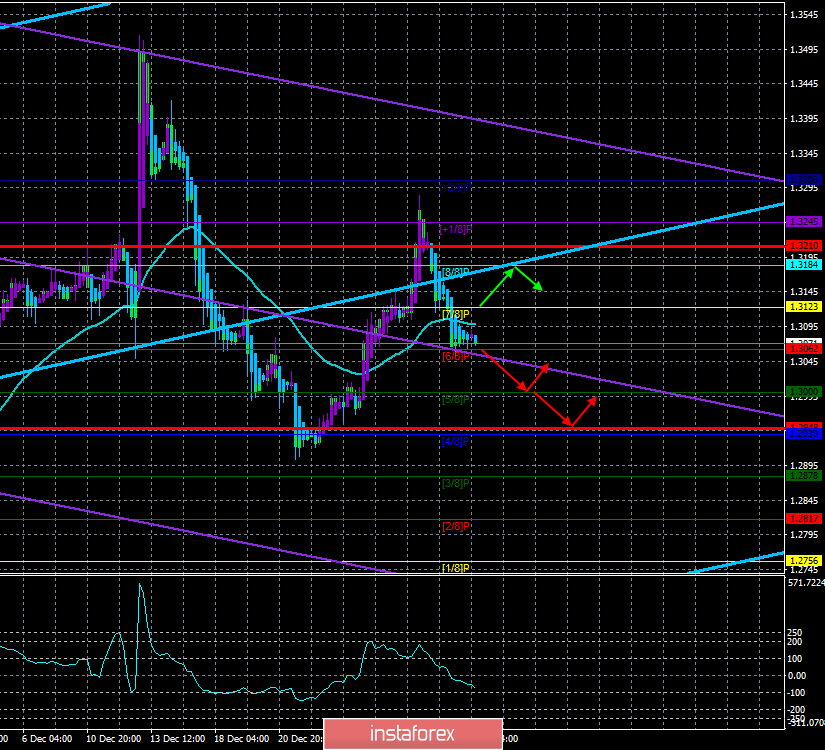

4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - down.

CCI: -64.9175

The British pound resumed its downward movement after correction of 61.8% and is now ready for a new fall. We still believe that the minimum target for the British currency is located near the levels of 1.2900 and 1.2800, although the downward movement may be even stronger. We have repeatedly listed a whole list of factors based on which the British pound has almost no chance of strengthening. Moreover, we believe that the rise to $1.35 was just a New Year's gift for the British currency and now it is time to return the debts.

On the first trading day of the week, January 6, only one macroeconomic publication is planned in the UK - the index of business activity in the services sector for December. This figure is expected to rise, but only to 49.2. Recall that the UK remains the only country among the largest in which all business activity indices are in the recession zone. Thus, with such a fundamental basis, it is very difficult to expect an acceleration in inflation, growth in industrial production, GDP growth and overall acceleration of the UK economy. And if nothing like this is expected soon, then the pound is likely to continue to fall. However, we have repeatedly said that the main reason for the new prolonged fall of the British pound will be again Brexit and its consequences. Boris Johnson has already announced the start of negotiations on a trade agreement with the head of the European Commission Ursula von der Leyen, but so far this is not even a negotiation. The talks will be led by official delegations from London and Brussels, while Ursula von der Leyen is going to London to talk to the British Prime Minister and find out his attitude on various issues related to future negotiations.

The first stage of Brexit ends for the UK on January 31. And although two more votes on Boris Johnson's Brexit bill should take place before that time, it is clear to everyone now that both the Upper House of the UK Parliament and the EU Parliament will make this decision and, accordingly, the "transition period" will begin on February 1. In fact, from February 1 to December 31, 2020, the UK will continue to enjoy all the preferences of the EU member state, but will no longer take part in the political life of the Alliance. Thus, from February 1, little will change in economic and trade terms for the UK. However, on the other hand, for the time being, the Kingdom in the full sense of the word remains in the European Union, which, however, does not prevent economic indicators from continuing to decline and slow down. It is not the first time that the eyes of market participants are already directed towards the Bank of England, as it can stimulate the economy. However, the British Regulator itself takes a wait-and-see position. At least, that was the impression at the last two meetings. Two out of nine members of the Monetary Committee vote in favor of an immediate rate cut, which would be perfectly reasonable given the deterioration in macroeconomic statistics in recent months. However, seven other members are holding a pause and do not believe that monetary easing is necessary right now.

From a technical point of view, the pound-dollar pair is fully prepared for a new downward movement, as traders have fixed the pair below the moving average line. Now it remains only to overcome the Murray level of "6/8" - 1.3062. Of course, you always need to be prepared for the unexpected, so fixing the quotes above the moving average and the Murray level of "7/8" will return the bullish mood to the market.

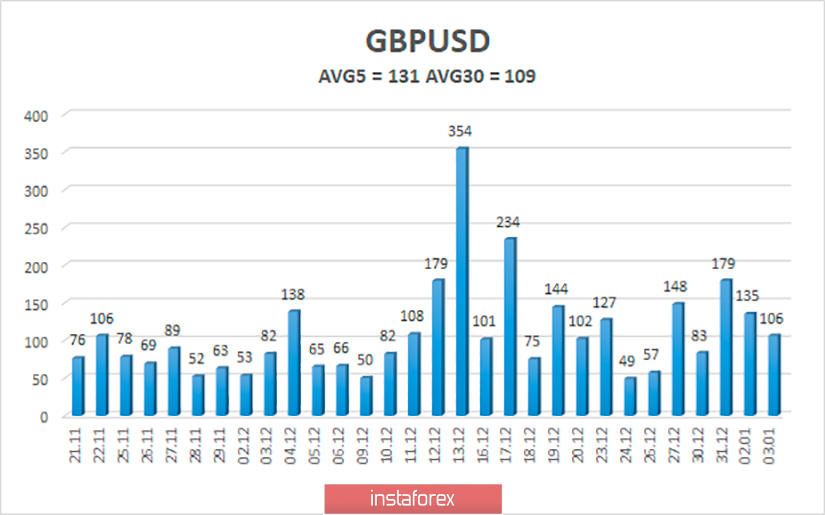

The average volatility of the pound-dollar pair over the past 5 days is 131 points, remaining at a fairly high level. According to the current level of volatility, the working channel on January 6 is limited to the levels of 1.2948 and 1.3210, and we believe that the pair will once again strive for its lower border.

Nearest support levels:

S1 - 1.3062

S2 - 1.3000

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3123

R2 - 1.3184

R3 - 1.3245

Trading recommendations:

The GBP/USD pair resumed its downward movement. Thus, traders are advised to stay in the pair's sales with the targets of 1.3000 and 1.2948 until the Heiken Ashi indicator turns up, which signals a round of upward correction. It is recommended to return to the purchases of the pound-dollar pair not earlier than the reverse consolidation above the moving average line with the first target of 1.3184.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.