The run of the pound and the single European currency in different directions was somewhat discouraging and shocking, especially since there were simply no macroeconomic data that would substantiate such behavior. But the thing is the tricks of Boris Johnson, having gained absolute control over the House of Commons and realizing that nothing will stop him from fulfilling his election promise for a final and irrevocable secession from the European Union, Johnson decided to legislate the only right political course.

A bill is being submitted to the House of Commons, which prohibits even the very possibility of extending the transitional period, which will begin after January 31. This period should last about a year, and during this time, the UK and the European Union should gradually replace all mechanisms of interaction from the current to new ones that do not imply membership of the United Kingdom in the European Union. Although there are a number of unresolved issues and there is a risk that they will not be able to solve this problem in a year. However, issues such as trade and the border between Ireland and Northern Ireland are most worrying. If these issues do not have time to be resolved, then the Brexit will be held without an agreement, because all other issues are not so important.

So the weakening of the pound is quite justified, as the business is seriously in trouble. But the growth of the single European currency amid the lamentations of the Brussels bureaucrats that this is an extremely rash step, which carries many risks, and so on, is interesting. In short, a list of official languages is not so difficult to imagine. So, the growth of the single European currency looks funny, since it reflects the mood of European business, which explains that such a move by Boris Johnson will lead to serious losses of British capital in continental Europe. Also, the vacant place will be occupied precisely by European business, primarily from Germany and France.

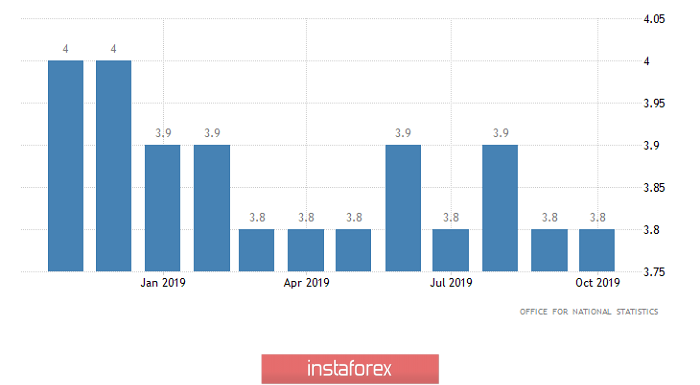

However, as mentioned above, there were simply no other reasons for the weakening of the pound. At least, exactly at the time when this race in different directions happened. Indeed, the data on the labor market in the UK in the worst case can be called neutral. Yes, the growth rate of the average wage decreased from 3.6% to 3.5%. And taking into account premiums, in general, that is from 3.7% to 3.2%. However, this was completely compensated by the fact that the unemployment rate did not increase from 3.8% to 3.9%, but remained unchanged. Moreover, employment did not decrease by 10 thousand, but grew by 24 thousand. In other words, the slowdown in wage growth is entirely justified, as employment is growing.

Unemployment Rate (UK):

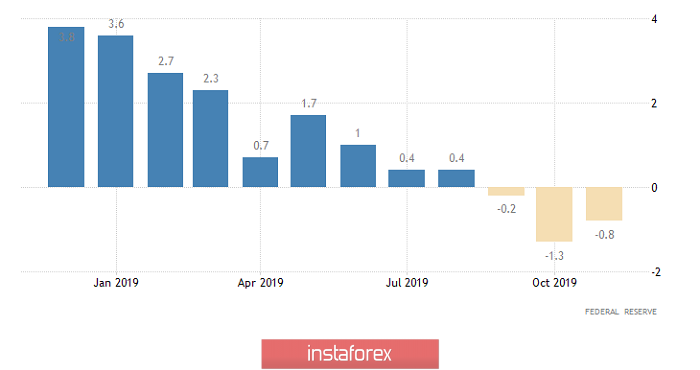

Nevertheless, by the evening, the single European currency returned to its starting position and the pound remained in those positions that it managed to reach. And this process almost completely coincided in time with the publication of American statistics, which turned out to be much better than forecasts. So, as expected, the number of started construction projects increased not by 2.5% but by 3.2%. Moreover, they expected a decrease of 3.2% in the number of issued building permits but it grew by 1.4%. This means that if the number of new construction projects will decrease in the future it will not be strong. Rather, we can talk about the prospects for further growth. But the data on industrial production looks more interesting, the decline of which did not increase from -1.3% to -1.6%, but decreased to -0.8%. So

Industrial Production (United States):

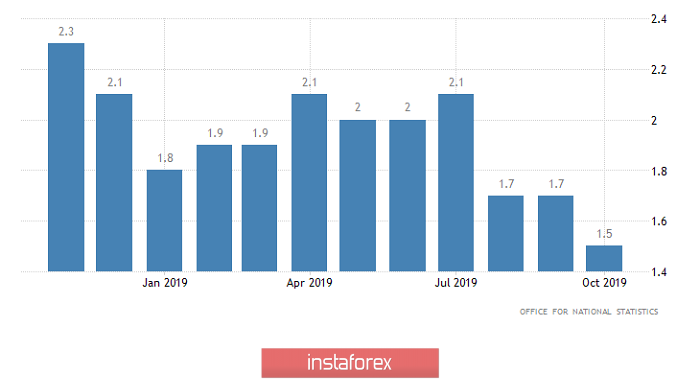

The greatest interest today is the publication of inflation data in the UK, especially since they should show its decrease from 1.5% to 1.4%. And if these forecasts are confirmed, then this will mean that starting in August, inflation in the United Kingdom only deals with what is decreasing. Naturally, this will negatively affect the pound, as investors do not like a steady decline in inflation because this leads to a noticeable increase in the payback period of investments.

Inflation (UK):

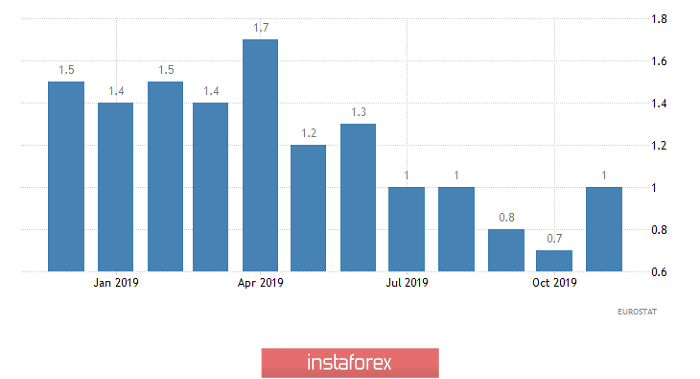

Similar data are also published in the eurozone but they should coincide with the preliminary estimate which showed inflation growth from 0.7% to 1.0%. So, in theory, nothing supernatural should happen, since the growth of this very inflation has already been taken into account by the market. However, there is a likelihood that the resulting inflation data will present an unpleasant surprise. The fact is that data on producer prices in Germany have already been released, the rates of decline of which have increased from -0.6% to -0.7% when they should have remained unchanged. However, the likelihood of this is not so great, and in any case, it is more likely that the rate of acceleration of inflation will be slightly less. In addition, the data on construction may turn out to be positive, which is still decreasing by 0.7%, and may show growth of 2.

Inflation (Europe):

Even if the data on inflation in Europe turn out to be slightly worse than forecasts, it is still a question of its growth, so that a single European currency has good chances to grow to 1.1150.

The pound will most likely continue to decline though not at such a rapid pace as yesterday. The reference point is the mark of 1.3050.