The Christmas week begins with the decline of Chinese stock indexes, an increased demand for protective assets, and weakening crude oil prices. At the same time, the US dollar remains under pressure, in the wake of extremely low activity in the currency markets. All this is accompanied by the traditional low volumes for the end of December, which allows short-term speculators to accelerate the value of assets in the right direction for them.

With regards to the dynamics of the value of protective assets, we note that the continuing interest, despite the announcement of the signing of the first part of the new trade agreement between Washington and Beijing, is due on one hand, to the lack of details on this transaction as they remain secret, and on the other, the time they still have before its signing, as D. Trump stated that it will be released next month. In our opinion, there is another reason for this behavior. There is a high risk of the deal being canceled if the American President thinks that something is going wrong again. Taught by the bitter experience, investors are clearly in no hurry to reconsider their view of the situation in the markets.

In addition, the apparent weakness of the US currency is monitored, and the reason for which was the December meeting of the fed, which stated that there are no prospects for both raising rates and lowering them in the United States next year. The regulator made it clear that it will not change rates either way, however, it became clear that the Bank will resort to adding liquidity to America's financial system.

Although the Fed doesn't call it a quantitative easing program, it has all its signs. In this case, the growth of the dollar supply affects its rate, but at the same time, there is a stimulation of purchases of shares on the local stock market, extremely necessary for Trump during the active election campaign for the presidency that begins next year .

We expect that today, the general trends that developed in the markets by the end of last week will continue.

Forecast of the day:

Gold prices are rising in the wake of low volumes due to the advent of Christmas week and the lack of details on the trade deal between America and China. The price is above the level of 1481.30, allowing it to make an attempt to grow to 1493.65, the upper limit of the short-term upward trend. The price of the asset is pushed up by the expected expiration of "gold" futures contracts on December 25.

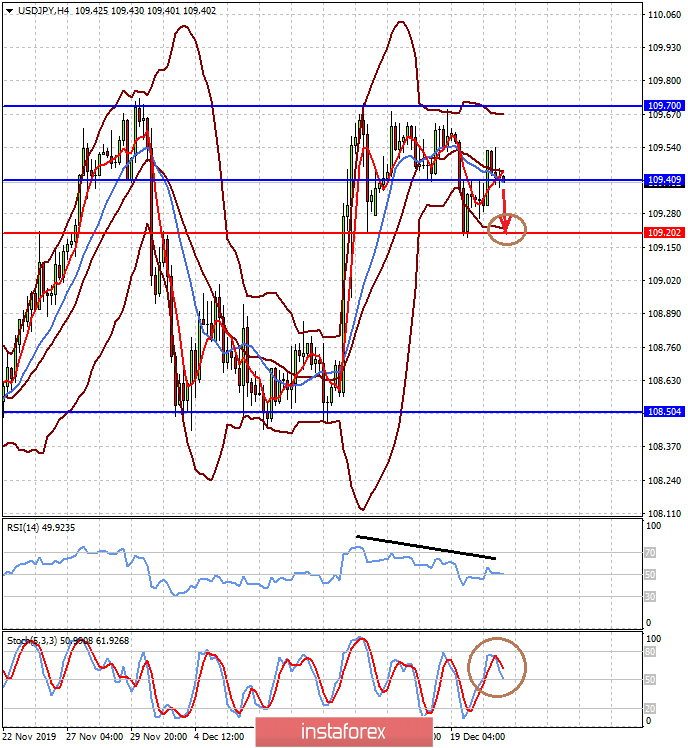

The USD / JPY pair is also declining in the wake of uncertainty about the content of the trade deal between Washington and Beijing. Overcoming the price mark of 109.40 may be the basis for its fall to 109.20.