4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - up.

CCI: -16.8839

On Wednesday, December 18, the currency pair EUR/USD continues to trade near the moving average line, having previously failed to overcome the Murray level of "6/8" - 1.1169. More doubts arise about the ability and desire of bulls to continue buying the European currency, which in the last few weeks has formed a kind of upward trend. As we have repeatedly said, the general fundamental background remains not in favor of the European currency. On Tuesday, December 17, we were once again convinced of this, as industrial production in the United States for November increased by 1.1%, which exceeded both the previous value of the indicator and the forecast value. In the European Union, yesterday, the calendar of macroeconomic events was empty, so on Monday, we have weak data on business activity in the European Union and good - in the United States, and on Tuesday - a strong report on industrial production in the United States. There is no reason to strengthen the euro currency even in the short term. But they have the US dollar, but the bulls are now frankly resting. One would assume that market participants are simply waiting for more serious and important news and do not want to risk unnecessarily before them. However, there are no important events on the horizon, such as the Central Bank meeting. Based on this, we are again forced to return to the "paradoxical situation", which has already been described many times before. As you can see, now the scheme is working again, in which the bulls have no reason to buy the euro, and the bears do not want to buy the American currency.

On Wednesday, December 18, the European Union will release an important inflation report, which once again can create pressure on the European currency, at least in theory. The fact that the consumer price index in November is projected at 1.0% y/y, but in monthly terms, inflation may lose 0.3%. It can also be recalled that at the end of November, inflation in Germany did not accelerate and amounted to 1.1% y/y, and in Italy - it slowed to 0.2%. Thus, there is no reason to expect that pan-European inflation will unexpectedly accelerate and exceed 1.0%. Therefore, buyers will not even have a hypothetical opportunity to buy euros based on this report. At best, inflation in the EU will remain at 1.0% y/y, at worst - it will slow down again. ECB chief Christine Lagarde is also scheduled to speak today. However, first of all, it is not known what her speech will be devoted to, whether the issues related to monetary policy and the economy of the alliance will be touched upon. Secondly, again, what can Christine Lagarde please European currency buyers with? From our point of view, nothing. She, of course, may declare that she "sees" certain signs of recovery or improvement in the economic situation. Yes, only macroeconomic statistics from the European Union indicate the opposite. Thus, as in the case of the inflation report, at best, Christine Lagarde will take a neutral position or will not address these topics at all in her speech, and at worst - she will have to hint at a possible easing of monetary policy in the coming months or talk about the current state of the EU economy, which can only be described as "weak". It turns out that today, the euro/dollar currency pair will have at least two reasons to resume the downward trend, but whether the bears will take advantage of the given chances or simply ignore all the data is unknown. We would also like to remind you that today, the US House of Representatives will vote for two articles accusing Trump of abuse of power and obstruction of the work of the US Congress. "The House of Representatives will exercise one of the most solemn powers granted to us by the Constitution, as we will vote to approve two articles of impeachment of the President of the United States," House Speaker Nancy Pelosi said. We believe that most congressmen will approve the speaker's proposal.

From a technical point of view, the pair cannot yet resume the upward movement, the Heiken Ashi indicator paints the bars blue. Thus, the upward trend remains, but the bulls once again show their weakness, and the fundamental background remains extremely weak for the euro.

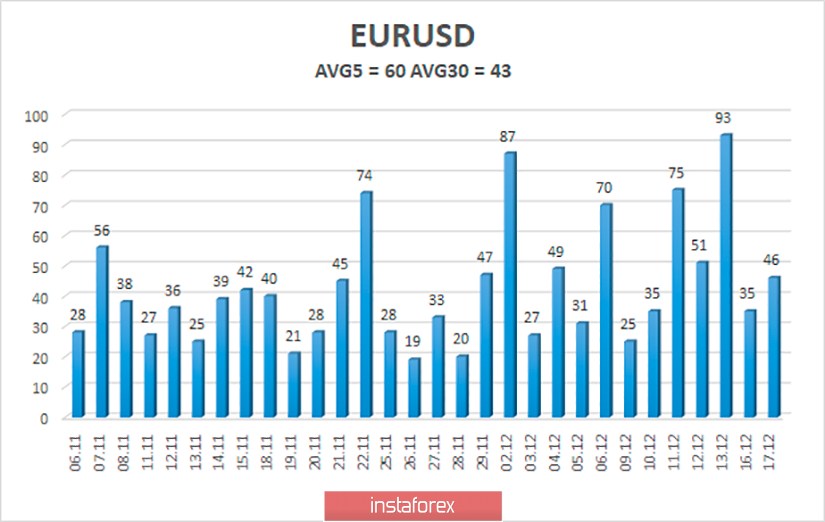

The average volatility of the euro/dollar currency pair continues to grow and is already 60 points per day, which is the average value for the pair. The average volatility for the last 30 days remains unchanged - 43 points. Thus, the channel in which the pair can move today is limited to the levels of 1.1106 and 1.1211. We still believe that around the level of 1.1183, the upward trend could have ended as traders failed to overcome the area around this level on October 21, October 31 and November 4.

Nearest support levels:

S1 - 1.1139

S2 - 1.1108

S3 - 1.1078

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1200

R3 - 1.1230

Trading recommendations:

The euro/dollar pair is correcting again, maintaining an upward trend. Thus, now the actual purchase of the euro with the targets of 1.1169 and 1.1200, which can be opened in small lots after the reversal of the indicator Heiken Ashi up. The general fundamental background is not on the side of the euro, but until the pair's quotes consolidate below the moving average line, it is not recommended to buy the US currency. After overcoming the moving average, sell positions with a target of 1.1108 will become relevant.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper channel of linear regression - the blue line of the unidirectional movement.

The lower channel of linear regression - the purple line of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Support and resistance - the red horizontal lines.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.