USD/CAD is into a strong downwards movement after failing to stay in the buyer's territory. The pair dropped below strong downside obstacles, so a further drop is favored. The Loonie has taken full control even if the US has reported positive data during the week.

The Dollar Index challenges an uptrend line. DXY maintains a bullish bias as long as it stays above this dynamic support. The Canadian Dollar received a helping hand from the Employment Change which was reported at 157.1K far above 59.5K expected and versus 90.2K in the previous reporting period. In addition, the Canadian Unemployment Rate dropped from 7.1% to 6.9% as expected.

The greenback was punished by worse than expected US Non-Farm Employment Change which was reported at 194K in September compared to the 490K estimate.

USD/CAD Deep In The Seller's Territory!

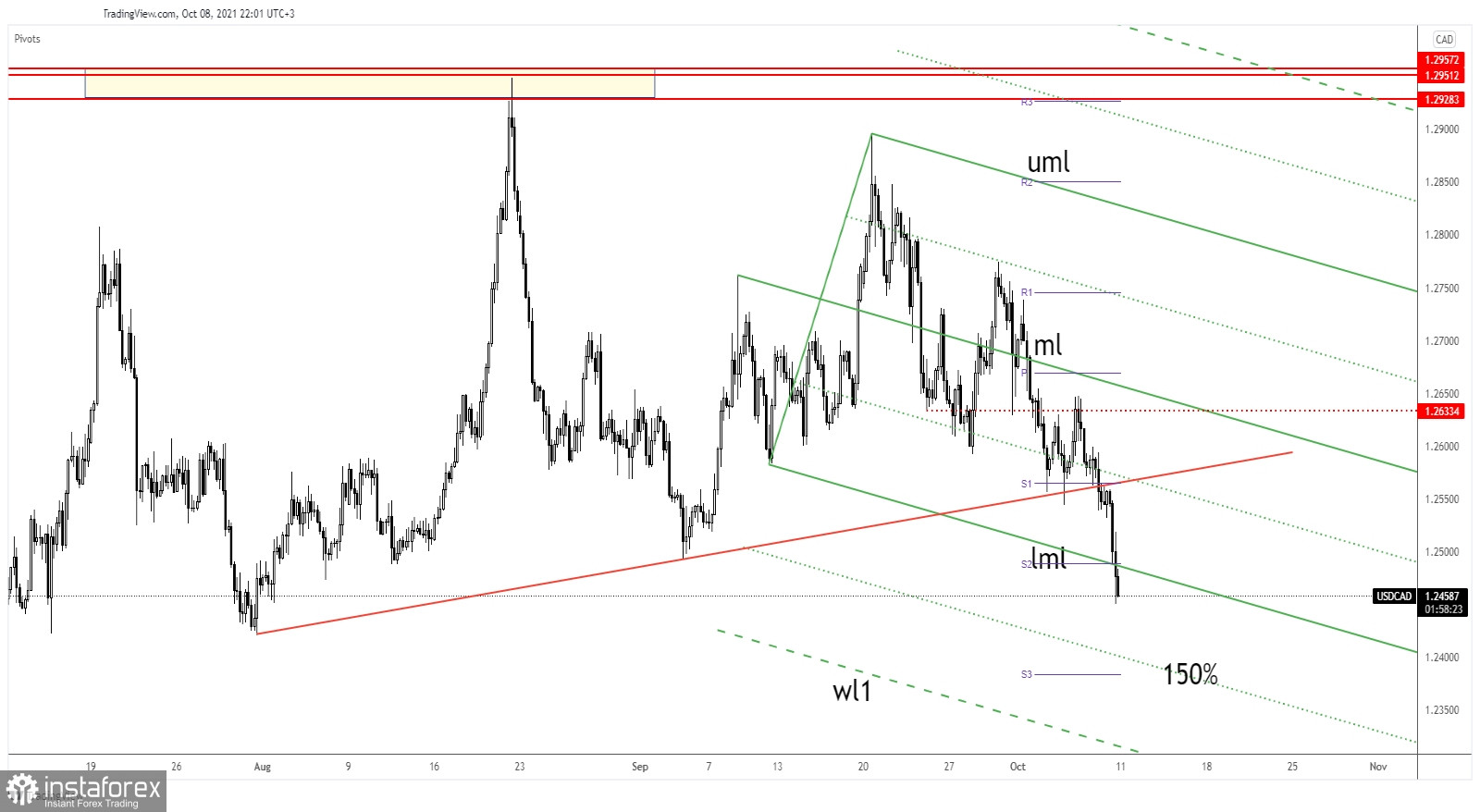

USD/CAD extended its drop and now is located below the descending pitchfork's lower median line (lml). Its failure to stay above the uptrend line announced a deeper drop. Also, the price action has signaled a downwards movement after failing to approach and reach the 1.2949 higher high.

Stabilizing below 1.2489 and under the descending pitchfork's lower median line (lml) may confirm more declines. Still, in the short term, a rebound is in cards after the amazing sell-off.

USD/CAD Prediction!

A deeper drop is favored after escaping from the descending pitchfork's lower median line (lml). Testing and retesting the lower median line (lml) could bring us new short opportunities.

The 150% Fibonacci line stands as a potential downside target, an obstacle if the rate drops deeper.