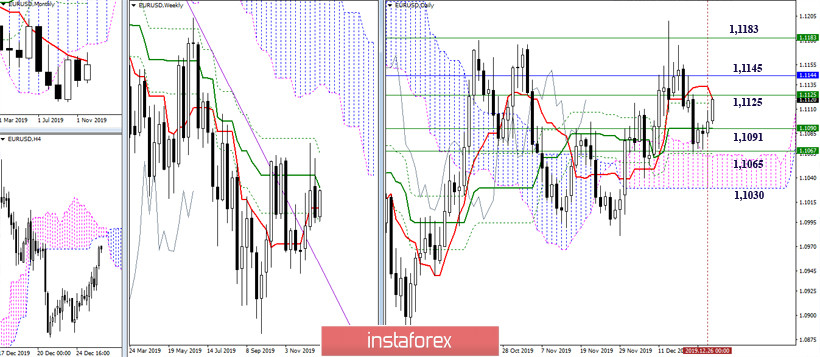

EUR / USD

The players have been able to improve their positions by increasing over the past time of the current working week. Now, the result of closing not only the week, but also the month is interesting. At the same time, consolidating above the monthly short-term trend (1.1145) will be in this case, a good potential for continuing to strengthen the bullish positions in January next year. On the other hand, the formation of rebound from the encountered resistance and the loss in the coming days before the close of December of the daily medium-term (1.1091) and weekly short-term (1.1091) trends can significantly affect the nature of the monthly results and future prospects.

In the lower halves, the advantage belongs entirely to the players on the upside. Resistance within the day can be identified at 1.1123 (R2) and 1.1137 (R3). This resistance zone is amplified from the main resistance of the older time intervals - weekly Kijun 1.1125 and monthly Tenkan 1.1145. Therefore, its testing and the result of interaction are the main task of players to increase in the near future. Today, key support combined in the area of 1.1096 (central Pivot level + weekly long-term trend). Now, consolidating below will change the current balance of power.

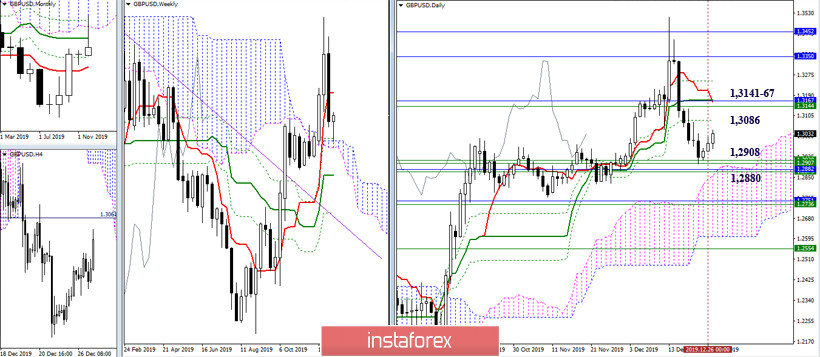

GBP / USD

In addition, the result of not only closing the current week, but also the subsequent closing of the month is now important for the pound, as well as for the euro. The formation of the rebound from the weekly cloud, as well as the realization of the rise and consolidation above the weekly short-term (1.3141) and monthly medium-term (1.3167) trends can be a good guarantee of strengthening bullish positions and moods at the beginning of next year. However, in case of its failure, a return to support (1.2880 - 1.2908 weekly cloud + monthly Fibo Kijun + weekly Fibo Kijun) and even more so their loss will return prospects for players on the downside.

Players on the upside found in the lower halves were able to reach an advantage in strength and advantages. If they maintain their positions now and deploy moving, then they can count on new upward prospects. Today, resistance within the day are the classic pivot levels 1.3045 (R2) - 1.3075 (R3). At the same time, key support for H1 has now joined forces in the area of 1.2988-96 (central Pivot level + weekly long-term trend). Consolidating below levels out all the achievements of the players on the upside and returns the initial advantages to the side of the bears. The main task of which will be to restore the downward trend and consolidate below the minimum extremum (1.2904).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic ), Moving Average (120)