GBP/USD

Analysis:

The chart of the British pound has been dominated by an upward trend since the middle of last year. The wave is not complete. On December 13, a correction began to develop towards the main rate. The first 2 parts of the wave zigzag (A-B-C) are traced in the movement structure.

Forecast:

In the coming day, you can expect to complete the preparation for the price reduction. In the first half of the day, a price pullback is possible up, no further than the resistance zone. Next, we expect a reversal and a price move down. The volatility of the movement may increase sharply when it decreases.

Potential reversal zones

Resistance:

- 1.3130/1.3160

Support:

- 1.3060/1.3030

- 1.2960/1.2930

Recommendations:

Short-term purchases of the pound today are possible in the next session. It is necessary to take into account the low trading volumes in the market. We recommend that you focus on finding sales signals of the instrument.

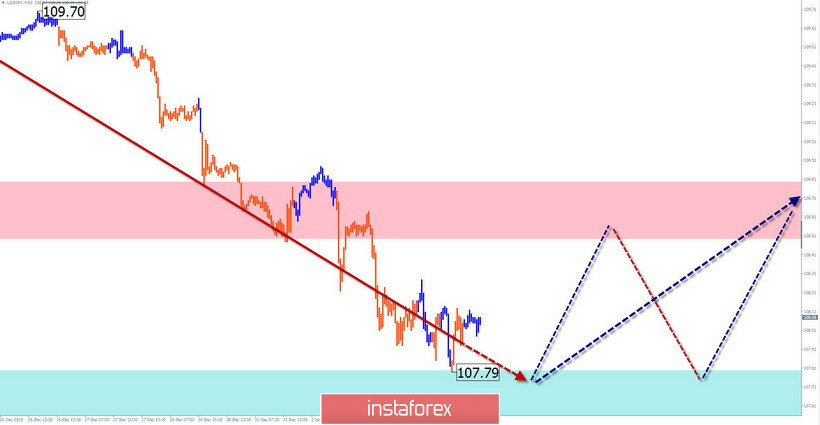

USD/JPY

Analysis:

The main direction of the Japanese price trend over the past year was set by an upward wave. Since August, the final part (C) has been developing. Until the completion of the main wave model, all downward movements are temporary. The bearish section of the chart from December 13 reached the support level of the senior TF.

Forecast:

In the next trading sessions, the end of the current price decline in recent days is possible. After attempts to pressure the support, you can expect a price rebound up. It can be an intermediate correction and the beginning of a new bullish wave on the main trend.

Potential reversal zones

Resistance:

- 108.50/108.80

Support:

- 107.80/107.50

Recommendations:

In the coming day, there will be no conditions for full-fledged transactions on the yen market. Intraday supporters can make short-term transactions in the side corridor between the counter zones, according to the expected sequence. Next, the pair's purchases will become promising.

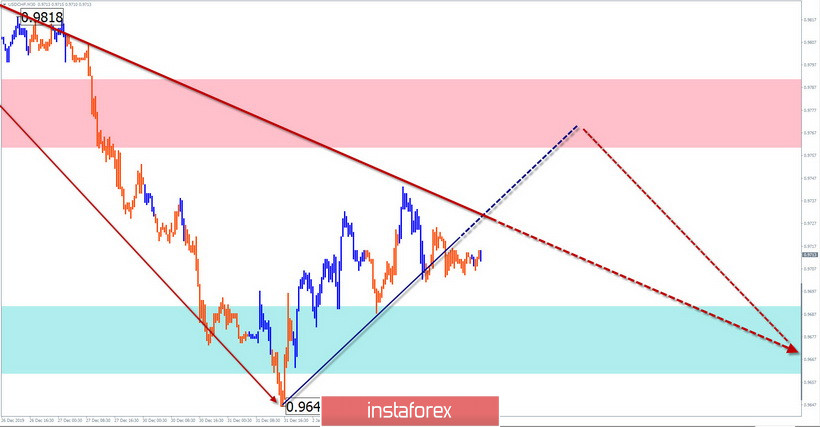

USD/CHF

Analysis:

The main wave structure of the Swiss franc is downward. It starts in April of last year. By the end of the year, the first 2 parts (A-B) were formed. From November 29, the final section (C) is formed. The price has reached the level of large-scale support.

Forecast:

Price growth is expected from the reversal zone today. In the next session, a short-term pullback is possible, after which the rate will continue to rise. The end of the rise is likely in the area of the calculated resistance.

Potential reversal zones

Resistance:

- 0.9760/0.9790

Support:

- 0.9690/0.9630

Recommendations:

Until the end of the main wave, the pair's sales remain promising. Today, intraday purchases with a reduced lot are possible. It is safer to refrain from entering the market until the current upswing is complete.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the tool movements in time!