Economic calendar (London time)

The important events of today's economic calendar are:

10:30 consumer price index (United Kingdom);

16:30 crude oil reserves (USA).

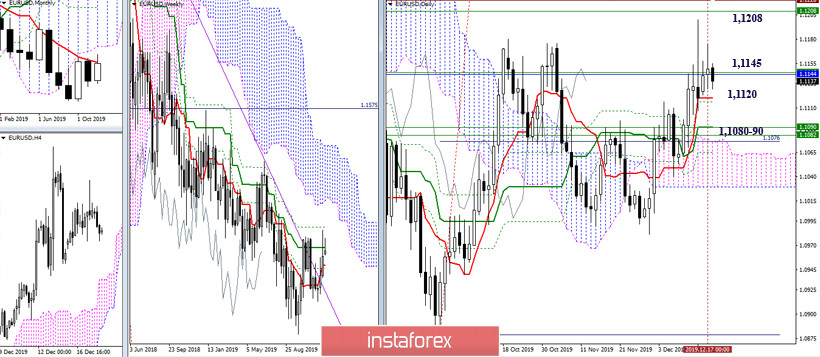

EUR / USD

The situation has not significantly changed again. The EUR/USD pair continues to consolidate within the limits of Friday's movement. Last week's high (1.1200) and the accumulation of subsequent resistances 1.1208, 1.1234-73, 1.1253, 1,1283 are bullish signs. The center of attraction is now the union of the weekly Kijun (1.1145) and the monthly Tenkan (1.1145). The nearest support is located at 1.1120 (daily Tenkan), and in case of a decline, a strengthened support zone at 1.1090-80 (weekly + daily levels) will come into operation.

At the moment, the players on the downward trend seek to take hold the key levels of the lower halves, which now form the resistance line within 1.1151-38 (weekly long-term trend + Central Pivot level). The reversal of the movement will strengthen the bearish sentiment. Once the decline continues, performance will be important. During the day, the support is located at 1.1105 (S2) - 1.1082 (S3). It should be noted that the classic Pivot levels are strengthened by the support of the senior halves, so for the implementation of further plans, it will be especially important for players to overcome this zone.

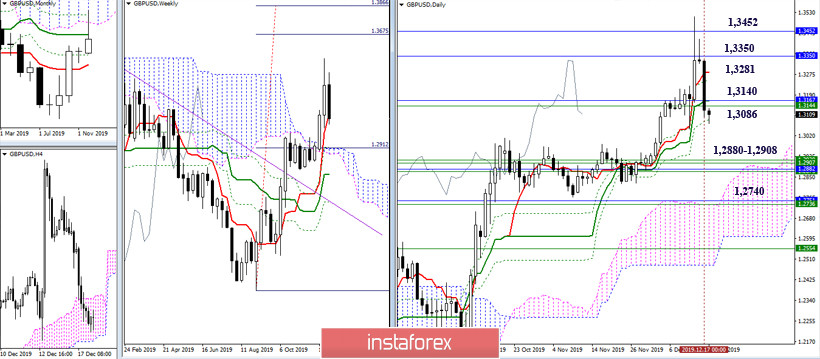

GBP/USD

Players on the downward trend continue to develop the decline. As a result, to date, they have performed a correction to the weekly Tenkan (1.3141), which strengthens the final boundaries of the daily golden cross (1.3086). A break of the met supports will eliminate the daily golden cross, depriving the support of the weekly short-term trend, and allowing us to consider the benchmarks of the downward correction on the monthly half. The area of 1.2880 – 1.2908 (weekly cloud + monthly Fibo Kijun) will be the most fortified nearest support zone, enabling us to allocate the area of 1.2740 (monthly Tenkan + weekly Kijun + daily cloud). In this situation, it is important to note what kind of mood will prevail in the remaining days of December. Maintaining the current sentiment and continuing the development of bearish trends will form a rebound from the important monthly resistance, and close the month with a reversal candle. In turn, a positive factor for the players to increase the closing of December may be above the monthly medium-term trend (1.3167), and the formation of a minimum upper shadow on the monthly and annual candles.

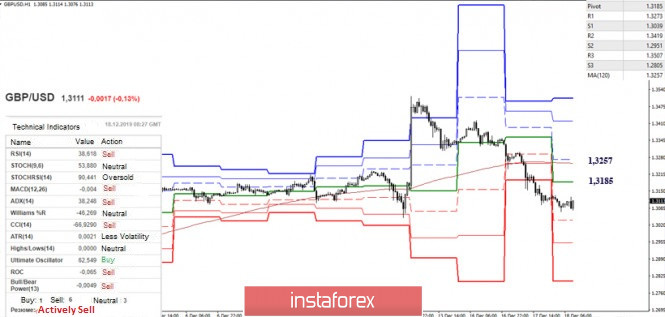

After breaking the weekly long-term trend, the advantage in the lower halves belong entirely to the players on the downward trend. They are supported by all analyzed technical elements. The change in the balance of power and the emergence of new bullish prospects will be possible after the players return to increase the key levels of H1-1.3185 (Central Pivot level) and 1.3257 (weekly long-term trend). Anything below these levels will serve to preserve and strengthen bearish sentiment. Support for classic Pivot levels today are located at 1.3039, 1.2951, 1.2805. The resistances are at 1.3273, 1.3419, 1.3507.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (50), Moving Avarage (120)