Judging by today's report, which brought the euro quotes to a new weekly low against the US dollar, the bottom in the German industry is still far from being formed. If in 2018 and 2019, many experts associated the weakness of industry with trade wars, which resulted in a decrease in external demand, now, judging by today's report, a decline is observed in the domestic orders market. It is important to note that domestic orders dropped faster than foreign ones.

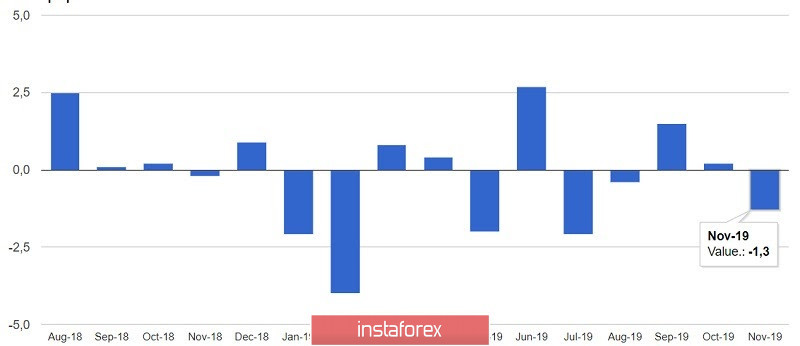

According to the statistics agency Destatis, orders in the industry fell by 1.3% in November compared to October 2019, while, according to revised data, orders increased by 0.2% in October. Economists had expected orders to remain at the October level in November. Orders fell by 6.5% compared to November last year. As I noted above, the volume of domestic orders grew by only 1.6%, while export orders fell by 3.1%.

From all this, it remains to conclude that the October growth in orders in the industrial sector in Germany, which inspired hope for economic growth in the fourth quarter of 2019, was only a temporary phenomenon, and the problems that production faced throughout the year did not go anywhere. share it.

Consumer confidence in France in December was also not good, as it declined for the first time since December 2018. According to a report by Insee, France's National Bureau of Statistics, the consumer confidence index dropped to 102 points in December 2019 from 105 points in November. Economists predicted that the index would remain unchanged. Consumer expectations about their financial situation worsened. The share of households that intend to make large purchases in the near future has also decreased.

Today's Ifo report that the eurozone economy will gain momentum in 2020 was rather skeptical. Ifo economists believe that eurozone GDP growth in the fourth quarter of 2019 will be 0.3%, which is slightly higher than in the third quarter, when the economy grew by only 0.2%. In the first two quarters of 2020, eurozone GDP growth rates will be 0.3% each. The calculation is made to increase household consumption.

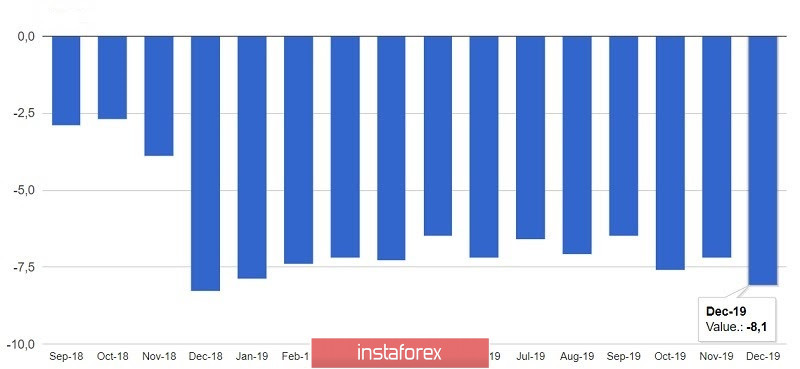

But the consumer confidence index in the eurozone is not as positive as the previous report. According to the data, consumer confidence fell, and the index fell to -8.1 points in December 2019 from -7.2 in November. The data fully coincided with the forecasts of economists. Problems remained in the eurozone industry confidence index, which fell to -9.3 points in December from -9.1 points in November, while the services confidence index rose to 11.4 points.

As for the technical picture of the EURUSD pair, the situation is developing according to the bearish scenario, which I drew attention to in the morning review. Sellers of risky assets are now seeking support at 1.1115, a breakthrough of which will pull down the trading instrument to the lows of 1.1070 and 1.1040.

The British pound has experienced a temporary surge of power, as it is expected that the bill on Brexit, proposed by British Prime Minister Boris Johnson, will be approved by Parliament after a three-day debate in the House of Commons. Official voting on it will be tomorrow, and the first round of discussions took place yesterday.