Hello everyone!

Today's review of the pair of two North American dollars will begin with macroeconomic statistics, which will arrive before the end of the weekly trading and will certainly have an impact on the price dynamics of USD/CAD.

Tomorrow, we will receive important reports on retail sales and prices for new housing from Canada.

From the US, data on initial applications for unemployment benefits, the balance of payments, the production index from the Philadelphia Federal Reserve, personal income and expenses of Americans, and the base price index for personal consumption expenses are expected.

You can learn more about the date, time of release and forecasts for these and other macroeconomic reports in the economic calendar.

Usually, I consider the weekly chart on Mondays, after the end of the next trading week, but I consider the current situation on the pair to be extremely important, so I will deviate from this rule.

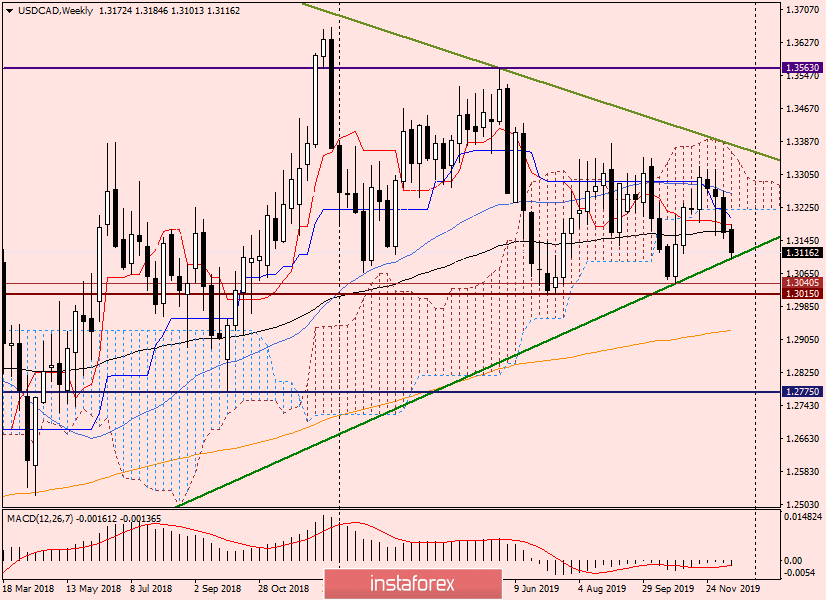

Weekly

This week (at the time of writing), the pair is dominated by bears and declining. The breakdown of the green support line 1.2061-1.3041 is being tested. If the current weekly trading closes below this line, the bearish sentiment on USD/CAD will strengthen and this will open the way to further sellers' targets in the area of 1.3040-1.3000 and 1.2926, where the 200 exponential moving average passes.

It is also worth considering the strong technical and historical level of 1.3062, which has repeatedly influenced the price and turned it around. Naturally, special attention should be paid to the psychological mark of 1.3000. Based on all of the above and indicated, an easy walk for bears on USD/CAD, most likely, will not work.

Given that the pair is trading under 89 EMA, Tenkan and Kijun lines of the Ichimoku indicator, as well as below the Ichimoku cloud and 50 simple moving average, the growth scenario looks even more complicated. We are waiting for the end of trading and the closing price relative to the support line of 1.2061-1.3041.

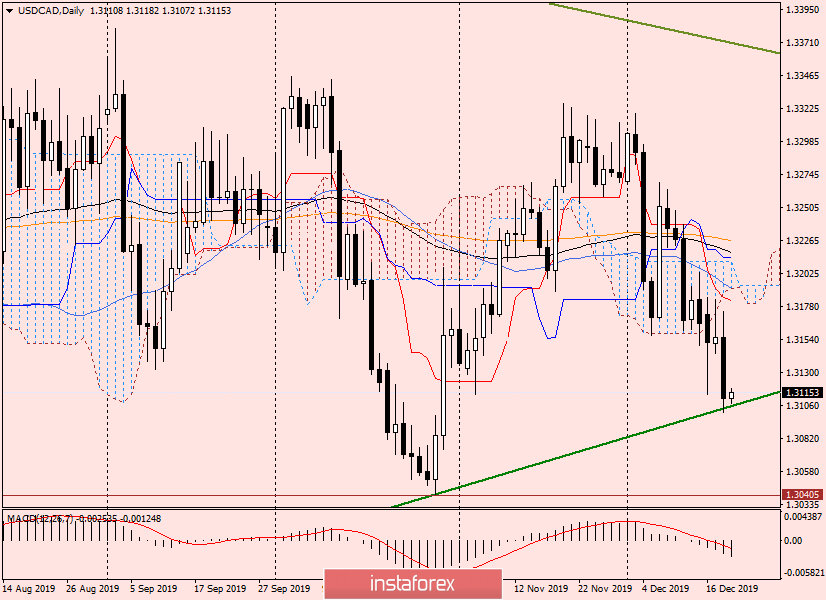

Daily

The daily chart is quite bearish. The pair came down from the Ichimoku cloud, and attempts to return to it was not successful. This factor indicates that USD/CAD is under the control of sellers.

However, at the time of writing, there are attempts to rebound the price from the weekly support line of 1.2061-1.3041, which is quite expected, given the technical analysis.

If the pair continues to move north, its nearest target will be yesterday's highs at 1.3174. If they are updated, the longer-range targets will be in the area of 1.3181-1.3191, where the broken Tenkan, the lower border of the cloud and the 50 simple moving average.

Upon the true breakdown of the green support line, the next target will be the horizontal level of 1.3045.

H1

After yesterday's fall, the "Canadian" is consolidating, which may be a harbinger of the subsequent strong and directional movement.

At the same time, I do not exclude the formation of a figure for the continuation of the technical analysis of the "Inverted Flag". If so, then after completing the panel of the figure (and this has already happened), a sharp exit down and working out the inverted flag is possible. In this case, those who trade for a breakdown can plan to open short positions on the break of a significant mark of 1.3100.

For me, the most relevant are opening positions after corrective pullbacks. Who shares such a trading strategy, I suggest considering the sale of USD/CAD after the pair rises to the price zone of 1.3130-1.3150. As you can see, here are the levels of the Fibonacci grid stretched to yesterday's decline of 1.3174-1.3101, as well as 50 simple and 89 exponential moving averages.

Successful trading!