Hello!

Although the "Aussie" trading during the last five-day ended with growth, there are serious questions about the further ability of the AUD/USD pair to continue moving in the north direction

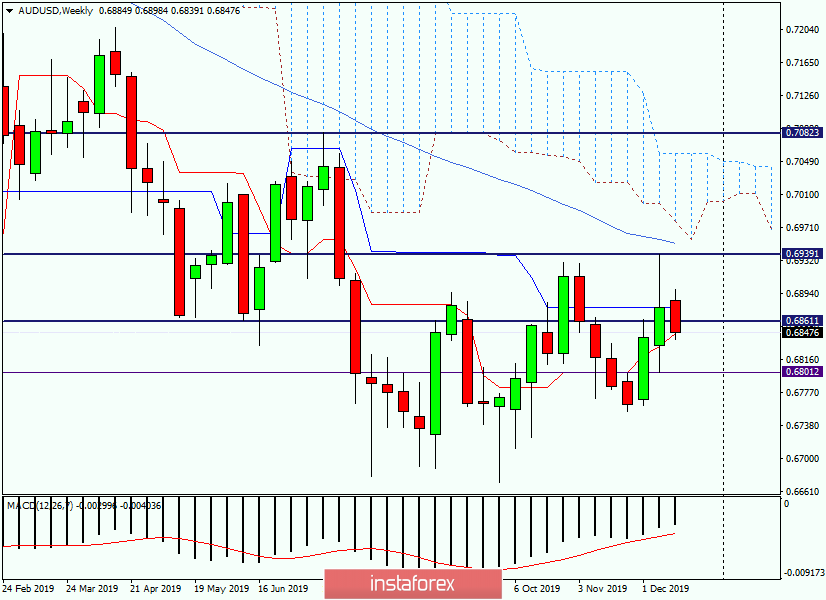

Weekly

First of all, the potential for further growth may be negatively affected by the large upper shadow of the last candle. Those who are familiar with candlestick analysis should be aware that such long upper shadows, which are larger than the body itself, tend to indicate the inability to further strengthen the instrument and often lead to a change in trend.

At the time of writing, this is exactly what is observed. Bulls on the "Aussie" tried to resume the rise of the course, but on the approach to the important and strong level of 0.6900, it could not hold the reins and handed them to the opposing side.

It is worth noting that the Kijun line of the Ichimoku indicator had not the last role in the quality of resistance. Now, if the decline continues, the nearest target of the bears on the "Australian" will be the previous lows in the area of another important mark of 0.6800. Thus, given the trading between the two strong technical levels of 0.6900-0.6800, we can conclude that the breakdown of one of these levels will determine the further direction for AUD/USD, while possibly in the medium term. If I complete the description of the weekly chart, then I am more inclined to a downward scenario.

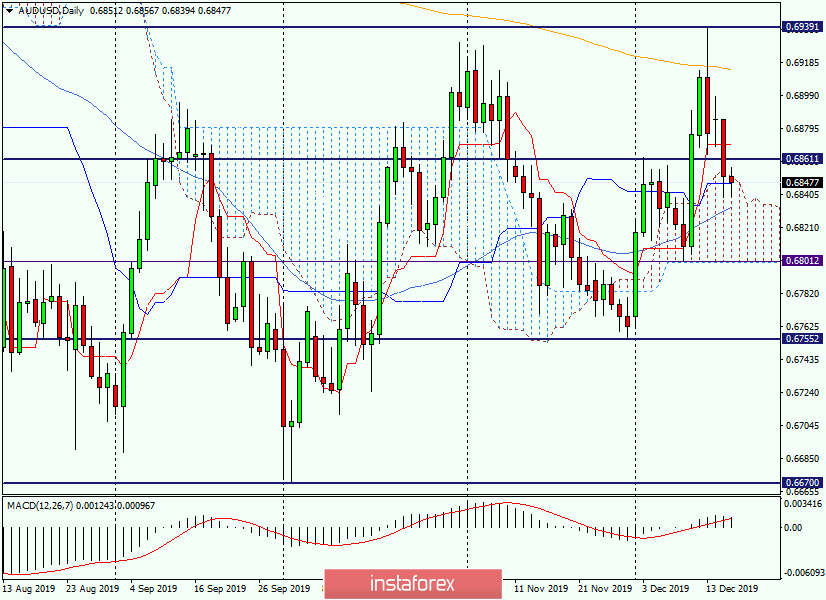

Daily

On the daily chart, we see that after the pair met strong resistance near the 200 exponential moving average and the horizontal level of 0.6940 on December 13, the rate began to decline.

At the time of writing, there is a struggle for being within the Ichimoku cloud and for breaking the Kijun line.

Given the candle for December 13, in my opinion, and on this timeframe, the downward scenario has more chances for its implementation.

If this assumption is correct, it is worth looking for points to open short positions on smaller time intervals.

H4

It is not so simple as it may seem on the weekly and daily charts. After a powerful and strong exit up from the downward channel, there is no less accentuated pullback to its broken upper border.

I believe that the 200 EMA, which runs right on the broken resistance line of the channel, can provide additional and quite strong support. Let me remind you that according to the classics of technical analysis, a rollback to a broken level or line is usually considered to open positions in the direction of a breakdown. In our case, these are purchases near 0.6840. However, do not rush, it is better to wait for the appropriate candlestick signals indicating growth, and only then open long positions.

If the pair falls below 200 EMA and returns to the abandoned channel, where it will close from one to three consecutive candles on attempts to exit the channel up again, we sell AUD/USD, but so far with small targets near 0.6800.

I recommend looking for short positions at more attractive prices near 0.6857, where 50 MA is located, and a little higher is the strong resistance of sellers.

At the end of this article, it is necessary to pay attention to important statistics from Australia - these are data on the labor market, which will be published tomorrow night at 01:30 (London time).

As a rule, labor reports from Australia have a strong impact on the price dynamics of the national currency, so technical signals can be broken.

Successful trading!