Hello, dear colleagues!

Yesterday's dynamics of the main currency pair of the Forex market were generally in line with expectations. At the auction on January 8, the pair continued to implement the expected downward scenario.

As for macroeconomic statistics, it was mixed for the eurozone, and the data itself cannot be called very important and have a strong impact on the dynamics of the single European currency.

But reports from the United States on the change in the number of employees from ADP were better than expected - 160 and amounted to 202. I believe that this was a positive factor for the US dollar and contributed to the strengthening of the US currency across a wide range of markets.

As it may seem surprising, but after Iran's attacks on US military bases in Iraq in retaliation for the murder of Iranian General Soleimani, after the initial strengthening of the currency, safe havens ceased to be in demand. Market participants were overwhelmed by a wave of optimism that the conflict between Tehran and Washington will not develop into a full-scale one. I don't think the risk sentiment will last long. Knowing the character of US President Donald Trump, the American response to Iran will not be long in coming. But what this answer will be, we can only assume.

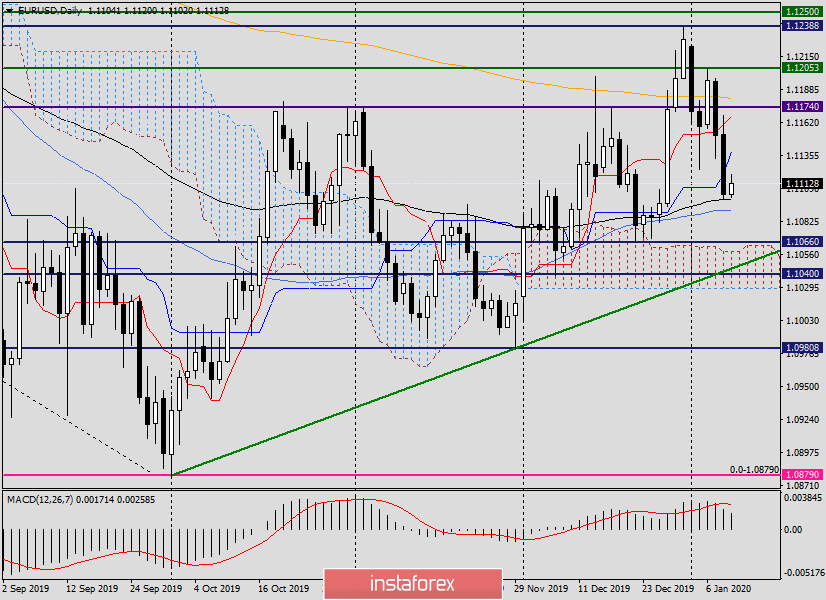

Now it's time to move on to the technical picture, and let's start with the daily schedule.

Daily

As expected in yesterday's review of EUR/USD, the pair tried to return above the Tenkan line of the Ichimoku indicator, but these attempts choked already at 1.168, from where the quote turned to decline.

As a result of a fairly decent downward dynamics, the pair fell to the area of 1.1100 and ended the trading session on January 8 at the level of 1.1104. Thus, all the goals outlined on the eve were achieved, and the idea of the next sales when rising to the price zone of 1.1157-1.1174 was correct.

What to expect today? After two intense days of decline, you can expect to adjust the rate. At the moment of writing, such attempts are observed. The pair is moderately strengthened and is now trading near 1.1118. Since the closing price of yesterday's trading was below the Kijun and Tenkan lines of the Ichimoku indicator, the pair's rise to these lines can be used to consider short positions on EUR/USD.

Kijun is at the level of 1.1140, and the Tenkan at the level of 1.1166. Let's remember these values.

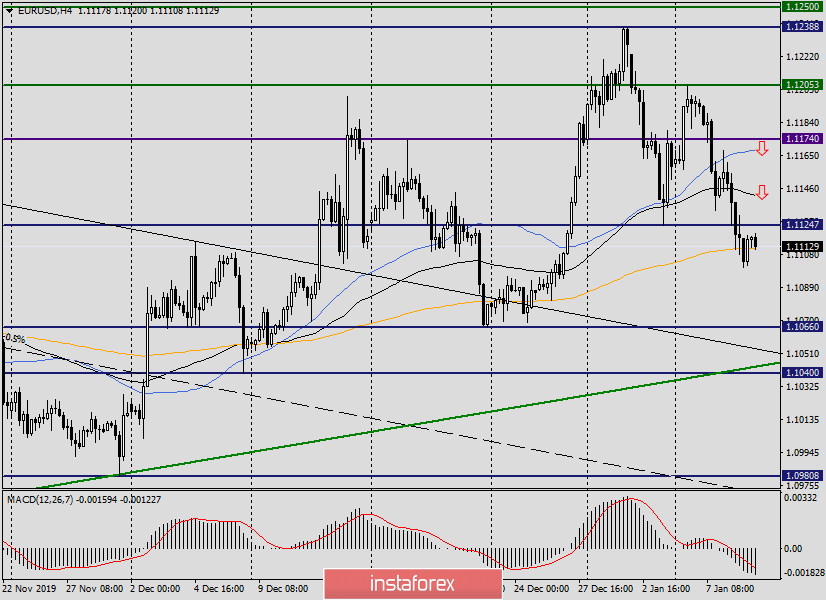

H4

As seen on the H4 chart, all trading ideas are marked with arrows. If the downward trend continues, we wait for the pair in the support area near 1.1066 and try to buy. It is better if the corresponding candlestick patterns are formed before this. A position against the current downward trend is therefore considered riskier.

But as for sales, there is a correspondence with the daily schedule, more precisely, with the Kijun and Tenkan lines located on it. As you can see, on the 4-hour timeframe, the 89 exponent is at 1.1143, and the 50 simple moving average is at 1.1168. I believe that each of these moving averages can provide strong resistance and turn the price down.

However, at the moment of completion of this review, after unsuccessful attempts to break above 233 EMA, the pair shows readiness to turn in the south direction from the current values. Well, a fair wind. I have no desire to sell at such low values and after such a significant two-day decline. And the fight around the 233 EMA is probably not over yet.

Good luck!