2020 started as a major shock for the oil market. US' drone attack killed a prominent Iranian military commander, Qasem Soleimani, who was also rightly called as the second man of the country. To this, Tehran promised revenge, and the Iraqi Parliament voted to withdraw American troops from its territory. Donald Trump replied that he does not need the permission of the congress to start a war in the Middle East, and Baghdad may face economic sanctions that it has not yet seen. Shortly after, on fears of a conflict, quotes of Brent futures jumped above $70 per barrel. Gradually though, investors came to understand that words about revenge from Iran does not worth anything.

Theoretically, Tehran can block the Strait of Hormuz, through which 20% of the world's black gold supplies pass. They can also organize a new diversion at the oil refineries in Saudi Arabia. At the same time, Baghdad can fulfill the government's demand on withdrawing the American troops in the country. In practice, both Middle Eastern states are put in the zugzwang position, where any move leads to a deterioration of their own position. Indeed, Iran, whose black gold exports have fallen significantly under the influence of US sanctions, needs foreign currency. Closing the Strait of Hormuz is not beneficial.

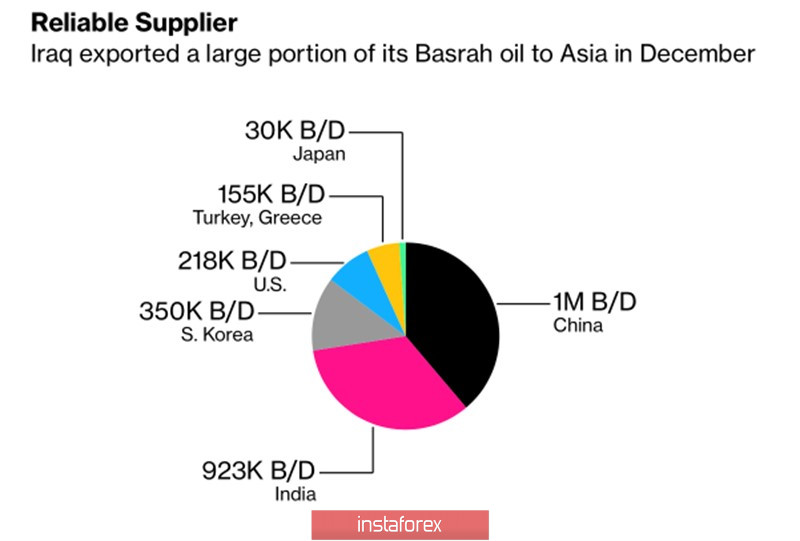

According to Bloomberg, Iraq's oil supplies outside the country amounted to 3.82 million, with China and India as the main buyers, where supply disruptions are highly undesirable.

The structure of the Iraqi oil exports

Interestingly, the rally of Brent and WTI are beneficial to the States. According to the US Energy Information Administration, their exports by the week of December 27 reached a record of 4.5 million, surpassing the previous maximum of 18%, which took place in June. The news of the conflict in the Middle East has inflated the quotes of companies in the American oil industry. Perhaps, with the murder of the Iranian military leader, Donald Trump has struck a blow to his competitors in the black gold market. If Tehran and Baghdad encountered problems with the supplies, China may switch and start to buy oil from the United States. Here's the answer to the question: how can it increase American imports by $200 billion over two years? This figure appears under the phase 1 of the agreeement to be signed by Washington and Beijing on January 15.

It is obvious that the White House has started a dangerous game, and investors need to consider the new-old driver of Brent and WTI exchange rate formation in the form of geopolitical risks. in case of attacks on the industrial facilities in Saudi Arabia on September, they will either become a long-term driver or will end very quickly. Only time will tell.

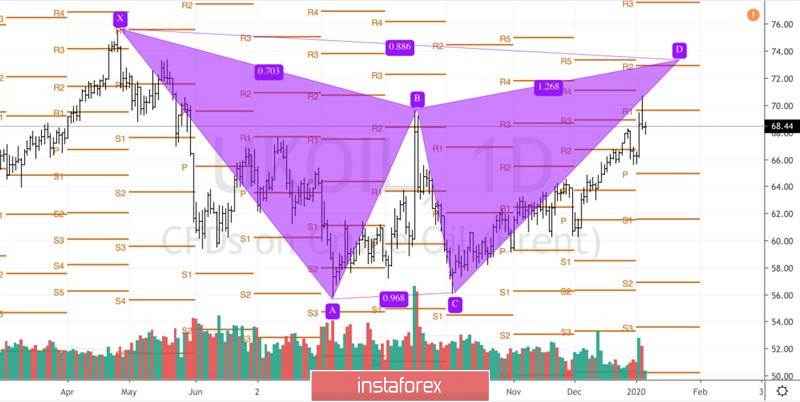

Technically, the daily chart of the North Sea variety continues the upward march to the target at 88.6%, according on the "double base" pattern. This is located near the $73.25 per barrel mark. However, the formation of a pin bar increases the risks of Brent correction to $66.75-66.9 and to $65.1.

Brent, daily chart