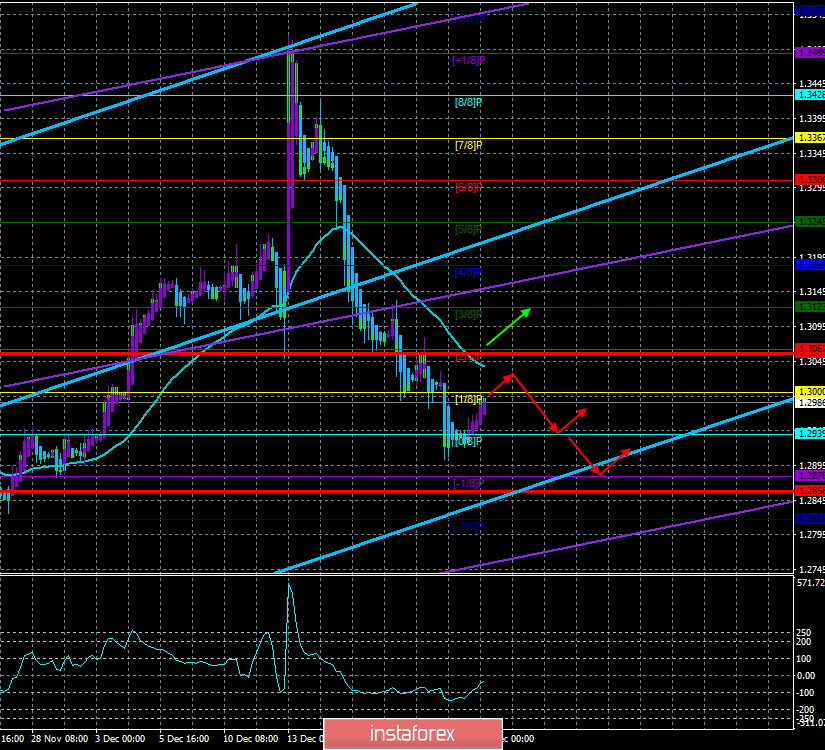

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - down.

CCI: -25.2069

In recent months and even years, we have repeatedly said that the UK is mired in a political crisis. It was the political crisis that did not allow the various political forces of the country to come to a common denominator on the issue of Brexit, which delayed the whole process. However, now the political crisis seems to have been left behind, a "majority government" has been formed in Britain and many political scientists have breathed freely. But is this good for the country?

With roughly equal forces between the conservatives and labor, much depended on the other, less numerous parties in parliament. That is, it can be argued that the opinion of each political force was taken into account. This was seen in the way the parties in Scotland, Wales, and Ireland voted. They all stood up to Boris Johnson, making it clear that they are against Brexit. However, now, after the next re-election to parliament, all decisions will be made exclusively by conservatives. To approve absolutely any bill, they do not need anyone's help. Even if all the opposition parties cooperate, there will still not be enough votes to oppose the conservatives. This means that now the fate of the UK will depend entirely on the wishes of Boris Johnson. Whether it is good or bad, everyone must judge for himself. However, as in the case of Donald Trump, Johnson cannot be called a tolerant politician who tries to take into account long-standing traditions or the interests of all segments of the population. Johnson will do what he sees fit, that is, only consider his own opinion, and we believe that this could turn into a collapse for the UK.

His very first decision in the head of government after the election makes one think. Johnson has banned the postponement of the completion date of the "transition period", so Brexit will take place before the end of 2020 in any case. But the problem is no longer Brexit, but how the UK will co-exist with the EU after it. On what terms, under what trade agreement. All political scientists and experts say that there can be no speech to conclude a comprehensive agreement in 11 months. It's just not possible. Maybe Johnson has his plan of action, such as political blackmail of the European Union, since now he no longer needs the approval of his actions, for example, by Labor. He can put pressure on EU leaders to negotiate a deal as quickly as possible and on more favorable terms for the UK. Will the EU "speed up the process"? Only time will tell. But in any case, there remains a considerable probability that there will be no agreement before the end of 2020, then the whole Brexit, which was delayed for several years mainly because there was no "hard" scenario, will be just disordered and without an agreement.

It is based on these considerations that we believe that the road for the pound is only one - down. We believe that 2020 will be a year of new disappointments for the British currency, for the British economy. We have repeatedly said that even before Brexit, macroeconomic statistics in the Foggy Albion leave much to be desired, and what will happen after Brexit? What will happen if an agreement with the European Union cannot be reached in 11 months?

From a technical point of view, a weakly volatile corrective movement has now begun and is continuing with the goal of a moving average line near which it can end. In this case, we expect the downward movement to resume despite the New Year holidays. Both linear regression channels are still directed upwards, but may soon begin to turn downwards.

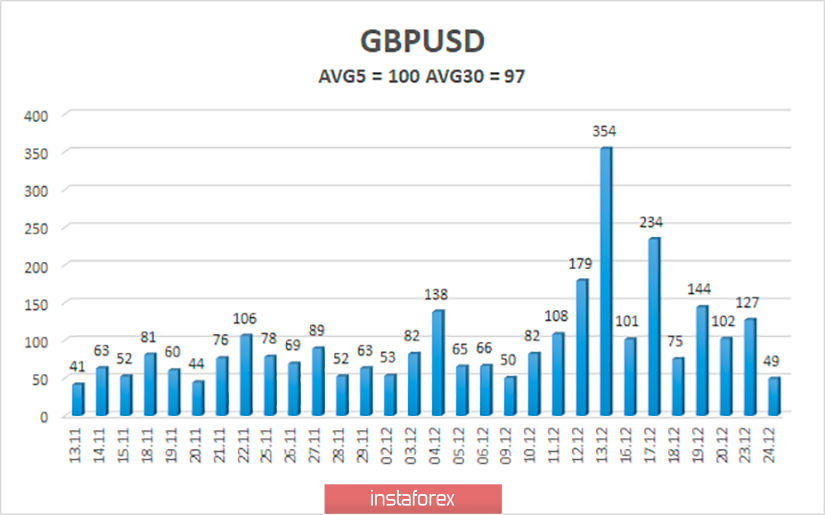

The average volatility of the pound/dollar pair over the past 5 days is exactly 100 points, remaining at a fairly high level, but the downward trend is visible to the naked eye. According to the current level of volatility, the working channel on December 26 is limited to the levels of 1.2858 and 1.3060. At the moment, the pound/dollar pair has started to adjust, and volatility may continue to decline in the Christmas and New Year weeks.

Nearest support levels:

S1 - 1.2939

S2 - 1.2878

S3 - 1.2817

Nearest resistance levels:

R1 - 1.3000

R2 - 1.3062

R3 - 1.3123

Trading recommendations:

The GBP/USD pair continues its upward correction. Thus, traders are advised to sell the British currency with the nearest targets of 1.2939 and 1.2878 after the reversal of the Heiken Ashi indicator back down, but very carefully. It is recommended to return to the purchases of the pound/dollar pair not earlier than the reverse consolidation above the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.