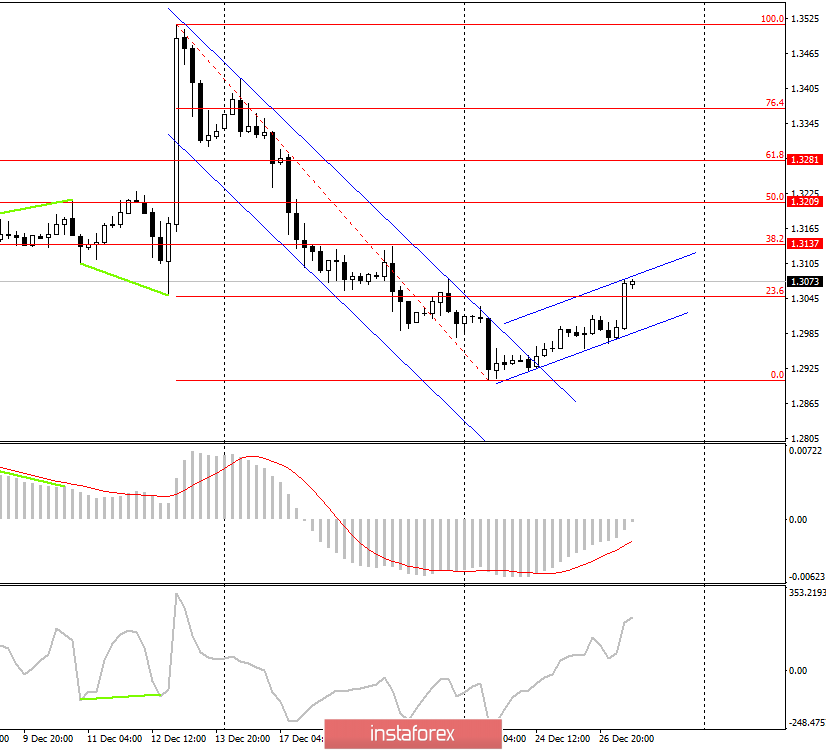

GBP/USD - 4H.

On December 26, the GBP/USD pair performed a consolidation over the downward trend corridor, within which the quotes performed a drop of more than 500 points. Now we have a new corridor - an upward one, which predicts corrective growth with the most popular corrective targets - 38.2% and 50.0% and 61.8%. Thus, I consider the possibility of growth of quotes with the targets of 1.3137, 1.3209, and 1.3281. Today, the divergence is not observed in any indicator. Closing over the ascending corridor will only strengthen the "bullish" mood of traders. The current trading plan will be canceled if the quotes are closed under the upward trend corridor. It may take several days for traders to reach the area of 1.3209-1.3281.

Forecast GBP/USD and trading recommendations:

Thus, the trading idea is to buy the British currency with the above goals. You can place Take Profit orders near each level. But I would not recommend selling a pair yet since there is still an upward corridor. Therefore, I recommend that you wait for the pair to exit through its lower border before getting rid of the British currency.

The pound-dollar pair will continue the growth process on December 27. At least this is what the graphic picture of the pair says. Traders tuned in to buy after a week and a half of non-stop falling. I recommend buying the pound with the targets of 1.3137 and 1.3209 (next) and do not recommend selling the pair yet.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.