To open long positions on GBPUSD, you need:

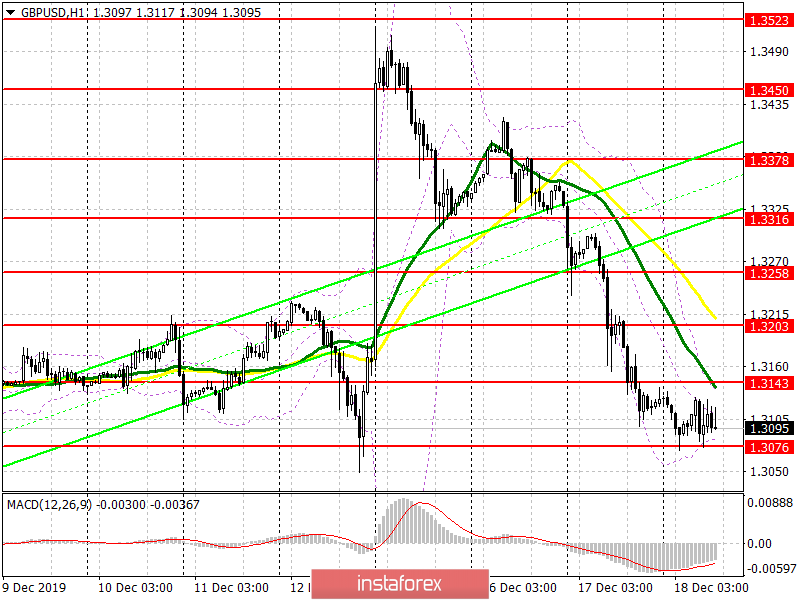

In the first half of the day, a report was released on the UK consumer price index, which rose in November this year, but completely coincided with the forecasts of economists. However, this was enough to help the pound stay above the level of 1.3076, which determines the further downward trend observed throughout this week. It is best to look for long positions after the formation of a false breakout in the support area of 1.3076, but buy immediately on the rebound from the lows of 1.3013 and 1.2952, where a bullish divergence on the MACD indicator can also be formed. Another, no less important task of the bulls will be the return and consolidation above the resistance of 1.3143, which will allow us to talk about an upward correction in the area of the highs of 1.3203 and 1.3316, where I recommend taking the profits.

To open short positions on GBPUSD, you need:

Bears are still aimed at breaking the support of 1.3076, which may lead to a continuation of the downward trend in the area of the lows of 1.3013 and 1.2952, where I recommend taking the profits. However, at these levels, a bullish divergence can be formed on the MACD indicator (hourly chart), which will limit the downward potential. If the bulls try to return to the market, the bears will defend the resistance of 1.3143 with all their strength, but it is best to open short positions from there if a false breakout is formed. You can sell the pound immediately on the rebound after updating the highs of 1.3203 and 1.3258.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 daily averages, which indicates a further downward correction in the pair.

Bollinger Bands

If the pound rises, the upper limit of the indicator in the area of 1.3143 will act as a resistance. Breaking the lower border around 1.3076 will hit the positions of buyers and lead to a decrease in the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA Period 12. Slow EMA Period 26. SMA Period 9.

- Bollinger Bands (Bollinger Bands). Period 20.