The single European currency could not stay above the base of the 12th figure due to weak statistics on business activity in the eurozone and Donald Trump's statement on the signing of a trade agreement between the United States and China on January 15. The latter allowed the S&P 500 to renew historic highs. However, during the Asian Forex session, futures on the US stock index already fell amid growing geopolitical tensions in the Middle East. In 2020, investors will most likely get used to the frequent ups and downs of both the US stock market and the main currency pair.

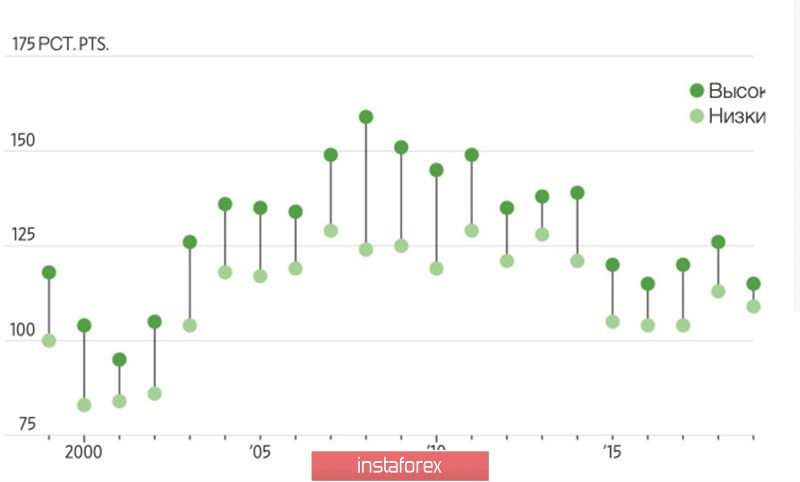

2019 was a record year for the euro in terms of the narrowness of the trading range. The pair EUR / USD was trading between 1.09 and 1.15. That is, we are talking about 6 pp On average, since its birth in 1999, the annual trade corridor has been 18 percentage points.

Dynamics of annual trading ranges in EUR / USD pair:

At first glance, factors such as the negative interest rates of the ECB, the weakness of the eurozone economy, the passivity of the Fed and the steady pace of US GDP make the prospects for EUR / USD grim. However, in 2019, the euro faced many difficulties, including Brexit, the Washington and Beijing trade war, Italian elections, lowering of the ECB rates, resuscitation of the European QE, and somehow still managed to survive. These problems will either disappear or become less painful in 2020, which allows the Wall Street Journal experts to predict the growth of the single European currency to $ 1.15 by the end of December. Specialists surveyed by Bloomberg, and even give out a figure of $ 1.16.

An ambiguous opinion is present on the market regarding the status of the euro as a funding currency. On the one hand, the recovery of the Chinese, European and global economies as a whole is a positive factor for risky assets, which makes the potential of the EUR / USD rally limited. Another one is the corrections of the S&P 500 will lead to the closure of carrying positions by traders, and there is little doubt that the US stock market will face serious pullbacks in the new year. The slowdown in the US economy, presidential elections, geopolitical risks, and other "bearish" drivers will not allow the stock index to grow quietly.

The central event for this week is on January 9, which will be the release of data on the labor market and business activity in the non-manufacturing sector of the United States, as well as the publication of the minutes of the last ECB meeting. There were rumors that last December, Christine Lagarde did not address the issue of the harm of negative interest rates due to a reluctance to allow the euro to strengthen at a press conference. In the minutes of the meeting, this moment will probably be reflected in what should be considered as a "bullish" factor for the EUR / USD pair. As for employment, Reuters experts expect to see its increase by 165 thousand by the end of the last month of 2019. It is a pretty decent figure, but if the actual data turns out to be worse, the main currency pair will resume its northern campaign.

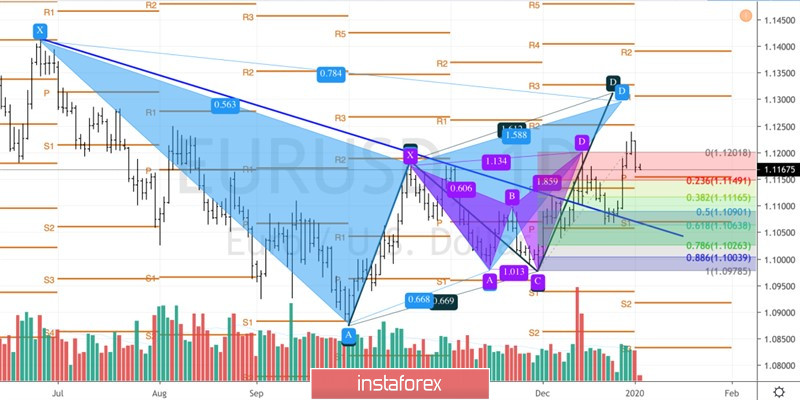

Technically, on the daily EUR / USD chart, the 5-0, AB = CD and Gartley patterns are realized. The last two targets are located near the 1.13 mark. A necessary condition for their implementation is to keep the "bulls" support at 1,115-1,1155 in their hands.

EUR / USD daily chart: