To open long positions on GBP/USD, you need:

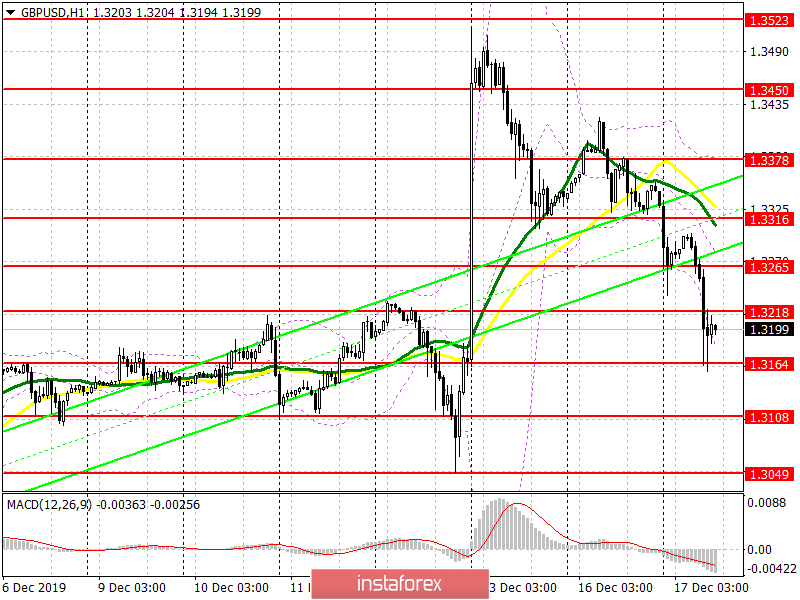

The report on the labor market, which was released in the first half of the day, was not in favor of buyers of the British pound, as the number of applications for unemployment benefits in the UK increased, being much higher than the forecasts of economists, who on the contrary expected a decrease in the number of applications. The test of the support level of 1.3164, which I paid attention to in the morning forecast, has fully worked itself out, and the bulls managed to protect this level. Also, at this minimum, you can build a new lower border of the upward channel. However, to stabilize the situation and stop the downward trend that formed after the elections to the UK Parliament, buyers need to regain the resistance of 1.3218, and this should be done as quickly as possible. Only in this case, you can expect to update the highs of 1.3265 and 1.3316, where I recommend taking the profits. If the bulls miss the support of 1.3164, then the situation will come under the control of the sellers of the pound. It is best to open new long positions from the lows of 1.3108 and 1.3049.

To open short positions on GBP/USD, you need:

The bears coped with the morning task and staged a sell-off of the pound below the level of 1.3265, which I paid attention to in my review. At the moment, a good signal to open short positions would be a bad return on the resistance of 1.3218, which may coincide with the release of positive data on the US economy, which would give the pair a downward momentum and will update the support of 1.3164, below which to break in the first half of the day failed. It is from this level that the probability of further downward correction to the area of the lows of 1.3108 and 1.3049 will depend, where I recommend taking the profits. In the scenario of GBP/USD growth in the second half of the day above the resistance of 1.3218, you can look at short positions from the level of 1.3265 and slightly higher, from the maximum of 1.3316.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 daily averages, which indicates a further downward correction in the pair.

Bollinger Bands

In the case of pound growth, the average border of the indicator in the area of 1.3265 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. The chart is marked in yellow.

- Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. The chart is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Convergence / Divergence of moving averages) - EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20