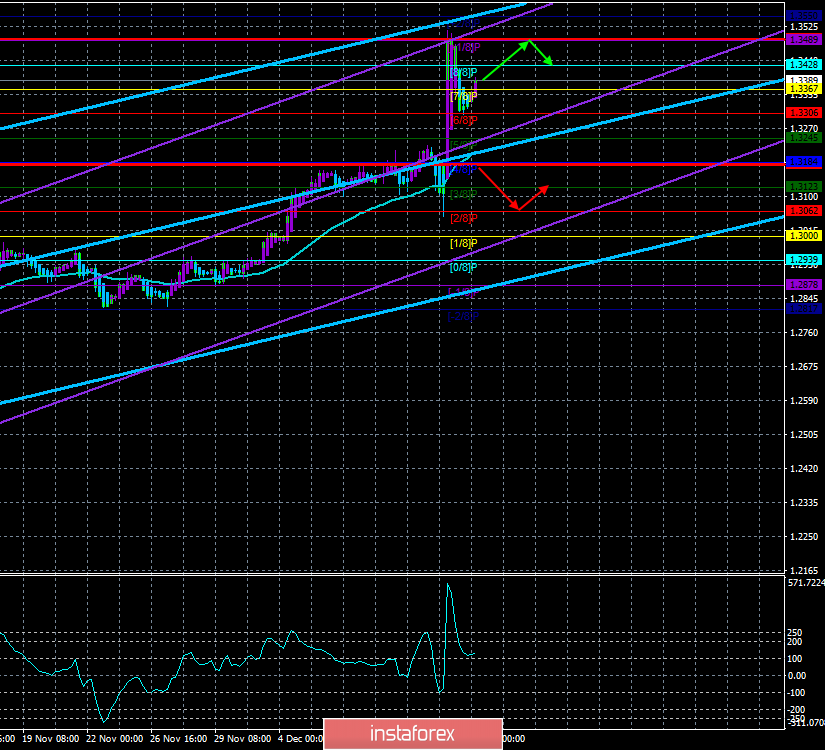

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: 116.4046

For the British currency, the past week has ended and now comes the harsh everyday life. The GBP/USD pair even managed to adjust against the strong upward trend last Friday, however, we still believe that this is not enough to consider the correction completed. As mentioned in previous reviews, the pound has been growing almost non-stop for more than two months. And based on only one factor. And without paying attention to other factors. Thus, we still believe that Boris Johnson's victory in the elections is good (for Brexit and all its supporters), the fact that Brexit is 99% likely to be implemented in the next six weeks is also good, but for the UK economy, on the indicators of which the British currency should be "built", nothing good has happened. Moreover, absolutely any Brexit in itself is a negative phenomenon for the EU economy and the UK economy. Thus, we still expect the pair to turn down and start a new downward trend, but, as in the case of the euro, we recommend not to try to guess the downward trend, but to wait for specific technical signals about the end of the current upward trend.

Meanwhile, the conservatives, who received a mandate to implement Brexit, are preparing for a new vote in Parliament. This was stated today by a member of the House of Commons from the Conservative Party and the Chief Secretary of the Treasury of Great Britain Rishi Sunak. "We will leave the European Union in a few weeks, by the end of January. We intend to bring the withdrawal bill back to Parliament before Christmas," Sunak added. It is expected that the bill will go to Parliament before December 25, as Boris Johnson said before the election. However, the fact that the UK will leave the European Union before the end of January, no one doubts, but what will happen next? Then there will be an 11-month transition period and long and difficult negotiations on a free trade area with the European Union. It is not yet known what requirements the European Union will put forward, but there is no doubt that they will be and there will be a sufficient number of them. The EU does not want to leave the UK with all trade preferences as if it were still part of the alliance. The European Union aims to leave London as dependent as possible on EU legislation. However, now Boris Johnson has a trump card on his hands, which he can regularly wave in front of the Europeans. This trump card is Donald Trump. The US President has long promised Britain an "extensive trade deal" once it leaves the EU. So, given the friendship between Trump and Johnson, negotiations could kick off right after January 31. According to some experts, Johnson can blackmail the European Union by concluding a "deal" with America. However, at the same time, the situation in this "triangle" will be very difficult, as the States do not want London to conclude any agreements with Brussels at all. In any case, the negotiations will most likely be with both sides, but it is difficult to say how they will end and when. In the coming days, we should understand whether the majority of market participants are set for further purchases of the pound? If so, all the fears for the future of the UK do not yet have any meaning and significance. Traders will still have to work out a continuing upward trend.

In the UK, by the way, indices of business activity in the areas of production and services will also be published today. In contrast to the European Union or the US, as well as the EU countries, all 4 PMI in the UK are below 50.0, indicating a decline in the manufacturing, services and construction industries (the fourth index is composite). According to experts, business activity in manufacturing and services will improve slightly in December and will be 49.4 and 49.6 respectively. Such values of business activity can indeed be considered "optimistic" since only a few tenths of a point will remain to the cherished level of 50.0, above which we can talk about growth in industries.

From a technical point of view, the Heiken Ashi indicator has already turned upwards, signaling that today the upward movement may resume. This option is possible, it remains only to find out whether it will be restrained "Monday" purchases of the GBP/USD pair or crazy purchases of "last week"?

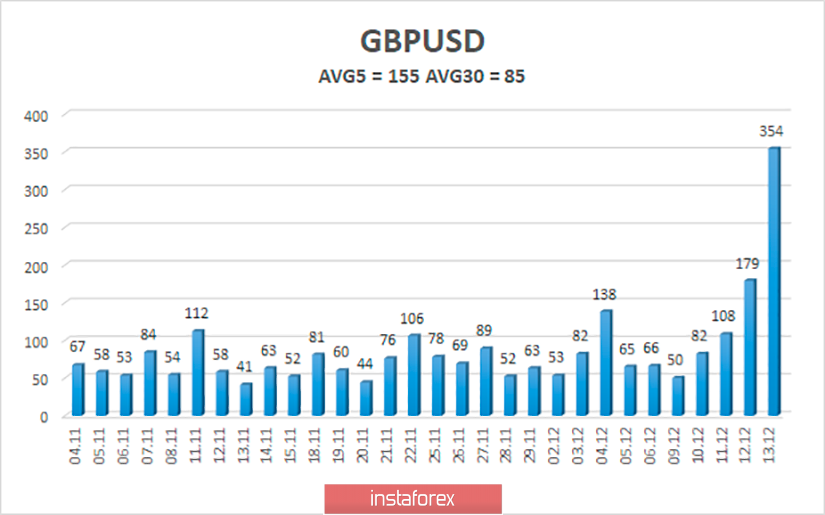

The average volatility of the pound/dollar pair over the past 5 days rose to 155 points mainly due to the last two days of the last week. Over the past 30 days, the average volatility has risen to 85 points. Thus, formally, the max and min levels today are 1.3180 and 1.3490. However, it is unlikely that any of them will be worked out. We expect more subdued movement with targets near Murray's immediate levels.

Nearest support levels:

S1 - 1.3367

S2 - 1.3306

S3 - 1.3245

Nearest resistance levels:

R1 - 1.3428

R2 - 1.3489

R3 - 1.3550

Trading recommendations:

The GBP/USD currency pair is trying to resume the upward movement. Thus, traders are advised to buy the British currency again before the new reversal of the Heiken Ashi indicator down from the targets of 1.3428 and 1.3489. It is recommended to return to sales not earlier than the crossing of the moving average line by traders, which is not expected soon.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the regression window of the indicator.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.