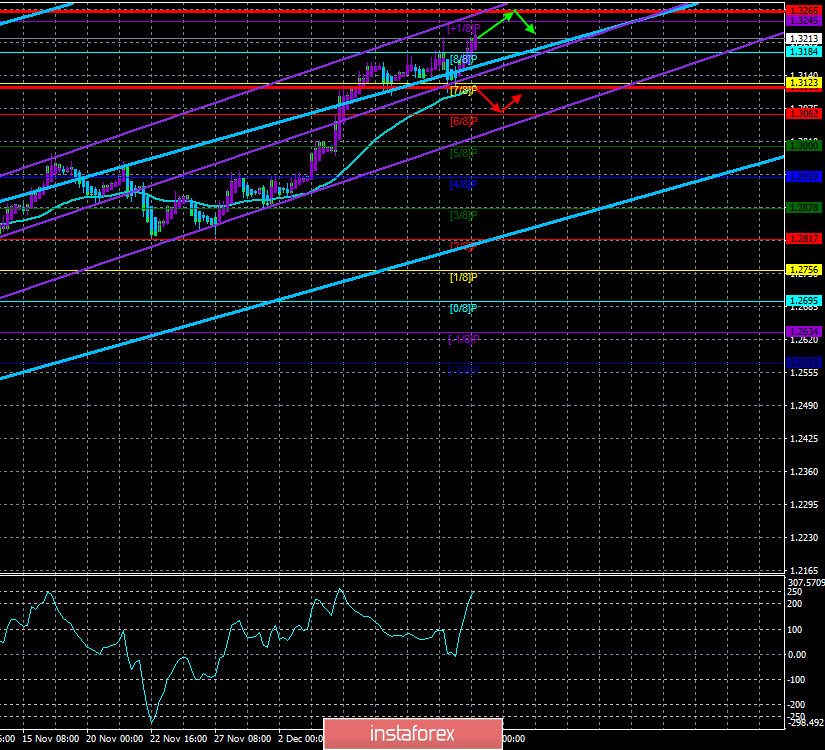

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 201.8255

As we have already found out, traders had something to turn their attention to yesterday - the publication of the consumer price index in the United States, the Fed meeting, and a speech by Jerome Powell. Even though the last two events were generally quite boring and uninteresting, traders could react, for example, to the inflation report. However, instead, the pound just continued to rise carelessly. Naturally, none of the market participants paid attention to inflation or the rhetoric of Jerome Powell, because parliamentary elections have already started in the UK today, which will last until 22:00 local time. Of course, until tomorrow morning, the topic of elections in the UK will be the number one topic for the whole world. The future of Great Britain, in particular, its Brexit, will depend on the results of these elections. Thus, on the same expectations of an unconditional victory for Boris Johnson's party, the pound may continue to rise until tomorrow morning, although even from a technical point of view, a correction would be more logical now. But market participants, for the most part, do not think so, the indicator Heiken Ashi turned up, all other trend indicators are also directed upwards. Thus, a completely uncorrected upward trend continues, but what will happen to the pound/dollar pair today and tomorrow are quite difficult to predict.

In principle, any macroeconomic statistics today and tomorrow can be ignored. The pound/dollar pair has been ignoring any macroeconomic reports for 2 months. The most commonplace scenario is the growth of the pound today and tomorrow if the victory of the Conservative Party will be confirmed in the end on Friday, the 13th morning. If Boris Johnson's party fails to form a "ruling majority", it is likely that the GBP/USD pair will collapse, as traders bribed the British currency for two months in a row solely on the expectations of a conservative victory, which will allow them to implement Brexit later. The fall of the British pound on Friday is possible even with the unconditional victory of Boris Johnson, as most traders can begin to fix the long-awaited profit on open buy orders, rightly assuming that it does not make sense to keep long positions open any longer. Thus, there are plenty of possible scenarios. In such a situation, we recommend that you closely monitor the technical picture. Bursts of emotions in the forex market will be possible tomorrow night and tomorrow morning. Until then, you can simply follow the trend, reacting only to possible reversals of trend indicators down.

Well, while traders continue to buy the pound carelessly, a new squabble has broken out between Boris Johnson and Jeremy Corbyn. The Labor leader drew the attention of UK residents to a 4-year-old child with pneumonia lying on the floor in the hospital, as there are no more beds available. Corbyn also said: "The conservatives had nine years to fund the health system properly! It's time to end their regime!". When this photo was shown to Boris Johnson and asked what he thought about the crisis state of the health system, the Prime Minister failed to respond adequately and only put the phone in his pocket, apologizing to the family of this boy.

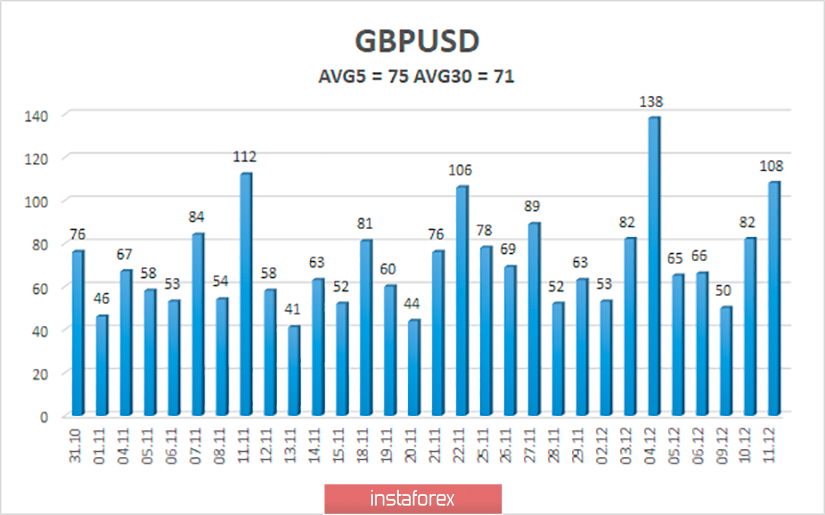

The average volatility of the pound/dollar pair for the last 5 days has decreased slightly and is 81 points, for the last 30 days - 71 points. Based on these indicators, the maximum possible level for today is 1.3265, if the pair continues its recoilless upward movement. However, as we have said, on Thursday and Friday, the pound may trade with increased volatility, so this value can be easily passed, as well as the lower limit of the channel 1.3115.

Nearest support levels:

S1 - 1.3184

S2 - 1.3123

S3 - 1.3062

Nearest resistance levels:

R1 - 1.3245

R2 - 1.3306

Trading recommendations:

The GBP/USD pair resumed its upward movement. Thus, in these conditions, it is recommended to continue buying the pound until the reversal of the Heiken Ashi indicator down from the targets of 1.3245 and 1.3265. It is recommended to return to sales not earlier than the crossing of the moving average line by traders with the goal of 1.3062. All macroeconomic statistics are still ignored by traders, political and technical factors are in the foreground.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.