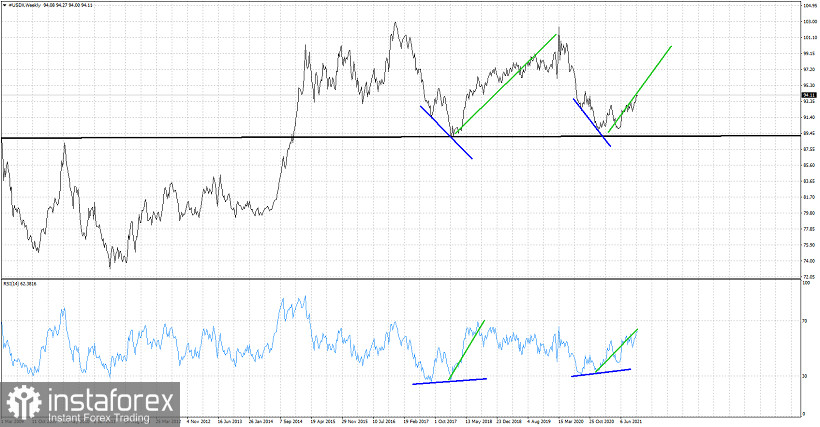

Helped by the USDJPY strength, the Dollar index continues to trade in an upward trend. As we mentioned in previous posts, the similarities to the bottom of 2017 were many and so were the chances of such an upward movement repeating itself.

Green lines - upward movements expected

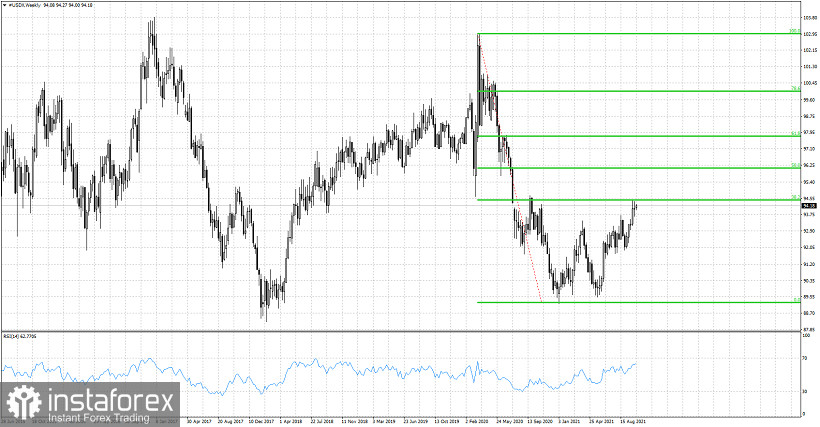

The Dollar index is still following the path from 2017. It is not necessary to continue its upward move and make an equal size increase in price, however the main characteristics of the pattern are so similar and that is why we expected the Dollar index to move higher, as long as the support at 89-90 was respected. The Dollar index is making higher highs and higher lows. Price has now reached important resistance levels.

The Dollar index has reached the 38% Fibonacci resistance level. This is important resistance. Breaking above this level will be an important bullish signal. Resistance is strong here at 94.50. A break of this resistance will open the way for a move towards the 50% retracement and the 96.15 level. Support is found at recent low of 91.90. As long as price is above this level, bulls remain in full control of the trend.