Imagine that you went to the market to buy tomatoes, and you see a merchant offering just the most common tomatoes, which are good and fresh tomatoes. You start to take a closer look at them and then another trader runs up to you selling exactly the same tomatoes but are packed in vacuum packaging, and are two times more expensive than the first one. And then it begins to beat you, constantly shouting that you can't even look at the tomatoes of other sellers. That is what the United States does.

Washington is not only ready to impose sanctions on European companies participating in the construction of Nord Stream 2, but even include this item in the Pentagon's budget. That is opposition to the construction of a gas pipeline, which will significantly reduce the cost of gas for Germany and German industry, transferred to the military plane.

Moreover, the threats are so serious that they include the seizure of property of companies in the United States and the ban on transactions in dollars. And the threats had their effect, since the Swiss company Allseas, which is just engaged in laying the pipe, not only suspended the work, but even took its ships from the area where the construction work is being carried out. The German authorities have already expressed their protest against the actions of the United States, calling them gross interference in the internal affairs of Europe as well as damaging German business.

Russia said that the actions of the United States are aimed at weakening European business, undermining its ability to compete with American companies. True, adding that it will be able to independently complete the construction of the gas pipeline, without fear of any sanctions, as already imposed by them. In any case, the growth of confrontation in this direction has seriously hit the positions of the single European currency, as investors are well aware that this is a blow to German business, which is the main beneficiary of Nord Stream 2. But still, a rather curious question arises, " What will the United States do if Russia really completes the gas pipeline on its own? and Will sanctions be imposed on companies buying gas supplied through Nord Stream 2? Nevertheless, so far we have just the panic weakening of the single European currency, which clearly demonstrates against whom all these sanctions are directed.

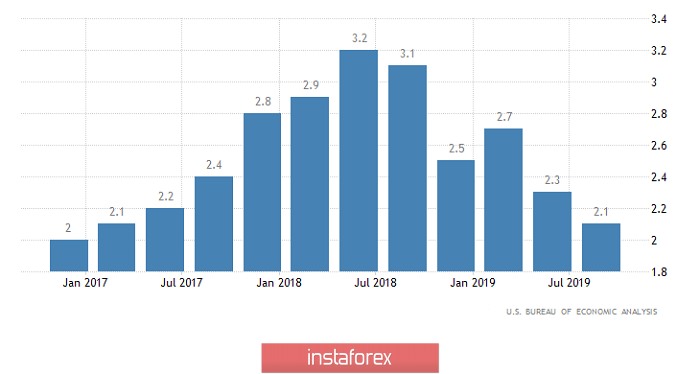

At the same time, there was no reason for the growth of the dollar, except for political hysteria, since the final data on the US GDP for the third quarter finally confirmed the fact of a slowdown in economic growth from 2.3% to 2.1%. So American statistics clearly do not give reasons for optimism.

GDP growth rate (United States):

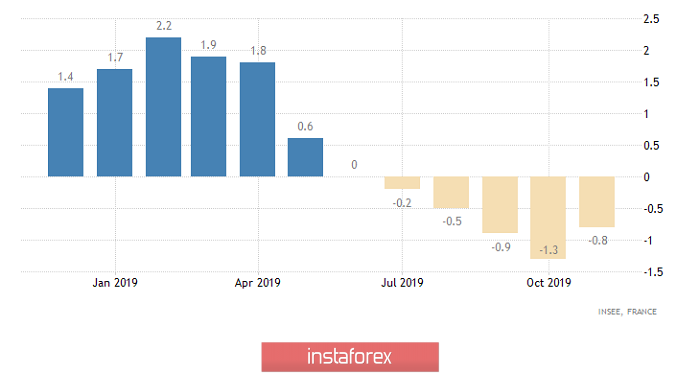

On the other hand, European statistics are not particularly encouraging. Thus, the decline in producer prices in France slowed down from -1.3% to -0.9%. Of course, there is a certain improvement in the situation, but this is still a decline in producer prices. In Italy, however, the decline in producer prices slowed down from -2.9% to -2.5%. So there is some positive dynamics, but the picture is not too joyful.

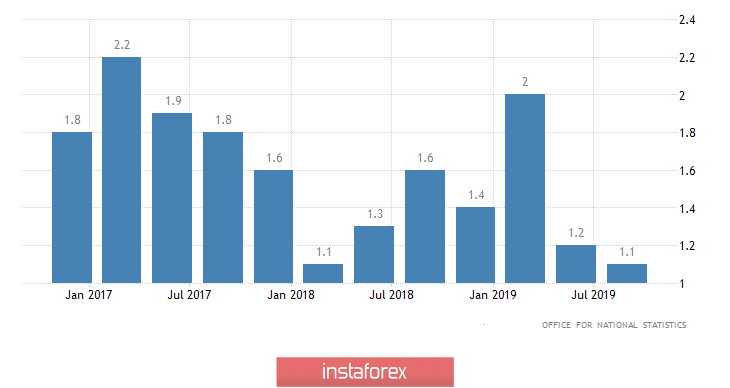

The situation is not the best in the UK, where the final GDP data turned out to be better than forecasts since they showed a slowdown in economic growth not to 1.0%, but to 1.1%. However, the previous results were reviewed for the worse, with 1.3% to 1.2%. So, in the United Kingdom, there is a clear slowdown in economic dynamics, which turned out to be enough for the pound to hold on to its positions.

GDP growth rate (UK):

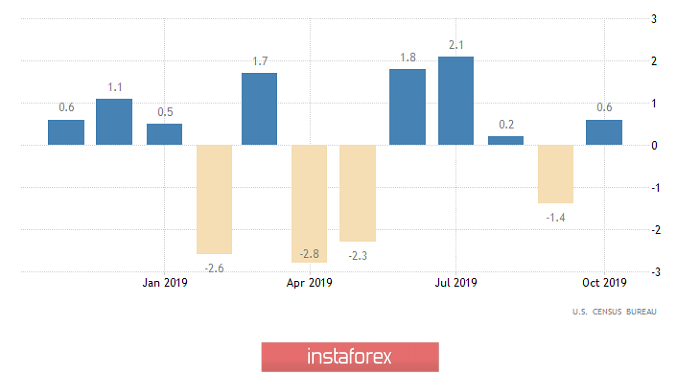

A lull begins on the market today, which apparently was happening the entire week and that is because Europe is resting. On the other hand, in the United States, there will be both weekends and shortened working days and no important macroeconomic data will be published. Only data on home sales in the primary market, as well as orders for durable goods, in particular, are published today. Of course, the data is interesting but in the current circumstances of universal preparation for the holidays, they will not produce such a serious effect. So, home sales in the primary should increase by 0.5%. Orders for durable goods may increase by 1.1%. So, in a good way, the dollar has a reason for slight growth.

Durable Goods Orders (United States):

The single European currency, of course, is very impressed by the actions of the United States. However, Washington is unlikely able to completely stop the gas pipeline in which the German business and the German government are extremely interested. Another thing is that today's macroeconomic statistics from the United States rather favors the dollar. In other words, taking both of these factors into account will lead to the stabilization of the single European currency at the level of 1.1075.

Over the past few days, the pound has already fallen in price, so it needs to adjust slightly. Although there is no particular reason for this, so it will consolidate around 1.3000.