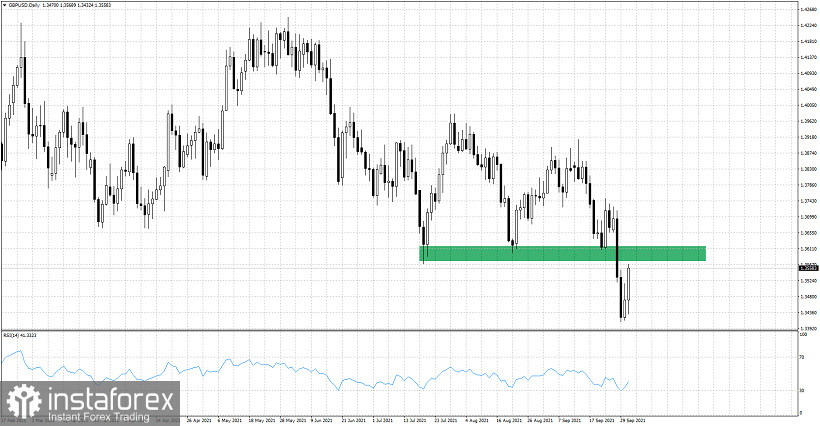

Trend remains bearish for GBPUSD as price is making lower lows and lower highs. Price today is bouncing higher towards the resistance of 1.3580-1.3610 where it was once key support. Back testing the breakdown level is justified and something bears should welcome. Why?

GBPUSD is back testing the horizontal support area as shown in the chart above. Why is this back test valuable? This back test will either confirm or invalidate the bearish break down. If price is unable to break and stay above this resistance level, then a rejection will follow. This will lead to us to believe that the sell signal given by the break down is confirmed and valid. This increases the significance of the bearish signal. If on the other hand bulls manage to recapture the green rectangle area and stay above it, then most probably the breakdown was a fake one. A trap most probably to lure more bears.