Technical analysis recommendations for EUR / USD and GBP / USD on December 23

Economic calendar (Universal time)

The economic calendar today contains little information. We can only note data from the United States, which are about basic orders for durable goods (12:30) and sales of new housing (15:00).

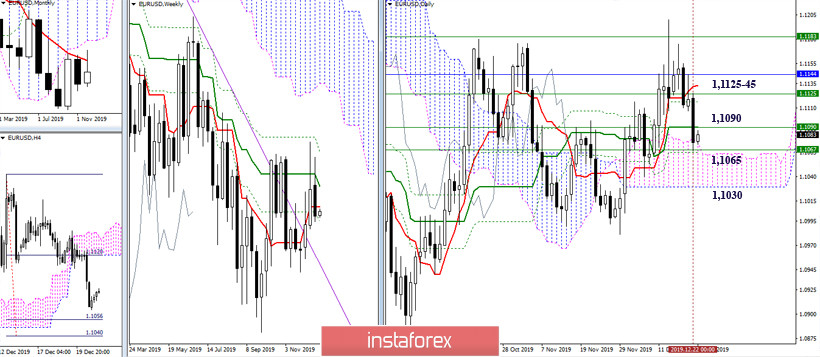

EUR / USD

Towards the closing of last week, the lowering players still managed to show themselves and performed a reduction to the previously indicated support area of 1.1090-65. As a result, the last weekly candle went down in history with a pronounced bearish character. In the near future, the question of the mood of the monthly candle and the results of the year will be decided. The closest bearish reference now is the daily cloud 1.1065 (Senkou Span A + weekly Fibo Kijun + daily Fibo Kijun) - 1.1030 (Senkou Span B). After the cloud passes and consolidates in the bearish zone relative to it, there will come a time of minimum extremes of 1.0981 to 1.0879, the updating of which will help to restore the global downward trend. If we consider the plans and opportunities for players to increase, then the first resistance to the restoration of bull positions is now 1.1090 (daily Kijun + weekly Tenkan). Furthermore, attention will be focused on the resistance zone 1.1145 - 25 (daily short-term trend + weekly medium-term trend + monthly short-term trend), followed by the liquidation of the weekly dead cross and updating the maximum which is at 1.1200 .

In the lower halves, the pair is in the correction zone, which the analyzed technical indicators have already set up to actively support. But at the same time, the increase players have not yet managed to overcome any of the key resistance, so now we can only talk about the origin of the correction. The most important resistances that can affect the distribution of forces are located at the central Pivot level which is 1.1089 to the weekly long-term trend of 1.1124. If you exit the correction zone and continue to decline, the support may be the intra-day classic Pivot levels at 1.1052 - 1.1030 - 1.0993.

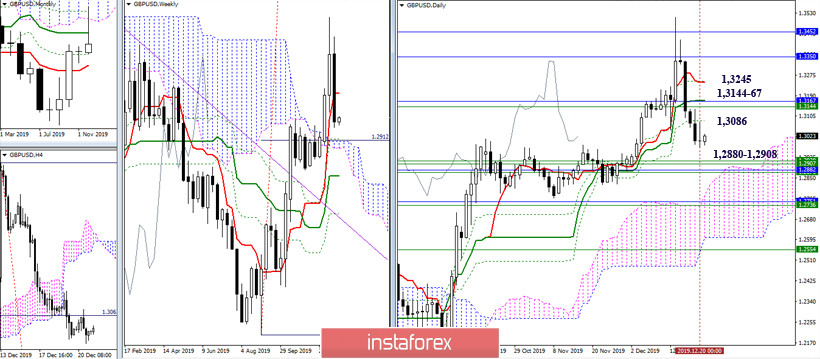

GBP / USD

Last week was marked by the bears, however, on Friday the pair indicated some inhibition so now it is possible to develop a correctional upward turn, which can develop into a retest of levels at 1.3086 for the daily Fibo Kijun, passed on the eve at 1.3144 - 67 for the weekly Tenkan + monthly Kijun + daily Kijun and at 1.3245 for the daily Tenkan. Immediate support is still concentrated in the area of 1.2880 - 1.2908 (weekly cloud + monthly Fibo Kijun + weekly Fibo Kijun).

Forming an upward correction, the upward players entered the fight for the central Pivot of the day which is at 1.3019. The next important reference will be the resistance of the weekly long-term trend concurrently located at 1.3116. If the players on the rise will fail again with the development of a corrective rise, then the couple is waiting for the support of the classic Pivot levels at 1.2960 - 1.2917 - 1.2858.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)