The US dollar ignored the good data on industrial production in the US as well as the growth in the construction of new homes, and strengthened only slightly against the European currency during the North American session. Meanwhile, the British pound continued its decline amidst the risk of a hard Brexit, a scenario that remains likely. The speeches of the Fed representatives did not affect the dollar much, as did the statements of the American President Donald Trump on the topic of further interest rate cuts.

As noted above, U.S. industrial production grew much stronger in November than what economists had expected. The Federal Reserve reported that while economists had expected a growth of 0.8%, industrial production in November 2019 actually increased by 1.1% as compared to the previous month. It noted that most of the increase was due to the ending of the Union of Automobile Workers' strike, which lasted for 40 days. Excluding automotive production, an increase of 0.5% was recorded. Manufacturing output increased by 0.3%.

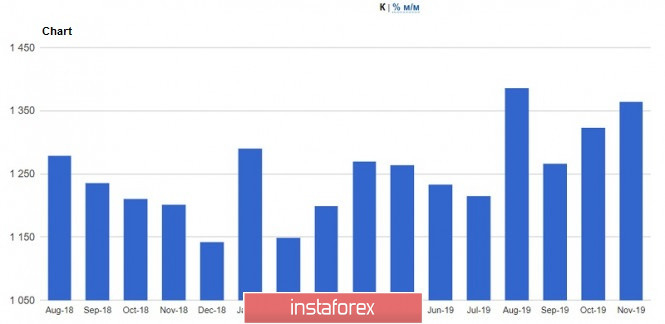

Another good news is the increase in the construction of new houses in the US, which indicates continued upward movement in the housing sector. According to the Ministry of Commerce of the country, the bookmarks of new homes in November this year increased by 3.2% as compared to the previous month, and amounted to 1.365 million. Economists initially expected that the bookmarks in November will show an increase of only 2.0%. Building permits also showed a 1.4% rise from the previous month, amounting to 1.482 million, while economists expected a 3.5% decline to 1.41 million.

Retail sales data, on the other hand, were ignored by the market. Reports by The Retail Economist and Goldman Sachs show that the US retail sales index for the week of December 8-14 rose to 2.2% and 1.4% compared to the same period in 2018.

Federal Reserve officials continued to make statements on interest rates and the economy. Robert Kaplan believes that inflation is unlikely to accelerate in the near future and will remain subdued, and that GDP in the US will grow up to 2% or slightly higher in 2020. On the issue of interest rates, Kaplan noted that the committee should not resort to their negative value.

Atlanta Federal Reserve Bank President Eric Rosengren also believes that there is no need to reduce rates based on the prospects of the economy, and central banks need to make an analysis of previously taken measures. According to him, the interest rates on Federal funds are now well below neutral levels, and the risks associated with trade and slowing global economic growth have decreased slightly.

On the other hand, the US president continues to voice his "low interest rate policy", by making a series of tweets yesterday declaring that it would be great if the Fed continued to cut interest rates, as the US dollar is very strong against other currencies, and inflation is almost not observed.

As for the technical picture of the EUR/USD, the pair remains unchanged as compared to the previous forecast. At the moment, the bears will continue to push the trading instrument below the support of 1.1110, which will lead to the lows of 1.1070 and 1.1040. With an upward correction, which can be formed in the first half of today, the problems of euro buyers can begin at the resistance area of 1.1165. Larger players will prefer the protection of the 1.1200 level, which is a kind of psychological mark. Its breakthrough will lead to the continuation of the upward trend of the European currency.

GBP/USD

The pressure on the British pound persisted further, and the bears broke through to a fairly important support level of 1.3075, which was formed before a sharp rise in GBP/USD after the elections to the UK Parliament.

The pressure on the pound is directly linked to the increased fears that the UK could leave the EU at the end of next year without a new trade agreement. Let me remind you that Boris Johnson intends to change the agreement on the withdrawal of the UK from the EU, and will be done in order to exclude the possibility of extending the transition period, which ends at the end of 2020. In short, the weak reports that have accompanied economists all week also do not add to the desire of pound buyers to return to the market.

Today, the market will be watching inflation data in the UK and the eurozone, which may further weaken the position of risky assets and lead to their decline against the US dollar.

As for the technical picture of the GBP/USD pair, a breakthrough of support at 1.3075 will hit the stop orders of buyers, but it is unlikely to expect the preservation of a powerful downward movement. Apparently, the bulls are beginning to gradually return to the market, but more acceptable levels for purchases are seen at around 1.3013 and 1.2952. The upward correction of the pound, if it occurs today, will be limited in the area of the 32nd figure.