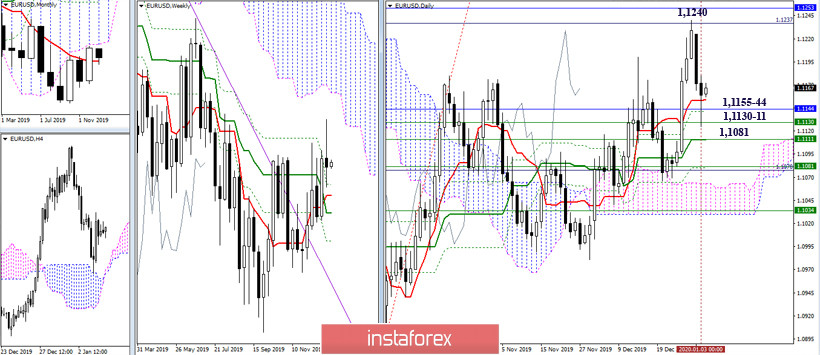

EUR / USD

On Friday, the pair continued to decline and at the close of the week formed a high "wave". This candle does not inspire optimism for players to decline. Thus, the pair will most likely spend a new week in thought and in the fight against the tested support zone, which the euro will seek to break through. The support zone did not change its location and composition of the levels. Therefore, we can still note the nearest strengthening at 1.1155-44 (daily and monthly Tenkan) - 1.1130-11 (weekly Fibo Kijun + Tenkan) and further strengthened support at 1.1081 (daily Fibo Kijun + weekly Kijun). Now, the primary task of the players on the upside will be to exit the correction zone (1.1240), in the case of confirmation of Friday's rebound from the support which was met and the restoration of bullish positions.

At the moment, the situation in the lower halves is in agreement with the ambiguity of the weekly "Wave". The pair managed to gain a foothold under the weekly long-term trend, but retains support for the central Pivot level of the day and the analyzed technical indicators at the same time. For bears, the main interest now is to update the minimum extremum (1.1125). Today, resistance of the current day 1.1178-84 (weekly long-term trend + R1) - 1.1210 (R2) - 1.1239 (R3), while support today is located at 1.1155 (central Pivot level) - 1.1129 (S1) - 1.1100 (S2) - 1.1074 (S3).

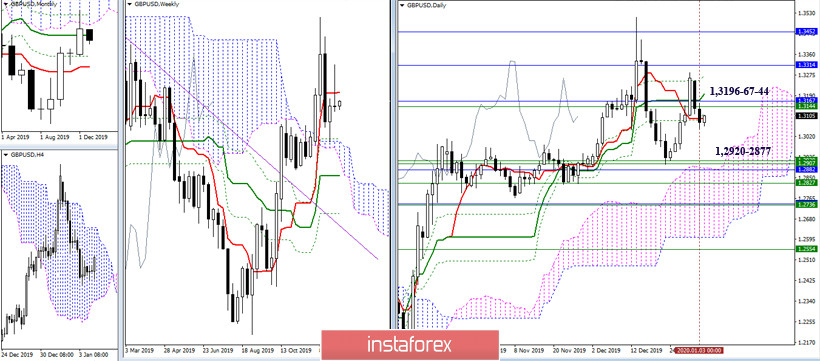

GBP / USD

A very promising candle for the players on the downside has been formed in the weeks. If the last increase really takes the form of a retest of the passed levels, then the decline will continue and the main task for the bears will be the struggle again for a strengthened support zone in the region of 1.2920 - 1.2877 (weekly cloud + monthly Fibo Kijun + upper border of the daily cloud). Meanwhile, resistance under the prevailing conditions continues to be provided by 1.3144-67-96 (daily Kijun + weekly Tenkan + monthly Kijun).

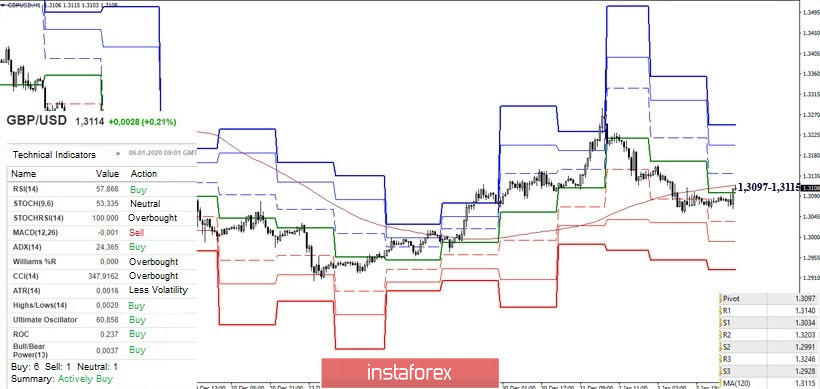

In the lower halves, the correction led to key resistance levels of 1.3097 - 1.3115 (central Pivot-level of the day + weekly long-term trend). The formation of the rebound and the updating of the minimum (1.3053) will allow the bears to restore the downward trend. Its reference points within the day will be the support of the classic Pivot levels (1.3034 - 1.2991 - 1.2928). Now, fixing above the key resistance of lower time intervals can trigger further strengthening of the bulls. Today, the resistance of the classic Pivot levels are located at 1.3140 (S1) - 1.3203 (S2) - 1.3246 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)