4-hour timeframe

Technical data:

The upper channel of linear regression: direction - up.

The lower channel of linear regression: direction - down.

The moving average (20; smoothed) - sideways.

CCI: -34.8577

The British pound sterling, following the example of the European currency, returned to the moving average line but failed to gain a foothold below it at the trading on January 7. Thus, at this time, the future fate of the pound is being decided, which must either bounce off the moving average and start a new round of upward movement, or overcome the moving average and continue downwards. Yesterday, no macroeconomic reports were published in the UK, so traders were deprived of the overall fundamental feed. The general fundamental background remains unchanged and, from our point of view, continues to work in favor of the US currency, but not in favor of the pound. Thus, we believe that there is more chance now for traders to overcome the moving average line with the resumption of the downward trend, despite the events in Iran, which, at first glance, should put pressure on the US currency.

Meanwhile, the UK Parliament has officially left vacation and resumed its work. Thus, soon, traders can begin to receive news of a political nature, which, although the situation with Brexit seems to have cleared up and the first stage of the "divorce" from the EU will take place on January 31, are still of great importance for the UK and the pound. All because it is now unknown and unclear what policy Boris Johnson will adhere to in the negotiations with Brussels, which he takes no more than 11 months? Does the Prime Minister fear the end of membership in the Alliance without signing a new trade agreement, or does it not matter to him? Many experts believe that last fall, Johnson secured the necessary concessions from Brussels thanks to his tough stance, and at times even with the help of "political blackmail". We believe that this is not quite true. Blackmail or bluff is good when the opponent does not know that the opposite side is blackmailing or bluffing. That is, Johnson's position has been such from the very first day of his premiership that he is ready to implement a "hard" Brexit, despite the possible huge losses for the UK. Johnson had the support of the electorate, and after re-election to the Parliament received all the power in the country in their hands. However, there was no doubt in anyone's mind that Johnson was simply trying to put pressure on the EU over the Brexit agreement. The EU, like the UK, does not need a "no-deal" Brexit, so Brussels has made concessions on the backstop issue. Or pretended to go. It should be understood that the EU at any time after Brexit can make the border on the island of Ireland. It will be one-sided, but what difference does one-sided or two-sided make? So far, the whole idea of Boris Johnson about customs points 20 kilometers from the real border, about the border by sea, about random checks of transported goods from Northern Ireland to Ireland and back, looks a little naive. It is difficult to imagine how all this will be implemented in practice.

Roughly the same can be with negotiations on a trade agreement. Johnson can put pressure on the EU Parliament as much as he wants, assuring that he will calmly withdraw Britain from the Alliance without a deal on December 31, 2020, if EU leaders do not try to resolve this issue as quickly as possible and with all kinds of concessions, but who will do worse than the Prime Minister? Only his nation, his people, his voters, his own country. And the worse he does, the less likely he is to be re-elected or not retire early. In the meantime, operation Yellowhammer has been officially completed by the British government.

From a technical point of view, the pound-dollar pair is near the moving average and should now either bounce back from it or overcome it. Until the first or second happens, it is not recommended to trade. The lower channel of the linear regression turned down, which indicates that the pair is ready for a downward trend.

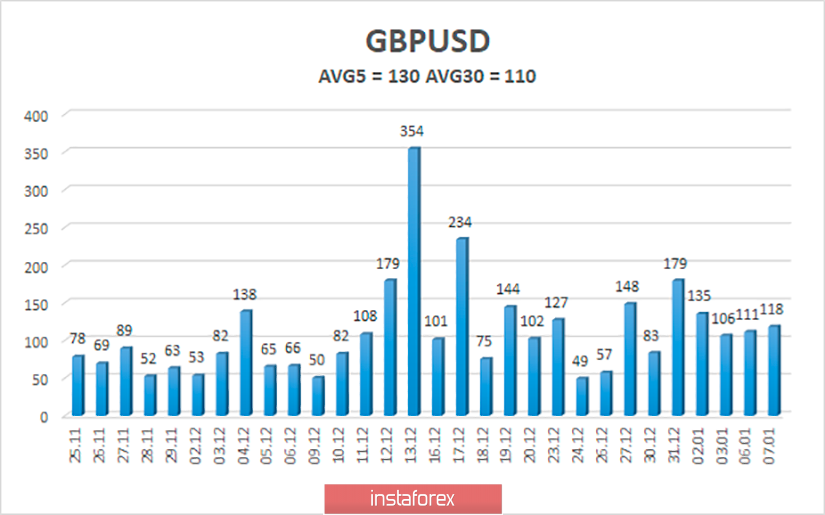

The average volatility of the pound-dollar pair over the past 5 days is 130 points, remaining at a fairly high level. According to the current level of volatility, the working channel on January 8 is limited to the levels of 1.2987 and 1.3247, and we believe that the pair will once again strive for its lower border.

Nearest support levels:

S1 - 1.3123

S2 - 1.3062

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3184

R2 - 1.3245

R3 - 1.3306

Trading recommendations:

The GBP/USD pair returned to the moving average line. Thus, traders are advised to buy the British pound with targets of 1.3184 and 1.3245 if the price rebounds from the moving average. It is recommended to return to selling the pound-dollar pair if the quotes are fixed under the moving average line with the targets of 1.3062 and 1.3000.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The upper channel of linear regression - the blue lines of the unidirectional movement.

The lower channel of linear regression - the purple lines of the unidirectional movement.

CCI - the blue line in the indicator regression window.

The moving average (20; smoothed) - the blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi - an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.