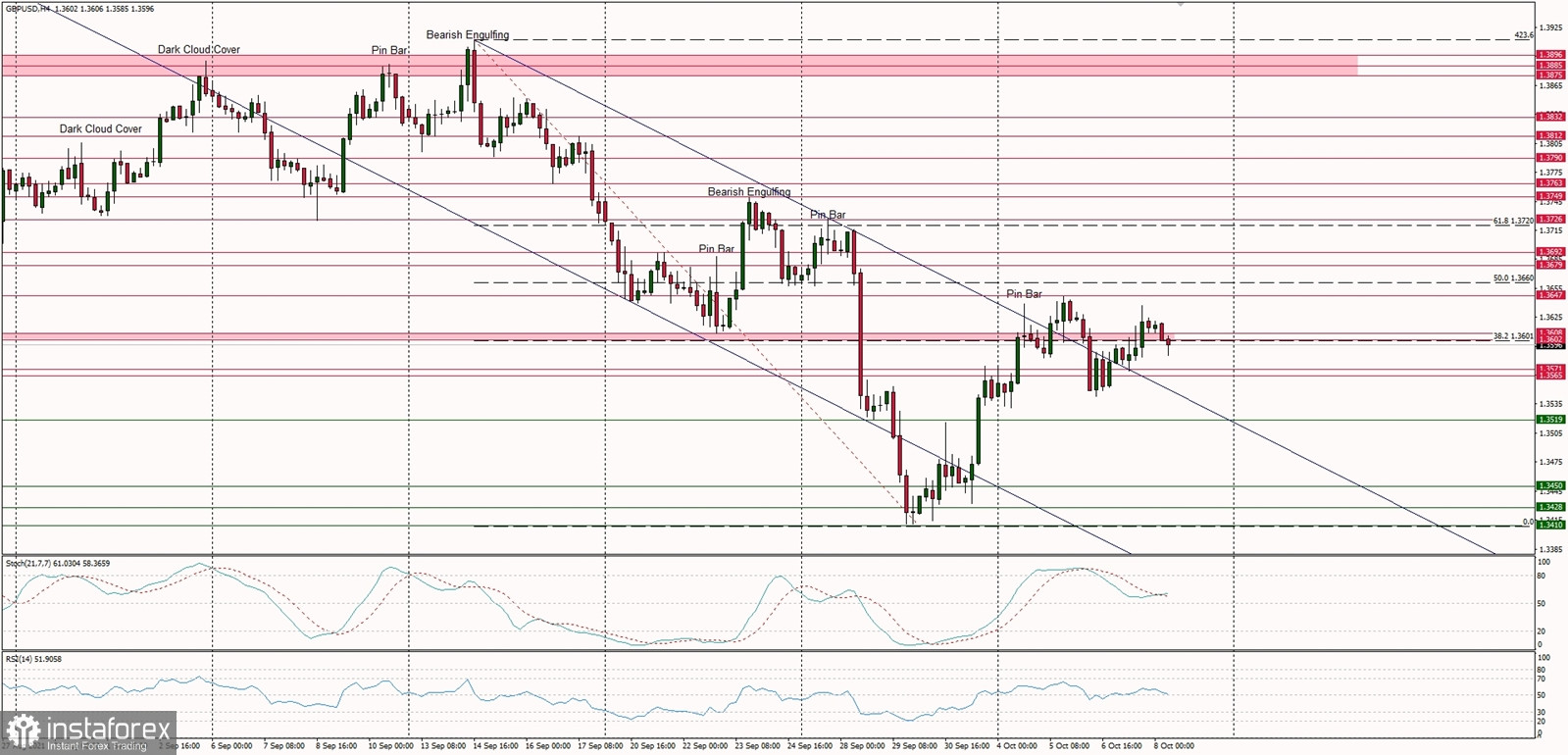

Technical Market Outlook:

The GBP/USD pair has tried to continue the rally and move away from the upper channel line, but the bears has managed to push the price back towards the consolidation zone located between the levels of 1.3548 - 1.3620. The next target for bulls is 50% Fibonacci retracement located at 1.3660. The nearest technical support is seen at 1.3519, but if this level is violated, then the down trend can resume lower towards the last weeks low located at 1.3410 or below. The momentum remains neutral and the price is consolidating around the level of 1.3602 as the market participants await a trigger the will increase the volatility again.

Weekly Pivot Points:

WR3 - 1.4014

WR2 - 1.3865

WR1 - 1.3697

Weekly Pivot - 1.3546

WS1 - 1.3375

WS2 - 1.3218

WS3 - 1.3052

Trading Outlook:

The weekly and monthly time frame chart show a breakout below the key technical support located at 1.3516, so now the bears are in total control of the market. The next target for bears is seen at the level of 1.3174. The levels of 1.3408 and 1.3371 might give some support for bulls as they are 55 and 200 weekly moving average levels.