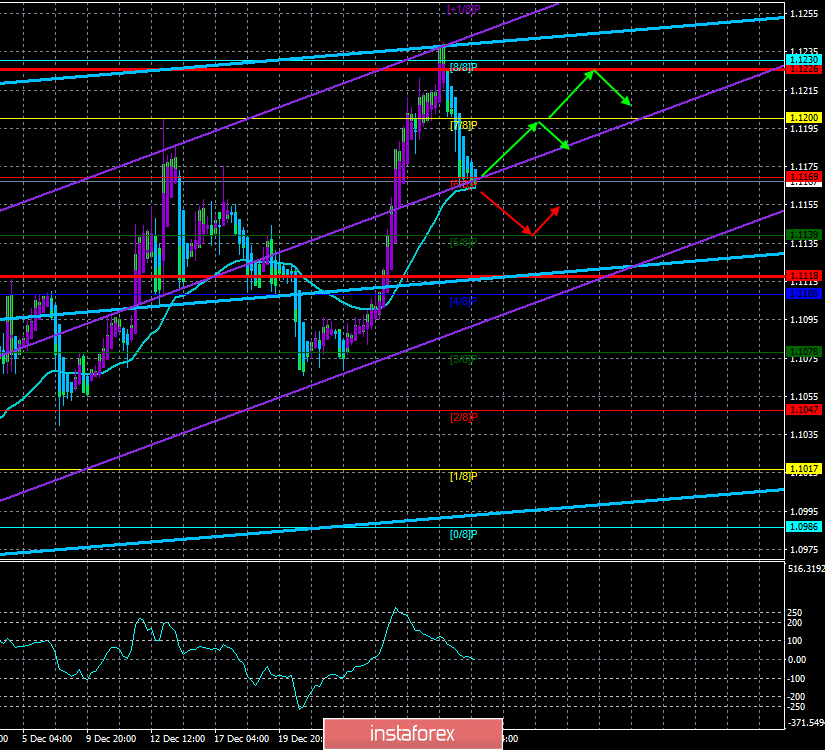

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - up.

The moving average (20; smoothed) - sideways.

CCI: -16.9567

The first trading day of the week ended for the EUR/USD pair exactly as we expected. The euro moved lower and worked out the moving average line by the end of the day. Even today, the pair's quotes can overcome the moving, which will mean a change in the trend for the pair to a downward one. Thus, today or at the beginning of the next week, it will be possible to state the resumption of the downward trend. We have already said that, from our point of view, it is time for the euro currency to "pay off its debts". The euro rose too much at the end of last year. Too strong and too unreasonable. The general fundamental background remains not in favor of the euro currency, which, by the way, was confirmed by yesterday's macroeconomic publications of business activity indices in the spheres of production in the EU countries. Let's look at them in more detail.

Let's start with the fact that the overall indicator of business activity in the EU production sector exceeded the forecast values and amounted to 46.3. However, any value below 50.0 is considered negative and does not support the currency in which the indicator is published. Thus, we can only state a slight improvement in the weak indicator of business activity. The situation is even worse in Germany, where business activity also increased slightly to 43.7. Such a meaning can be characterized by the phrase "below the plinth". Although formally, there is also some improvement in the situation. In Italy, business activity in the production sector fell to 46.2 in December. Thus, we can draw an almost unambiguous conclusion: macroeconomic statistics from the EU on Thursday could not support the euro currency.

As for American business activity in the manufacturing sector according to Markit, there was a slight decrease from 52.5 to 52.4. However, the key point is the very value of the indicator 52.4 - above 50.0 - the industry is growing. Such a small decrease in the indicator compared to the previous month, by only 0.1, cannot be regarded as a deterioration at all, since no indicator can constantly show growth. So it turns out that, in general, we have a stable state of business activity in the States and weak - in the EU. Thus, industrial production in the European Union may also disappoint, and other indicators of the state of the European economy.

On Friday, January 3, it is planned to publish the index of business activity in the US manufacturing sector according to the ISM version, which is considered more important and significant and which is under the key mark of 50.0. According to experts, the indicator can grow to 49.0, which will be a big step towards a return to the area "above 50.0". Thus, a higher value than 49.0 may support the US currency. Also, today, the consumer price index in Germany will be published, a preliminary value for December, which, according to experts, may accelerate to 1.4% y/y. If this happens, it will be a positive moment for the euro, but only in the context of the future publication of inflation in the European Union.

And at the end of the review, we will pay attention to the technical picture. Already at the current bar, the euro-dollar pair may consolidate below the moving average line, which will indicate the readiness of traders to continue the downward movement in the medium term. Both linear regression channels are directed upwards but may start to reverse downwards if the pair spends 5-6 days below the moving average. As we have said many times, we believe that the most likely scenario is a new long-term downward movement.

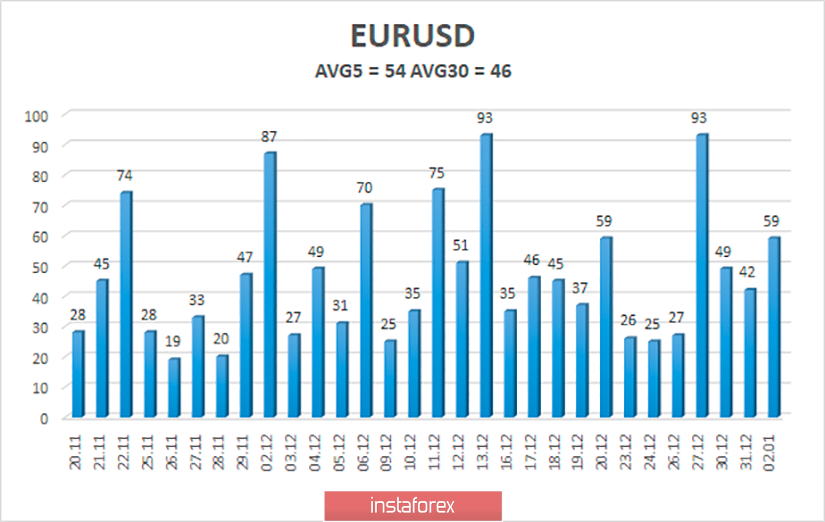

The average volatility of the euro-dollar currency pair is now 54 points, which is the average value for the euro currency. Thus, we have volatility levels on January 3 - 1.1118 and 1.1226. Thus, today we again expect to work out the lower limit of the volatility channel.

Nearest support levels:

S1 - 1.1139

S2 - 1.1108

S3 - 1.1078

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1200

R3 - 1.1230

Trading recommendations:

The euro-dollar pair continues its downward movement. Thus, it is recommended to wait until the price is fixed below the moving average, and then start trading on the downside with the targets of 1.1139 and 1.1118. The general fundamental background remains not on the side of the euro currency, so the pair's fall is more preferable. It is recommended to return to buying the euro-dollar pair only if the price rebounds from the moving average line.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.