The European currency, along with the US dollar, was locked in a side channel because of the low intraday trading volume and weak volatility. Meanwhile, the British pound returned some positions before the Christmas holidays and continued to recover today in the Asian session. However, the growth is only corrective in nature. For a larger upward trend, a number of conditions must be met, which we will discuss later.

As for the statistics on the American economy, it was very mediocre before the weekend, and was not of wide interest to traders.

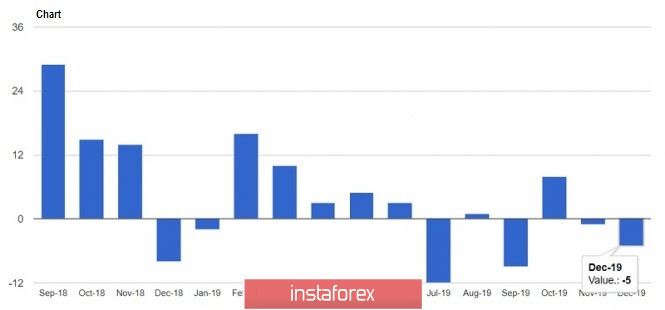

Manufacturing activity in the area of responsibility of the Federal Reserve Bank of Richmond declined in December, and the index showed its decrease. According to the data, the production index calculated by the Fed-Richmond in December fell to -5 points from -1 point in November. The decline was due to weak indicators on the index of deliveries and new orders. The increase was noted in wages due to the problems of employers in finding qualified employees. The earnings index rose to 29 points in December from 24 points in November.

According to The Retail Economist and Goldman Sachs, the US retail sales index for the week from December 15 to 21 increased by 0.6%, as compared to the same period in 2018. The growth was 2.2%.

On the other hand, the data from Redbook was much worse. According to the report, retail sales in the United States for the first 3 weeks of December, although increasing by 5.3% compared to the same period in 2018, fell by 3.4% compared to November. Sales showed an increase of 6.2% year-on-year for the week, from December 15 to 21.

As for the technical picture, the EUR/USD pair remained unchanged. Given the low volatility and low trading volume in the post-Christmas period, there's no expected particular trend. The growth of the trading instrument, in the event of a breakthrough of the resistance of 1.1095, will be limited in the area of 1.1130. Meanwhile support will be provided by a minimum of 1.1040, below which sellers of risky assets are unlikely to break through.

GBP/USD

The British pound has slightly recovered its position against the US dollar, but the pressure on it may continue. Much will depend on the direction in which trade relations between the UK and the EU will be built. If, as economists expect, the negotiations turn out to be difficult, and the probability of a no-deal Brexit grows, the pressure on the pound will continue. If the relationship develops in a positive way in 2020, which, as we can remember, both the EU and Prime Minister Boris Johnson want, then in the medium term, demand for the pound will recover. Any statements by Boris Johnson about a change in the agreement to leave the European Union, a provision prohibiting the extension of the transition period ending in December 2020, will also support the pound.

As for the technical picture of the GBP/USD pair, the nearest targets for sellers will be the lows of December this year in the area of 1.2880, and their update in the area of 1.2830. It is only after the return and consolidation at the resistance of 1.3000, as well as after the test of a more important maximum in the area of 1.3130, that a talk about the growth scenario of the British currency is possible.