The currency market has practically stopped. Volatility declined markedly, and volumes fell. Now, how can such dynamics be explained?

If stock markets are trying to grow, which is likely to form an impulse for the so-called "Christmas rally", and the commodity asset market is also in positive territory, the currency exchange market has almost stood up, as many factors with multidirectional influence do not allow an unambiguous interpretation of the possible development of events. In other words, a certain direction of dynamics.

The most important factors include, first of all, of course, the negotiation process on trade between Washington and Beijing. Of course, everyone is already tired of this topic, but, unfortunately, its influence remains significant. In addition, this crisis is not completely resolved and may be in limbo for an indefinite period of time, despite the fact that there is an agreement on the first stage. By the way, the dynamics of gold clearly indicates this. Quotes of the "yellow metal" are almost in place for the third day.

Moreover, the prospects for the monetary policy of the ECB remains to be another important issue. The outcome of the December meeting of the bank somewhat reduced the possibility of large-scale measures to stimulate the economy of the euro region, but did not exclude it. The euro grew against this background, but its further strengthening stalled, as C. Lagarde's attempt to be optimistic about the prospects for the European economy provided only short-term support for the single currency, and the certainty in the prospects for British national fun Brexit stimulated short-term upward dynamics, and nothing more. However, one thing remains clear, the problems in the region have not gone away and their solution remains extremely complicated, which is unlikely to contribute to further growth of the euro.

Another problem hanging over the markets is the consequences of the legitimate coming to power of B. Johnson, who had already promised that Britain would leave the EU before January 31. What will happen next to the economies of "foggy Albion" and the eurozone is difficult to say, but the fact that the "divorce" of Britain and the EU will cause a firework of joy and economic growth both on the European continent and on the "Tin Islands", as the ancient Romans called Britain, no hope.

Assessing the prospects for the dynamics of the currency exchange market, we believe that its weakness can persist until the end of the year, unless, of course, something extraordinary happens.

Forecast of the day:

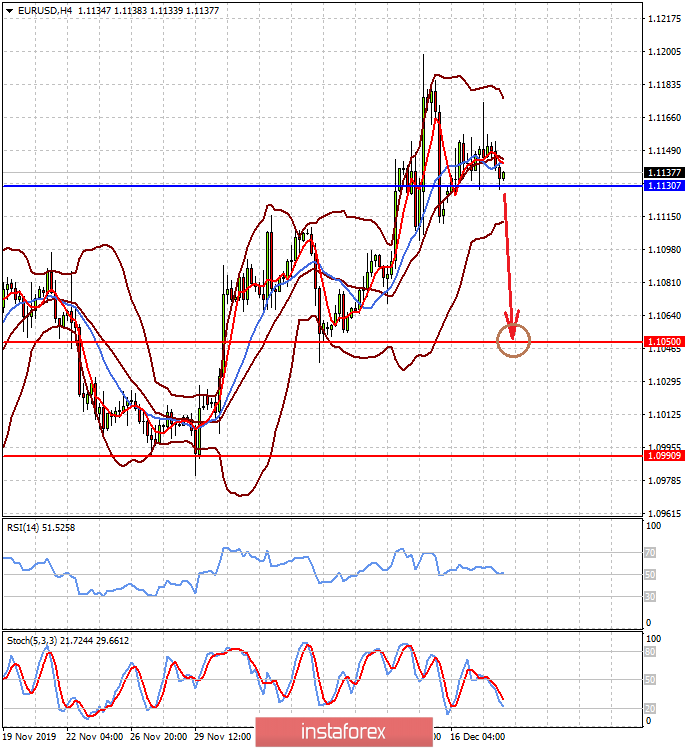

EUR/USD is consolidating above the level of 1.1130 in anticipation of a speech by C. Lagarde, as well as the publication of inflation data in the eurozone. Now, we can expect the pair to decline to 1.1050 after the price crosses the level of 1.1130 if the head of the ECB begins to talk about the need for incentives for the eurozone economy, and the values of consumer inflation will be weaker than forecasts.

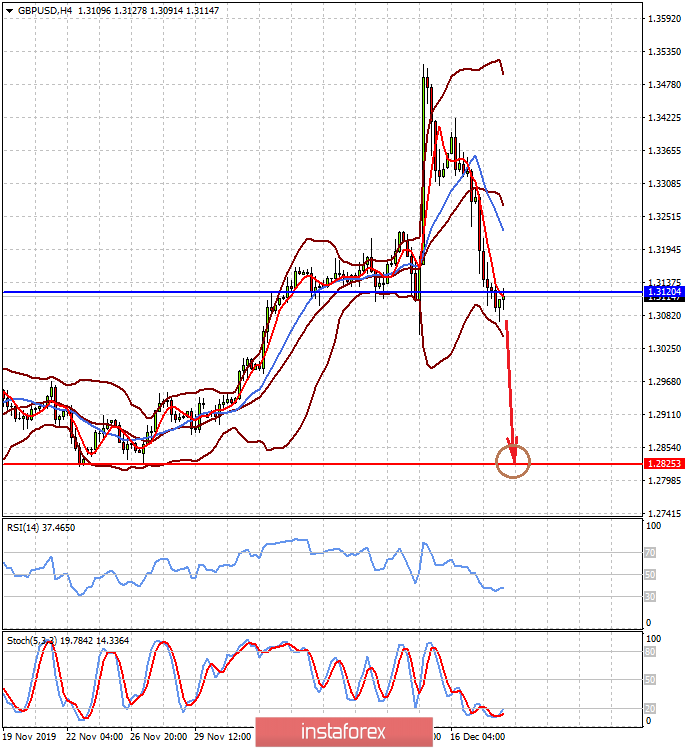

GBP/USD pair rolled back after the outcome of parliamentary elections in Britain. The price is below 1.3120. Thus, we consider it possible to resume the sale of the pair with a probable target of 1.2825, if it stays below it and consumer inflation will be lower than expected.