Economic calendar (London time)

The following indicators deserve the main attention today:

10:30 volume retail sales (UK);

13:00 Bank of England's interest rate decision and other monetary policy news;

16:00 sales in the secondary housing market (USA).

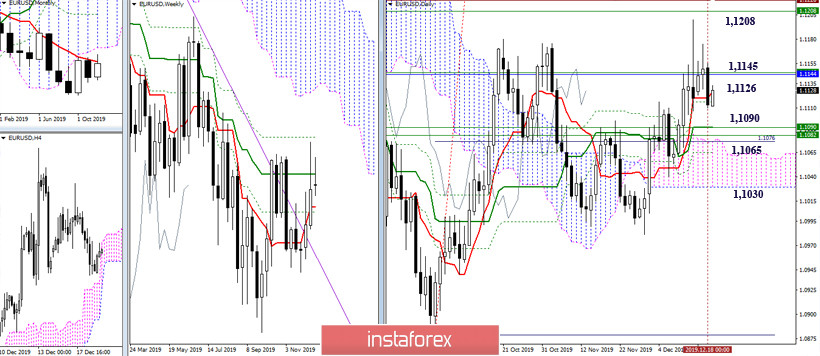

EUR/USD

The bears were busy reducing yesterday, and managed to close the day under the daily short-term trend. Keeping the daily short-term, today, the level is located at 1,1126, with the bears contributing to the continuation of the decline. At the same time, a fairly wide support zone of 1.1090-1.1065 (weekly Tenkan + Fibo Kijun + daily Kijun + Fibo Kijun + Senkou span A) should soon be expected. The nearest resistance is now at 1.1145 (monthly Tenkan + weekly Kijun).

A development of correction is observed in the lower halves. To date, the players have risen above the Central Pivot level (1,1126). The next upward indicator is the weekly long-term trend and R1 (1.1140-42), where there is an increase from the levels of the senior halves of 1.1145, levelling out all the gains of the bears yesterday. If the decline continues, the classic Pivot levels 1,1097 – 1,1081 – 1,1052 will act as supports inside the day.

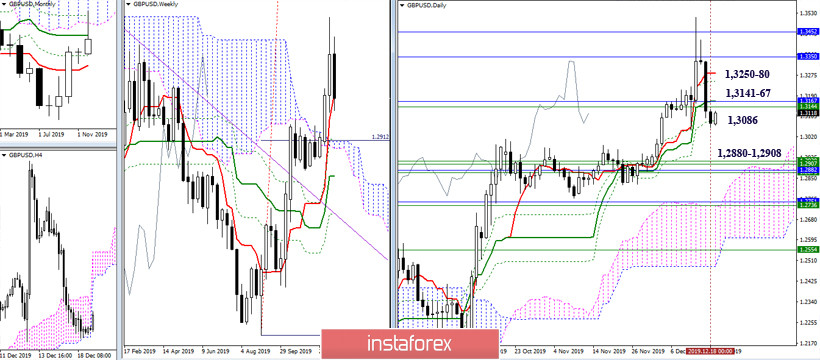

GBP/USD

Yesterday's movement did not have the same effectiveness, as downward players took a break. All opportunities and conclusions on the future development of events, voiced in yesterday's review, remain the same and relevant. Today, the nearest resistance levels are located at 1.3141-67 (monthly Kijun + weekly Tenkan) and 1.3250-80 (daily Tenkan + Fibo Kijun). The supports in this situation still remain at their location and value of 1.2880 – 1.2908 (weekly cloud + monthly Fibo Kijun) and around 1.2740 (monthly Tenkan + weekly Kijun + daily cloud).

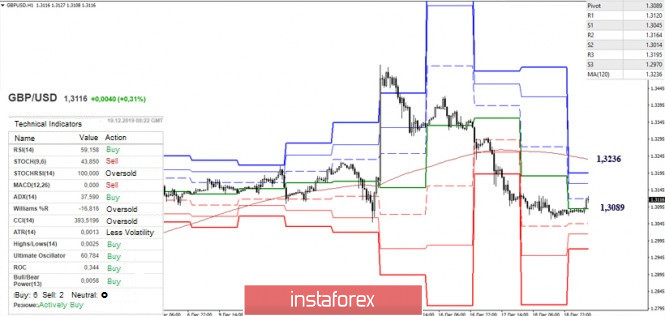

At the moment, we are witnessing the development of an upward correction. Upward players, while they have already secured the majority of the votes of the technical indicators, are seeking support status for the Central Pivot level (1.3089). The next most important resistance is the weekly long-term trend (1.3236), which is now located at a considerable distance from the price chart. Thus, intermediate resistance today may be more relevant at -1.3120 (R1) – 1.3164 (R2) - 1.3195 (R3). If the correction is completed and the decline continues, the role of supports throughout the day can be performed by the classic Pivot levels, located today at 1,3045 – 1,3014 – 1,2970.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (50), Moving Avarage (120)