This Christmas week, the Japanese are perhaps the most active in terms of providing macroeconomic statistics. However, the Japanese currency reacts rather sluggishly to its statistics, which cannot be said about the reaction of the yen to macroeconomic reports from the United States.

Nevertheless, it is worth noting that data on construction orders and bookmarking of new homes came out of Japan this morning. Both reports were weaker than expected and, oddly enough, led to a significant decline in the yen against the US dollar. In this regard, let me remind you that tomorrow at 12:30 (London time) a large block of statistics will be released from the Land of the Rising Sun. Here it is necessary to highlight the report on the unemployment rate, data on industrial production and retail sales. These are much more important releases than today's, the more interesting it will be to observe the reaction of market participants to them.

In the meantime, let's go to the charts of the USD/JPY currency pair and see what interesting trading ideas there might be.

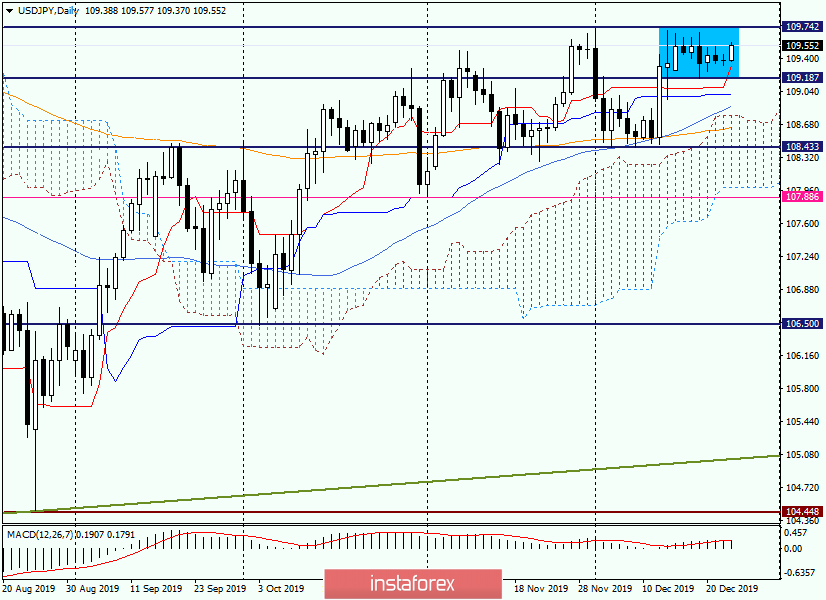

Daily

This is amazing, but by and large, nothing has changed here. The pair is still trading in the range of 109.19-109.74 and cannot say goodbye to it. However, judging by today's growth, USD/JPY is dominated by bullish sentiment. However, only the breakdown of sellers' resistance at 109.74 and consolidation above will convince of this. In other words, to make sure that the pair can move to new goals higher, it is necessary to go out of the designated range up.

At the same time, do not forget about the strong and extremely important price area of 110.00-110.20, which has repeatedly influenced the price and turned the market. Thus, in my personal opinion, the breakdown of 109.74 will not give a clear answer to the question of the ability to move further north. There are too many strong resistances at the top. In addition to the area of 110.00-110.20, another strong price zone is slightly higher (110.50-110.80).

Although I do not exclude that after such a long and diligent consolidation, the exit to one of the parties can be very strong and powerful. If you go up, 110.00 and 110.20 will fly by first, as if these levels are not there at all, but then they will return to them and circle. According to long-term observations, this is exactly what happened more than once. Well, let's see.

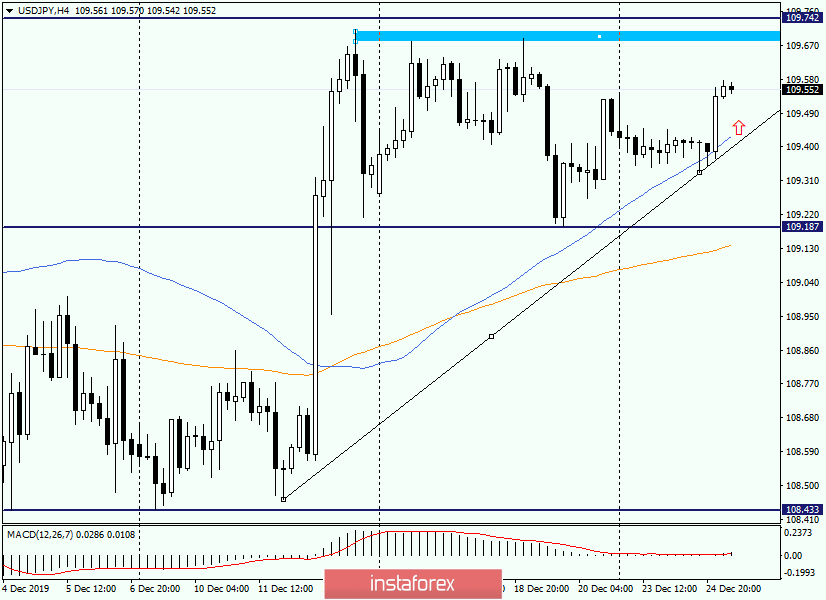

H4

It is characteristic that the pair meets strong resistance from sellers near the level of 109.70, after which it shows a decline. Despite today's positive mood, at the end of the review, there is a fading upward momentum. If the current candle is formed in the form of a bearish model, you can expect a decline and try accurate sales of USD/JPY.

Although I generally look at the dollar/yen pair from a bearish position, in the current situation, the growth in the area of 110.00-110.20 looks more likely. From here, we can expect a corrective pullback to the area of 109.80, after which the pair will again try to return above the key technical zone of 110.00-110.20.

In my opinion, the purchases look most optimal on the short-term decline to 50 of the simple moving average, which passes slightly below another important level of 109.50. It is characteristic that there is a support line built at points 108.46-109.33.

If 50 MA and the black support line are broken and the pair consolidates below, on the rollback to the broken lines and movings it will be time to think about selling USD/JPY.

Since the current situation is far from certain, for those who do not want to be nervous and take risks, I recommend staying out of the market for now. Let's see at what price the current Christmas week closes. Perhaps, after that, you will have a clearer idea of the future direction of this currency pair.

Have a nice day!